Swiss Franc breaks higher in early US session as benchmark treasury yields in both the US and Europe plummeted. This rise was partly triggered by US retail sales data coming in much weaker than anticipated. Additionally, investor sentiment in Europe remains fragile due to ongoing political risks in France.

On the geopolitical front, Russian President Vladimir Putin pledged to deepen trade and security ties with North Korea and support it against the US. This visit marks Putin’s first to North Korea in 24 years. Simultaneously, Beijing has initiated an anti-dumping investigation targeting certain pork products from the European Union, following Brussels’ recent move to raise tariffs on Chinese vehicles.

Australian Dollar is also performing strongly today, following RBA’s decision to keep interest rates unchanged and leave door open for future rate hikes. Governor Michele Bullock indicated that the board did not discuss rate cuts today but did consider the rising risks of inflation. The consumer price inflation data for the June quarter will be critical, as it will provide a comprehensive view of inflationary pressures and guide the next monetary policy decisions.

In contrast, New Zealand Dollar is the weakest performer, further pressured by selloff against Australian Dollar. British Pound is the second weakest, followed by Canadian Dollar. Dollar, Euro, and Japanese Yen are trading in the middle of the pack.

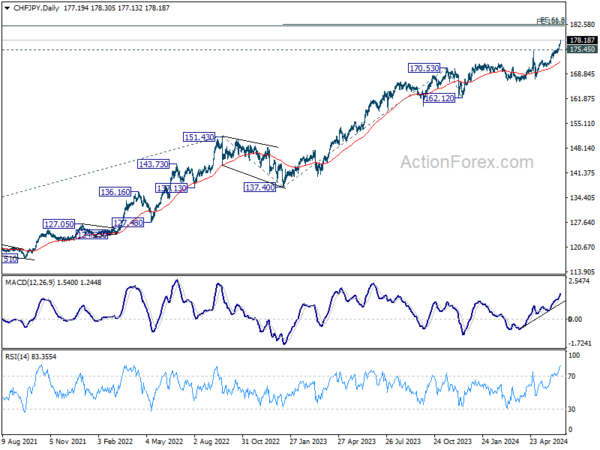

Technically, CHF/JPY is continuing its record run. Near term outlook will stay bullish as long as 175.45 support holds. Next target is 61.8% projection of 137.40 to 170.53 from 162.12 at 182.59.

In Europe, at the time of writing, FTSE is up 0.52%. DAX is up 0.27%. CAC is up 0.61%. UK 10-year yield is down -0.038 at 4.082. Germany 10-year yield is down -0.006 at 2.409. Earlier in Asia, Nikkei rose 1.00%. Hong Kong HSI fell -0.11%. China Shanghai SSE rose 0.48%. Singapore Strait Times rose 0.13%. Japan 10-year JGB yield rose 0.0158 at 0.947.

US retail sales rise 0.1% mom in May, ex-auto sales down -0.1% mom.

US retail sales rose 0.1% mom to USD 703.1B in May, below expectation of 0.3% mom. Ex-auto sales fell -0.1% mom to 569.0B, worse than expectation of 0.2% mom growth. Ex-gasoline sales rose 0.3% mom to USD 649.5B. Ex-auto and gasoline sales rose 0.1% mom to USD 515.5B.

Total sales for the March through May period were up 2.9% from the same period a year ago.

ECB’s de Guindos emphasizes importance of economic projections in rate decisions

ECB Vice President Luis de Guindos highlighted the critical role of updated macroeconomic projections in shaping interest rate decisions. During an interview with Spanish state broadcaster TVE, Guindos noted, “The projections are updated every three months, so we’ll soon have new ones in September”

“Those are the most significant and interesting moments from the point of view of monetary policy, because our projections are a very important indicator when it comes to deciding the evolution of interest rates,” he added.

Separately, according to the latest Reuters poll conducted from June 12-18, a substantial majority of economists (nearly 80%, or 64 out of 81) anticipate that ECB will implement two more rate cuts this year, specifically in September and December. This would lower the deposit rate to 3.25%.

Additionally, almost 90% of those surveyed (36 out of 41) believe the risks are tilted towards ECB making fewer cuts than more.

German ZEW ticks up to 47.5, sentiment and situation stagnate

German ZEW Economic Sentiment ticked up from 47.1 to 47.5 in June, below expectation of 50.0. Current Situation Index fell from -72.3 to -73.8, below expectation of -69.0.

Eurozone ZEW Economic Sentiment rose from 47.0 to 51.3, above expectation of 47.2. Current Situation Index was unchanged at -38.6.

ZEW President Professor Achim Wambach said: “Both the sentiment and the situation indicators stagnate. These developments must be interpreted in the context of a constant situation indicator for the eurozone as a whole. In contrast, the inflation expectations of the respondents increase, which is likely related to the inflation rate in May, which turned out higher than what was expected.”

Eurozone CPI finalized at 2.6% in May, core at 2.9%

Eurozone CPI was finalized at 2.6% yoy in May, up from April’s 2.4% yoy. CPI core (ex energy, food, alcohol & tobacco) was finalized at 2.9% yoy, up from prior month’s 2.7% yoy. The highest contribution to the annual inflation rate came from services (+1.83 percentage points, pp), followed by food, alcohol & tobacco (+0.51 pp), non-energy industrial goods (+0.18 pp) and energy (+0.04 pp).

