by OverviewFX | Oct 23, 2024 | taxes

Individual retirement accounts (IRAs) are designed to help you save for retirement, but what happens if someone passes away with money in an IRA? When you start contributing to an IRA, you can choose a beneficiary to inherit your IRA if you pass away. If you don’t...

by OverviewFX | Oct 23, 2024 | taxes

Deferred compensation is an agreement where employees can receive a portion of their earned wages at a later date. If you’re an employee of a business, you may be eligible for a deferred compensation plan. While deferred compensation is optional, these plans can be a...

by OverviewFX | Oct 22, 2024 | taxes

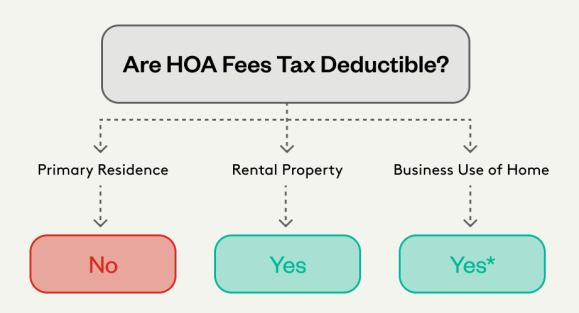

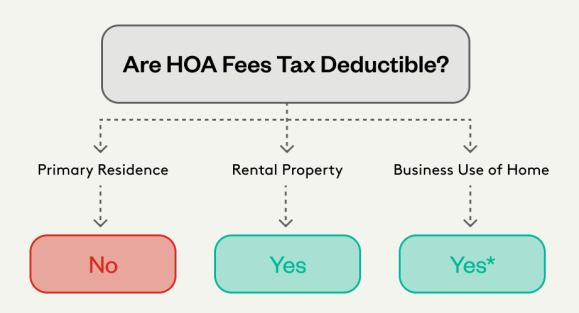

For some homeowners and renters, HOA fees are unavoidable yearly expenses. Depending on the home and location, HOA fees may be a steep cost at hundreds of dollars or as much over $1,000 each month for certain high-end communities. With such a big cost associated with...

by OverviewFX | Sep 19, 2024 | taxes

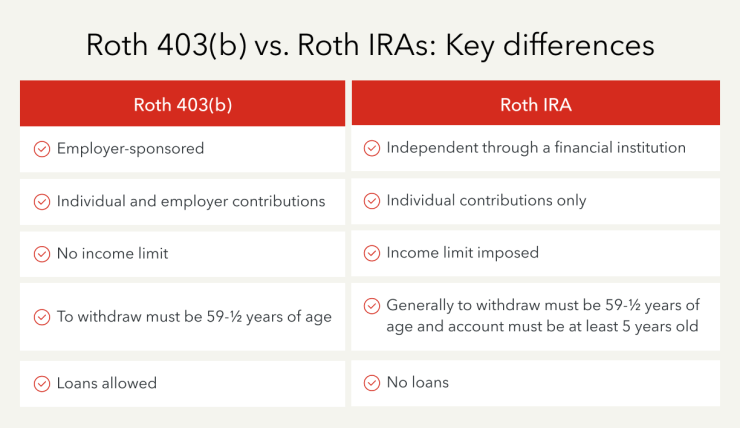

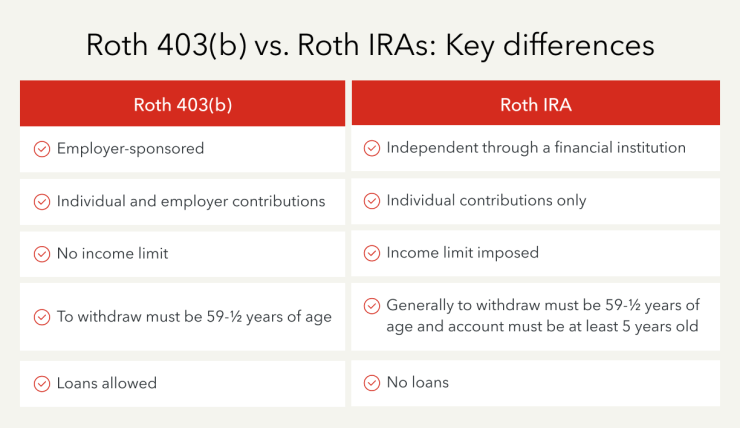

Putting together a plan to save for retirement can be a bit confusing with all the options that are available. In addition to employer-sponsored plans, there are individual plans, which further complicates the process of figuring out what’s right for you. Two popular...

by OverviewFX | Aug 21, 2024 | taxes

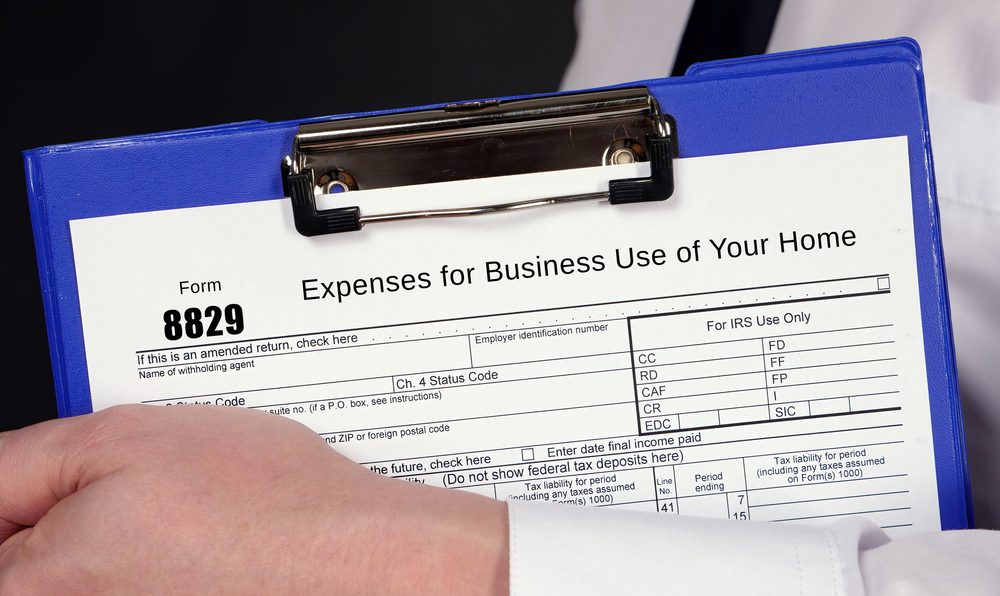

As a business owner, you can take advantage of deductions and write-offs to lower your tax liability when you file — but there are rules. If you use your home for business, you may be eligible for a deduction for the percentage of your home that you use exclusively as...

by OverviewFX | Jul 12, 2024 | taxes

Investing is one way to build wealth. But, understanding the tax implications is key for maximizing your returns. By managing your taxes well, you can keep more of your hard-earned gains. This guide provides essential tax tips to help you navigate investment taxation...