Swiss Franc bounced briefly earlier today, following release of slightly stronger than expected Swiss CPI data, only to see those gains quickly dissipate. With inflation levels persistently below SNB target, market consensus continues to lean towards an interest rate cut within the year, with September eyed as the probable month for the first reduction. However, the possibility of a rate cut as early as June has not been entirely dismissed. Meanwhile, the resurgence in the Franc’s sell-off, has bolstered Sterling, and to a lesser extent, Euro and Dollar.

On another front, Yen is trading as the day’s weakest performer for now, even trailing behind the weak Swiss Franc. Risk-on market sentiment, spurred by Nikkei’s ascent above the 40k mark to set another record high, has been the predominant influence on Yen. This investor optimism seems to be dimming the spotlight on BoJ rate hike expectations. Kiwi, Aussie, and Canadian Dollar displaying varied performances in the backdrop of these developments.

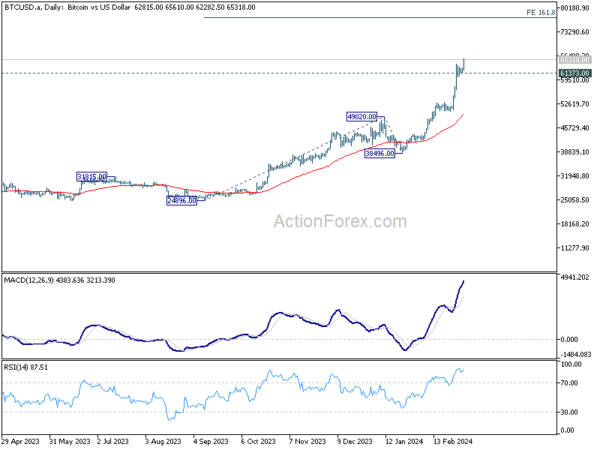

Technically, Bitcoin’s up trend resumes today and breaks over 65k handle. Near term outlook will now stay bullish as long as 61373 support holds. While it’s clearly overbought as seen in D RSI, based on the current momentum, there shouldn’t be any problem in breaking through 68986 record high. It might only start trying to make a medium term after hitting 161.8% projection of 24896 to 49020 from 38496 at 77528.

In Europe, at the time of writing, FTSE is down -0.61%. DAX is down -0.03%. CAC is up 0.09%. UK 10-year yield is up 0.006 at 4.220. Germany 10-year yield is down -0.013 at 2.408. Earlier in Asia, Nikkei rose 0.50%. Hong Kong HSI rose 0.04%. China Shanghai SSE rose 0.41%. Singapore Strait Times fell -0.43%. Japan 10-year JGB yield fell -0.004 to 0.716.

Eurozone Sentix rises to -10.5, but no classic spring revival

Eurozone Sentix Investor Confidence March climbed from -12.9 to -10.5 in March, slightly surpassing expectations of -10.8. This increment marks the fifth consecutive rise, achieving its highest level since April 2023. Current Situation Index also saw an increase for the fifth month, moving from -20.0 to -18.5, its highest since June 2023. Furthermore, Expectations Index had its sixth month of growth, advancing from -5.5 to -2.3, reaching its peak since February 2022, which predates the onset of the war in Ukraine.

Contrastingly, Germany, Eurozone’s largest economy, displayed a divergent trend, with Investor Confidence declining for the third consecutive month to -27.9 from -27.1. Current Situation fell for the 3rd straight month from -39.3 to -40.5, lowest reading since July 2020. Expectations Index fell from -14.0 to -14.3.

Sentix analysts interpreted the overall Eurozone data as moving “in the right direction,” though they cautioned against interpreting this as a sign of a “classic spring revival.” This cautious stance is attributed to “changed interest rate landscape”. Investors are expecting a more expansive monetary policy by ECB ahead.

Swiss CPI rises 0.6% mom in Feb, slows to 1.2% yoy

Swiss CPI rose 0.6% mom in February, above expectation of 0.5% mom. CPI core (excluding fresh and seasonal products, energy and fuel) rose 0.7% mom. Domestic products prices rose 0.5% mom while imported products prices rose 1.0% mom.

