by OverviewFX | Mar 1, 2025 | taxes

Kansas has a simple progressive state income tax structure with rates ranging from 5.2% to 5.58% for the 2024 tax year (the taxes you’ll file in 2025). The total amount of taxes you owe to Kansas depends on several things. Your filing status determines your tax...

by OverviewFX | Mar 1, 2025 | taxes

Illinois makes filing state income taxes straightforward with its flat tax rate of 4.95% for all individual taxpayers. Unlike states with complex tax brackets that increase rates based on income, Illinois’s flat tax system applies the same percentage to every...

by OverviewFX | Mar 1, 2025 | taxes

Indiana keeps state income tax simple with its flat tax rate of 3.05% for all individual taxpayers. This straightforward system ensures that everyone pays the same percentage, regardless of income level—making tax filing more predictable and manageable. In addition...

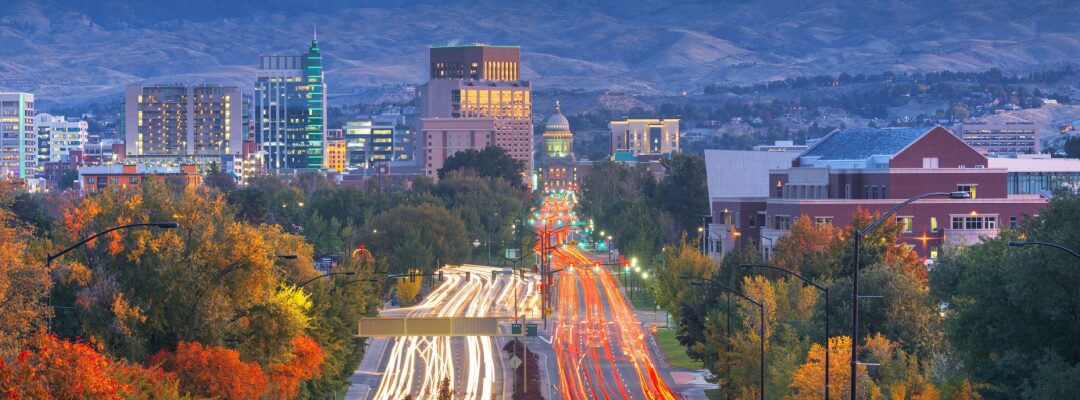

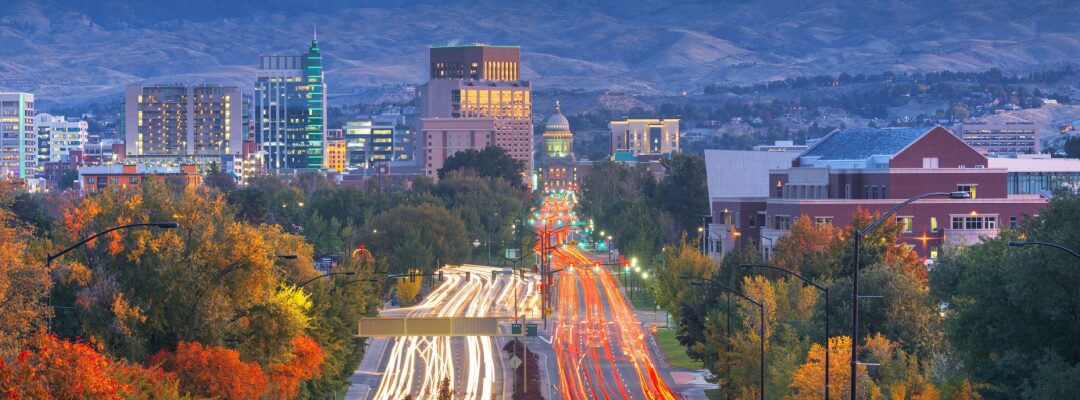

by OverviewFX | Mar 1, 2025 | taxes

Idaho’s straightforward flat tax rate of 5.695% offers taxpayers a simple structure. Everyone who pays state income tax in the Gem State pays the same rate regardless of income level. This streamlines the tax filing process for everyone who earns income in Idaho. ...

by OverviewFX | Feb 28, 2025 | taxes

If you’re looking for help with small business taxes and tax preparation, you’re not alone. Many business owners find the process of filing their small business tax return mysterious at best. You may wonder about forms, small business tax deadlines, small business tax...

by OverviewFX | Feb 25, 2025 | taxes

Nebraska state income tax follows a graduated system, meaning the tax rate increases as your income grows. For the 2024 tax year (the taxes you’ll file in 2025), Nebraska has four tax brackets, with rates ranging from 2.46% to 5.84%. Your tax rate depends on your...