There’s an old market adage: “Stocks go down in an elevator and up in a staircase.”

That sums up the S&P/TSX Venture Composite Index (CDNX) over the last 15 years, except this time, it didn’t just go down in an elevator. It got trapped in the basement, and every breakout attempt was met with rejection.

Now, it’s not just climbing, it’s breaking out. And hardly anyone’s paying attention.

The CDNX, Canada’s benchmark for early-stage resource and technology companies, has emerged from one of the longest and most painful sideways-to-down periods in its history. For over a decade, it’s been ignored by the mainstream, starved of capital, and left for dead by speculators who moved on to crypto, cannabis, AI, or just gave up.

But that’s changed. The long-term technicals are flashing green. Capital is rotating back into exploration. And the macro story, anchored by gold, copper, and the metals that power the global shift to electrification, is stronger than it’s been in years.

The Setup: Same Way Down, Same Way Up?

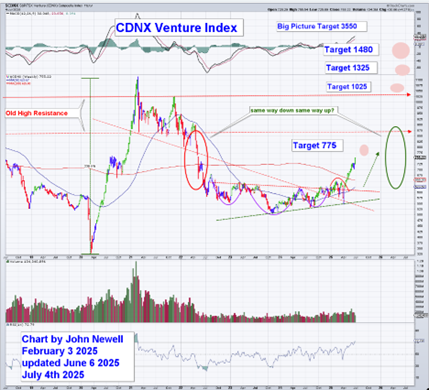

Pull up the long-term CDNX chart and you’ll see a dramatic elevator drop from the 2011 highs.

What followed was a decade-long churn that wore out all but the most patient investors. But the pattern that’s forming now? It looks a lot like the mirror image of the move down.

Same way down, same way up?

On the weekly chart, price has broken above long-term moving averages and resistance levels.

Technical targets are activating at 775, 1025, 1325, and 1480. And the long-term Big picture target?

3550, the level where everything started to unravel more than a decade ago.

This isn’t guesswork. It’s price memory. And markets never forget.

Amazon had 20% Corrections Too

Worried about volatility? Looking for the perfect entry? Consider Amazon.com Inc. (AMZN:NASDAQ).

Since the early 2000s, Amazon has gone through more than 15 corrections of 20% or more. Some were over 50%. That’s the price of conviction. And most investors can’t pay it.

If you want generational wealth, you don’t sit in the stands waving pom-poms, you put the pads on and step onto the field.

We celebrate Amazon, Microsoft, and Home Depot as legendary compounders. But almost no one held them through all the turbulence.

Now compare that to junior mining.

You’re not holding for 20 years, waiting on a trillion-dollar valuation. You’re hunting for a discovery, a single drill hole, or deal, that re-rates a company’s valuation in weeks. These aren’t slow burns.

They’re liftoff points.

This Isn’t Just a Rebound. It’s a Rotation.

The CDNX is heavily weighted toward the materials sector, about 40–50%, with gold and silver explorers doing most of the lifting. Base metals like copper and uranium are gaining momentum as investors wake up to the structural shortfalls in global supply.

This index doesn’t move unless real capital is coming back into exploration. And it is.

With gold now holding above $3,300 and copper emerging from a massive base, this isn’t just a bounce, it’s a rotation back to real assets. And junior miners, most of which are still trading near historic lows, are still early in that rotation.

The Venture Exchange is where the rerates happen first.

The Opportunity in One Chart

The index tells us capital is starting to flow. But if you want a more visceral example, take a look at what just happened with ArcWest Exploration Inc. (AWX:TSX.V).