by OverviewFX | Feb 24, 2025 | taxes

Alaska is one of the few states without an income tax, making it appealing for residents searching for tax savings. Other states like Florida, Texas, and Nevada also share this benefit. If you’re an Alaskan, you might still be subject to federal income tax for the...

by OverviewFX | Feb 24, 2025 | taxes

Louisiana’s graduated state individual income tax means tax rates increase as taxable income rises. This will change in 2026 when you do your tax year 2025 tax return, as Louisiana plans to switch to a flat tax rate of 3%. For the 2024 tax year (the taxes you’ll...

by OverviewFX | Feb 24, 2025 | taxes

The gig economy has boomed in recent years, and it shows no signs of slowing down. In 2024 alone, an estimated 41 million US workers reported having side hustles. While some Americans engage in a side gig because they’re passionate about it, the majority (72%) do it...

by OverviewFX | Feb 24, 2025 | taxes

Mississippi’s straightforward 4.7% state income tax rate for the 2024 tax year (the taxes you file in 2025) offers simplicity for taxpayers, especially compared to states that use multiple income tax brackets. With this flat tax rate, Magnolia State taxpayers pay the...

by OverviewFX | Feb 24, 2025 | taxes

Missouri has a graduated income tax system, meaning the rate you pay is based on your taxable income. For the 2024 tax year (the return you’ll file in 2025), tax brackets in the Show Me State range from 2% to 4.8%, with higher-earning taxpayers paying the top rate. ...

by OverviewFX | Feb 21, 2025 | taxes

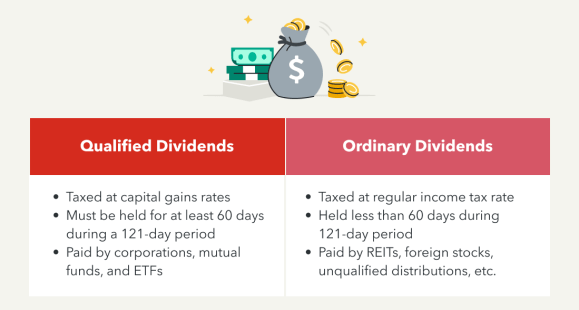

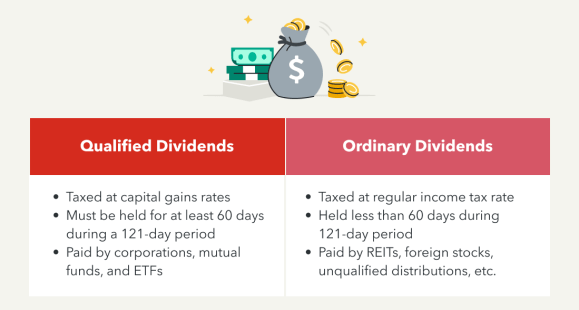

For most taxpayers, wages and salaries make up the majority of annual income. If you earn additional income from dividends, capital gains, or rental properties, your taxes immediately become more complex. If you receive dividend payments, you need to have a basic...