by OverviewFX | Mar 29, 2025 | taxes

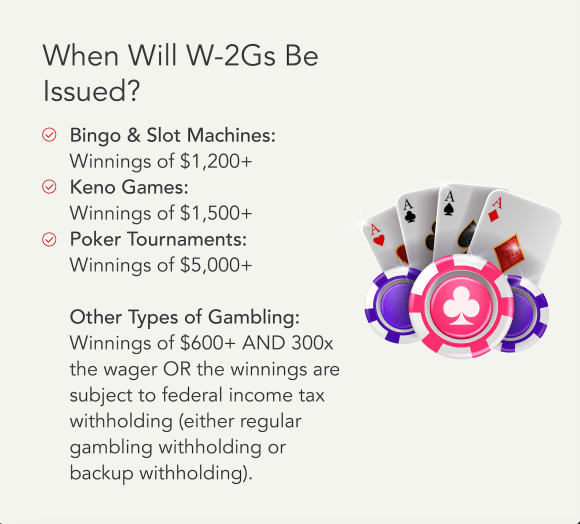

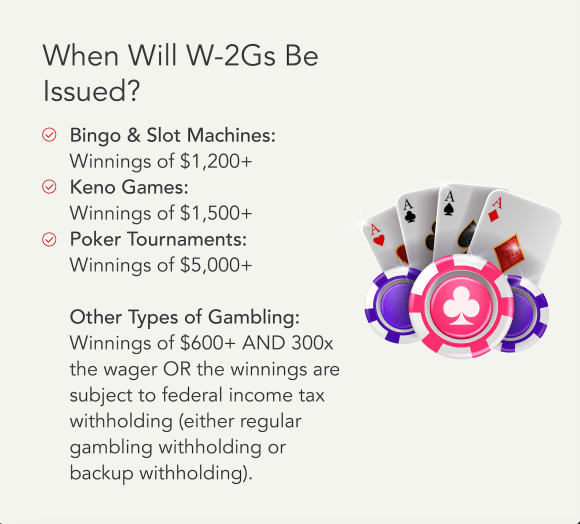

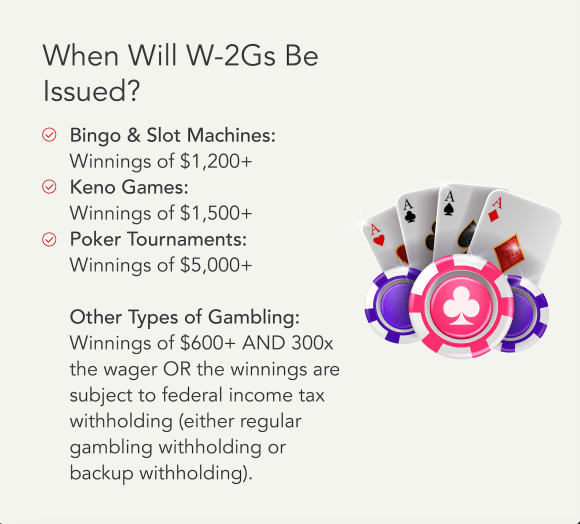

If you’ve recently struck gold at the casino, hit the jackpot in a poker tournament, or experienced the thrill of the lottery or any other gambling activity, you’re probably wondering about the potential tax implications. Spoiler alert: all your winnings, big or...

by OverviewFX | Mar 27, 2025 | taxes

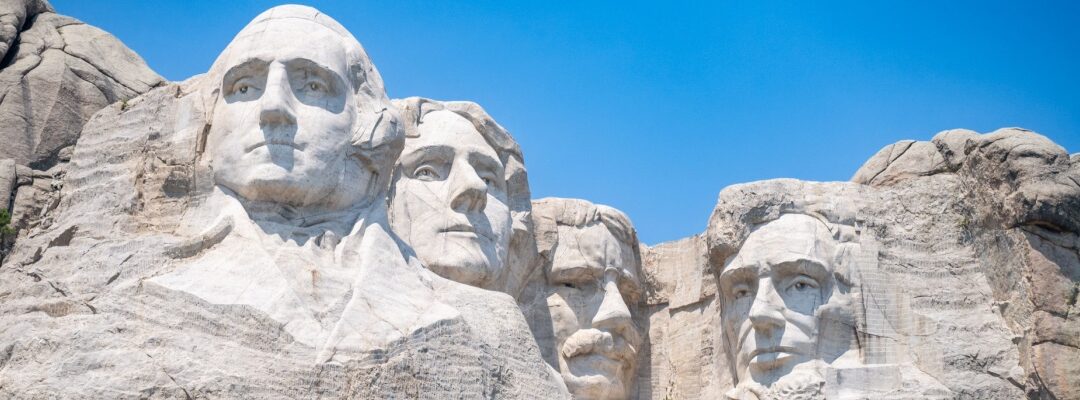

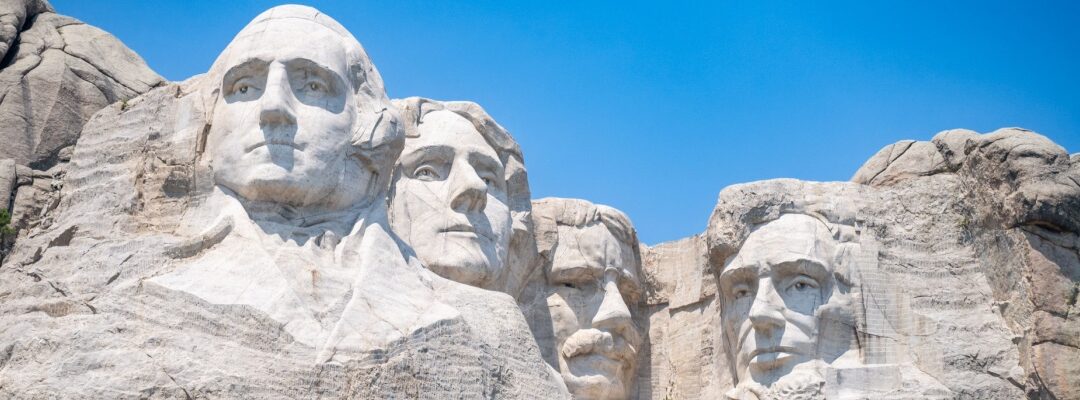

South Dakota is one of a handful of states without an individual state income tax. Additionally, the Mount Rushmore State is also known as a corporate income tax haven due to its lack of corporate income tax. Even though residents can reap these benefits, they’re...

by OverviewFX | Mar 27, 2025 | taxes

Utah has a flat state income tax rate of 4.55% for the 2024 tax year (the taxes due in 2025). This consistent rate means everyone pays the same percentage, simplifying tax filing compared to states like California, which have complex tax brackets with rates reaching...

by OverviewFX | Mar 26, 2025 | taxes

March Madness Tax Tips: How Student-Athletes Can Score Big with NIL Deals and Deductions – Intuit TurboTax Blog Skip to main content

by OverviewFX | Mar 25, 2025 | taxes

What is Form 720? Understanding the Ins and Outs of Quarterly Federal Excise Tax Returns – Intuit TurboTax Blog Skip to main content

by OverviewFX | Mar 25, 2025 | taxes

Form 2210 Instructions: How to Calculate and Pay Estimated Taxes to Avoid Penalties – Intuit TurboTax Blog Skip to main content