For the year, CPI slowed from 1.3% yoy to 1.2% yoy, above expectation of 1.1% yoy. CPI core slowed from 1.2% yoy to 1.1% yoy. Domestic product prices growth slowed from 2.0% yoy to 1.9% yoy. Imported products prices growth improved from -0.9% yoy to -1.0% yoy.

Japan’s capital expenditure surges 16.4% in Q4, signaling strong business investment momentum

Japan’s capital expenditure surged remarkably by of 16.4% yoy in Q4, significantly outperforming expectations of 2.9% yoy increase. This marked the eleventh consecutive quarter of business investment growth, highlighting the robust confidence among Japanese corporations in the country’s economic prospects.

The impressive figures come as a beacon of optimism, especially considering they will contribute to the revision of Q4’s GDP data, which initially indicated unexpected contraction of -0.4% qoq. With this revision, it’s anticipated that Japan may have narrowly avoided slipping into a technical recession.

The investment growth was particularly pronounced among manufacturers, who increased their spending by 20.6% yoy. This 11th consecutive quarter of expansion was predominantly driven by the information and communication machinery and transport equipment sectors.

Non-manufacturers also contributed with 14.2% yoy increase in investment, marking the sixth consecutive quarter of growth. The telecommunication, transportation, and postal service sectors were notably instrumental in this rise.

A Finance Ministry official commented on the data, stating, “The results reflect our view that the economy is recovering moderately. But we will need to monitor the impact of slowing overseas economies and inflation on corporate activity.”

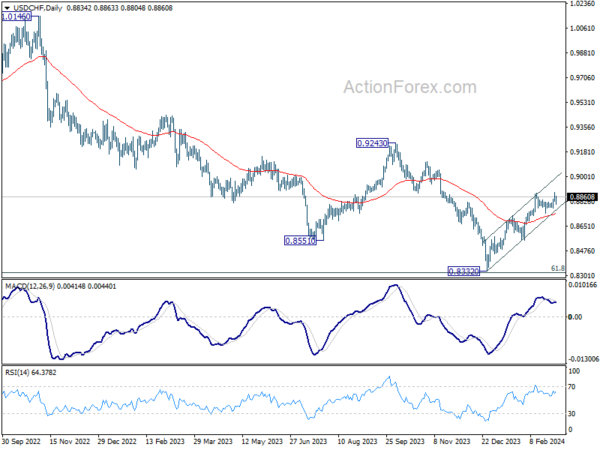

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8811; (P) 0.8852; (R1) 0.8874; More….

USD/CHF rebounds notably after drawing support from 55 4H EMA, but stays below 0.8891 temporary top. Intraday bias remains neutral first. Further rally is in favor as long as 0.8741 support holds. Break of 0.8891 will resume the whole rebound from 0.8332 towards 0.9243 key resistance. Nevertheless, break of 0.8741 support will turn bias back to the downside for deeper pullback.

In the bigger picture, a medium term bottom should be formed at 0.8332, on bullish convergence condition in W MACD, just ahead of 0.8317 long term fibonacci support. It’s still early to decide if the larger down trend from 1.0146 (2022 high) is reversing. But further rise should be seen to 0.9243 resistance even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q4 | -7.80% | -0.20% | -0.60% | |

| 23:50 | JPY | Capital Spending Q4 | 16.40% | 2.90% | 3.40% | |

| 23:50 | JPY | Monetary Base Y/Y Feb | 2.40% | 4.70% | 4.80% | |

| 00:00 | AUD | TD Securities Inflation M/M Feb | -0.10% | 0.30% | ||

| 00:30 | AUD | Building Permits M/M Jan | -1.00% | 4.00% | -9.50% | -10.10% |

| 07:30 | CHF | CPI M/M Feb | 0.60% | 0.50% | 0.20% | |

| 07:30 | CHF | CPI Y/Y Feb | 1.20% | 1.10% | 1.30% | |

| 09:30 | EUR | Eurozone Sentix Investor Confidence Mar | -10.5 | -10.8 | -12.9 |