U.S. Highlights

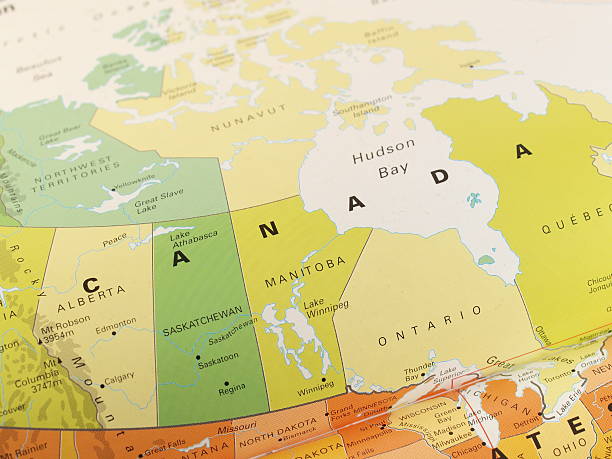

- U.S. retail sales grew marginally in May, however the downward revision in April points to waning momentum among U.S. consumers.

- Housing starts and building permits both declined in May as higher interest rates weigh on builder confidence.

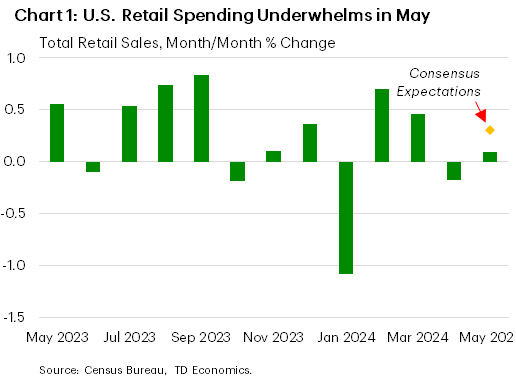

- U.S. existing home sales dipped for a third consecutive month as record home prices stretch buyers’ affordability limit.

Canadian Highlights

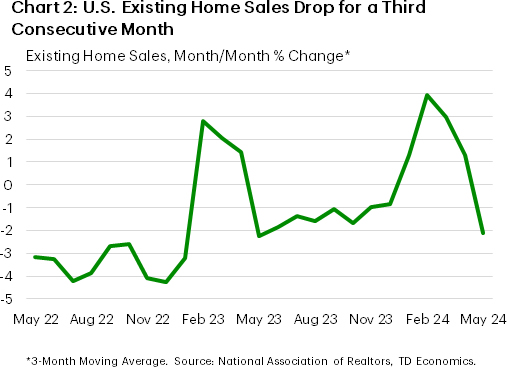

- The housing market showed mixed signals in May, with an increase in housing starts and contraction in home sales. The overall trend suggests the housing market will weigh on economic activity in the short term.

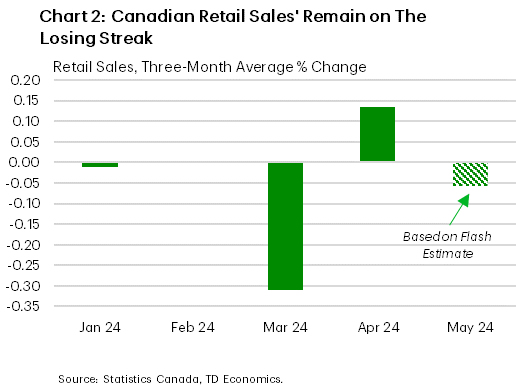

- Consumer spending also appears tepid, with a strong retail sales print in April overshadowed by weak performance in the prior two months, and an anticipated decline in May.

- The Summary of the Bank of Canada’s Governing Council deliberations showed that policymakers contemplated waiting until July to cut rates. The Bank will remain cautious, focusing on both inflation risks and economic performance, rather than foreign exchange divergence, when making the next move.

U.S. – Housing Market Strains Under the Weight of Higher Rates and Prices

Data out this week was largely tilted to the housing market, providing an update on where things stand in the usually busy spring season. Thus far, the situation appears largely unimpressive as market activity continues to be impacted by the dowsing effect of higher interest rates and prices. Another look at the health of the U.S. consumer via the retail spending report was also in the lineup. Despite news on the economic front, activity is the stock market was largely driven by the ups and downs of Nvidia, which managed to dethrone Microsoft this week as the most valuable public company in the world. Bond prices also continued to rise, driving yields lower. At the time of writing, the 10-year Treasury yield was down 0.5 basis points relative to where they started the week.