EU CPI was finalized at 2.7% yoy, up from April’s 2.6% yoy. The lowest annual rates were registered in Latvia (0.0%), Finland (0.4%) and Italy (0.8%). The highest annual rates were recorded in Romania (5.8%), Belgium (4.9%) and Croatia (4.3%). Compared with April, annual inflation fell in eleven Member States, remained stable in two and rose in fourteen.

RBA stands pat, still not ruling anything in or out

RBA left its cash rate target unchanged at 4.35%, as widely anticipated. It maintained its stance of “not ruling anything in or out,” indicating a cautious approach and open stance amid ongoing economic uncertainties.

While inflation is easing, RBA noted that it is doing so “more slowly than previously expected,” and inflation “remains high.” The central bank acknowledged that it will be “some time yet” before inflation is sustainably within the target range.

RBA added that recent economic data have been “mixed,” reinforcing the need to remain “vigilant to upside risks to inflation.” Consequently, the path of interest rates “remains uncertain”.

BoJ’s Ueda reiterates possibility of July rate hike

BoJ Governor Kazuo Ueda reiterated today that the central bank could raise interest rates again in July, stressing that this decision would be independent of the plan to taper bond purchases.

Speaking to parliament, Ueda clarified, “Our decision on bond-buying taper and interest rate hikes are two different things.” He emphasized that a rate hike at the next policy meeting will depend on the economic, price, and financial data available at the time.

A recent Reuters poll on Monday revealed that 31% of economists surveyed expect BoJ to raise interest rates at its next policy meeting on July 30-31. Another 41% predict the next hike will occur in October, while slightly more than 20% anticipate a September increase. The remaining economists do not foresee a rate hike until 2025. This diversity of expectations underscores the uncertainty in forecasting BoJ’s policy move.

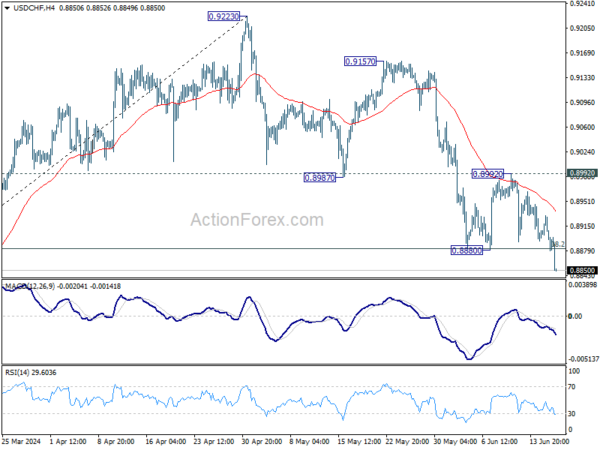

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8883; (P) 0.8908; (R1) 0.8921; More….

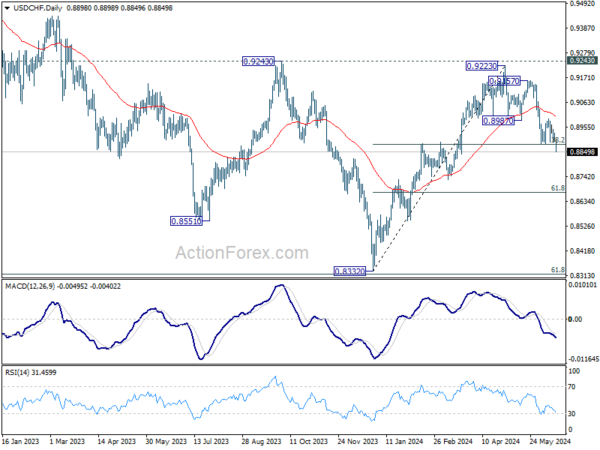

USD/CHF’s fall from 0.9223 resumed by breaking through 0.8880 support today. The break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 argues that whole rise from 0.8332 might be completed after missing 0.9243. Intraday bias is back on the downside for 61.8% retracement at 0.8672 next. For now, risk will stay on the downside as long as 0.8992 resistance holds, in case of recovery.

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance affirms this case, and maintain medium term bearishness. While more range trading could be seen between 0.8332/0.9243 first, downside break out is mildly in favor at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 09:00 | EUR | Eurozone CPI Y/Y May F | 2.60% | 2.60% | 2.60% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y May F | 2.90% | 2.90% | 2.90% | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Jun | 47.5 | 50 | 47.1 | |

| 09:00 | EUR | Germany ZEW Current Situation Jun | -73.8 | -69 | -72.3 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jun | 51.3 | 47.2 | 47 | |

| 12:30 | USD | Retail Sales M/M May | 0.10% | 0.30% | 0.00% | -0.20% |

| 12:30 | USD | Retail Sales ex Autos M/M May | -0.10% | 0.20% | 0.20% | -0.10% |

| 13:15 | USD | Industrial Production M/M May | 0.90% | 0.40% | 0.00% | |

| 13:15 | USD | Capacity Utilization May | 78.70% | 78.60% | 78.40% | 78.20% |

| 14:00 | USD | Business Inventories Apr | 0.30% | -0.10% |