The Wall Street axiom warns to “never fight the Fed.” But that’s exactly what traders are doing, and it could spark a rally in some of the forgotten corners of the stock market.

Federal Reserve forecasts and comments from central bankers couldn’t be more clear. Investors are being warned that interest rates will stay higher for longer than they’d expected, with the median projection from Fed officials calling for one interest rate cut this year.

And yet cash is pouring into stocks that benefit from lower borrowing costs. The technology sector had $2.1 billion of inflows this week, the most since March, according to data compiled by EPFR Global and Bank of America.

“The market is just not sold on the prospect of inflation and labor market readouts not giving the Fed the room for multiple cuts this year,” said Keith Buchanan, senior portfolio manager at GLOBALT Investments. “That stubbornness is keeping intact the environment that benefits risk assets.”

The central bank’s projections for fewer rate cuts this year and Fed Chair Jerome Powell’s seemingly hawkish comments at his press conference on Wednesday didn’t prevent the S&P 500 Index from eclipsing 5,400 for the first time ever, which also happened on Wednesday and held through at least Friday. The benchmark is up more than 50% since hitting a bottom in October 2022, during a bear market triggered by the Fed’s drastic interest rate increases that started in March 2022 and were aimed at taming runaway inflation.

The question now for investors is what will the market do when the Fed eventually does decide to cut?

Historically, rate cuts have marked a key inflection point that has ushered in strong equity returns — but only for cycles that aren’t triggered by a recession, like this one. That would explain why the latest flows data from Bank of America and EPFR Global show a rotation into financials, materials and utilities — three crucial groups closely tied to the economy that historically benefit from rate cuts as long as there’s robust economic growth.

The consensus expectation is that economic growth will remain sturdy, with the Atlanta Fed’s GDPNow model projecting second-quarter real GDP growth climbing to a 3.1% annual rate, from a 1.3% pace in the first quarter.

“There are very few signs on the horizon that you’re going to see any sort of truly bumpy landing,” said Carol Schleif, chief investment officer at BMO Family Office.

Tech Boost

Fund managers are also boosting exposure to tech stocks. The Nasdaq 100 Index has gained 17% in 2024. Shares of the seven biggest companies in the S&P 500 are priced at an average of 36 times projected profits, compared with a multiple of 22 for the benchmark, according to data compiled by Bloomberg.

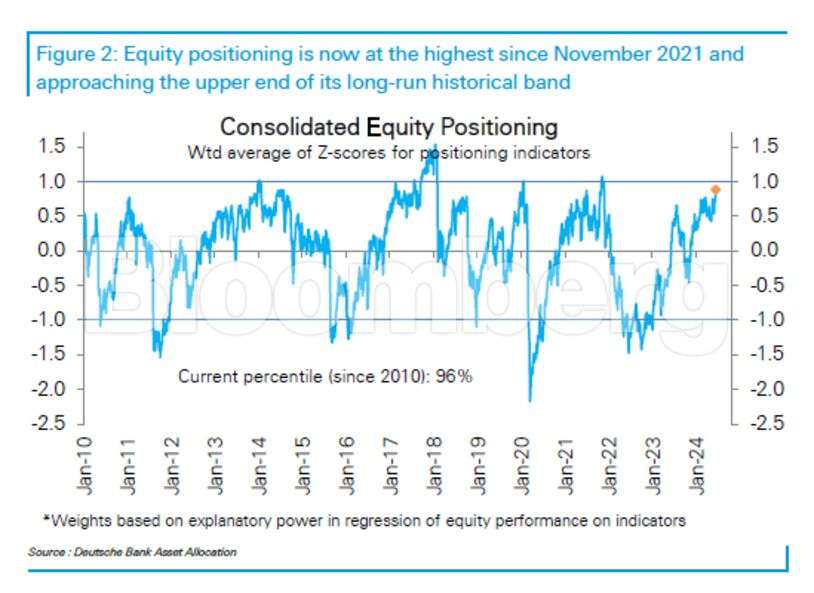

Aggregate equity positioning has now climbed to its highest level since November 2021, when the Nasdaq 100 was at a peak, data through the week ended June 14 compiled by Deutsche Bank AG show.

Rules-based and discretionary investors — who rely on predefined guidelines and algorithms to make decisions — drove the jump this week, with positioning in tech rising sharply, along with rate-sensitive groups like utilities, staples and real estate.

Should the Fed adopt a firm dovish stance, defensive corners of the market that pay steady dividends, like consumer staples and real estate, also become more attractive, said Terry Sandven, chief equity strategist at US Bank Wealth Management.

June usually marks a calm period for markets with lower trading volume heading into the summer. But next week has a wild card: “triple witching.” Contracts tied to stocks and indexes expire on Friday, coinciding with the quarterly rebalancing of indexes, a confluence that tends to create a burst of volatility and high trading volumes. So that could disrupt positioning in the very short term.

“Next week could prove quite eventful for equities,” said Frank Monkam, senior portfolio manager at Antimo.