Consumer spending continued to show signs of fading as retail sales barely grew in May (0.1% m/m), following a decline of -0.2% in April. The outturn was weaker than analysts expected (Chart 1). Overall, weak retail sales are consistent with a U.S. economy that is losing momentum. The main takeaway is that consumers may finally be starting to yield to the pressures of elevated prices and higher borrowing costs.

Nonetheless, most Fed speakers throughout the week were key to emphasize that there is still more ground to be gained on the inflation front with the current restrictive policy before normalization becomes appropriate. In a recent interview, Fed Governor Barkin suggested that consumer spending is “fine” despite the weak retail sales print. In his view, “consumer spending is solid, not frothy and not weak” and the Fed is well positioned to respond to any path the economy may take. Other speakers, including New York Fed President John Williams and Boston Fed President Susan Collins, stressed the Fed’s data dependent approach. Williams noted that he expects “interest rates to come down gradually over the next couple of years” but declined to give specific timing, while Collins stressed the need for patience and time to assess the “constellation of available data.”

On the housing front, homebuilding activity retreated last month with a decline in both housing starts and building permits. A consistent pullback in permitting activity over the past few months, has resulted in a decline in the number of units under construction. Evidently, elevated interest rates are weighing not only on buyers, who have pulled back on new home purchases resulting in higher inventory, but also on builders as it increases the cost of construction financing.

Despite a decline in the average 30-year fixed mortgage rate from a recent peak of 7.22% in early May to 6.87% this week, the housing market remains under pressure. Existing home sales slipped again for the third month in a row as home prices hit a record high (Chart 2). Buyers continue to be weighed down by high prices and rates, with little prospect of relief in the near term as the Fed continues to exercise patience with respect to rate cuts.

Looking ahead, the central bank’s preferred inflation gauge is out next week. Fed governors and market participants alike will be eager to see how much of the recent easing in the Consumer Price Index will flow through to the Personal Consumption Expenditure measure. Perhaps the Fed will find more of that “consistent data” they require to support a less restrictive policy stance.

Canada – A Grand Slam of Economic Data

Just as sports enthusiasts reveled in the array of top-tier events like the Euro Cup, Stanley Cup playoffs, and Copa America, economic news aficionados had a wealth of data to absorb this week. The economic arena was further energized by updates from forecasters, including yours truly – TD Economics – releasing our own view on the outlook for national and provincial economic growth.

The week kicked off with updates on the state of the housing market. Housing starts surprised to the upside, posting a robust 10% month-on-month increase. This performance boosted the three-month average, though it fell short of reaching the explosive growth seen during the pandemic-induced ‘race for space’.

Conversely, the spring home selling season failed to gain momentum in May, with residential home sales posting another monthly decline. This was not entirely unexpected, as many potential buyers remained cautious, awaiting signals from the Bank of Canada. Luckily, both short- and long-term interest rates moved lower after the BoC cut rates on June 5th. This will help make home borrowing more affordable. An increase to new listings also contributed to improved affordability. This combined with lower sales activity, the sales-to-listings ratio pushed further into balanced territory (Chart 1). With that, the benchmark home price index declined by 0.2% month-on-month, primarily due to weakness in the condo market. Despite these adjustments, the softer sales trend is expected to persist, leading to an anticipated 3% contraction in the second quarter. We forecast that housing will weigh on economic activity in the short term, with a rebound expected in the latter half of the year as interest rate uncertainty subsides.

Similarly, the consumer is not likely to be pulling the freight. The strong retail sales print for April is preceded by two months of weakness and is expected to be followed by a weak print in May (Chart 2). This hardly signals strength. Notably, auto sales declined sharply, erasing the marginal gains of the previous two months. Recent industry data points to sluggish demand in auto sales in May as consumers grapple with high borrowing cost and prices roughly 20% higher than three years ago. This weakness offsets some of the strength observed in services spending, weighing on our projections for personal consumer spending of 0.7% quarter-on-quarter annualized (down from 3.0% in the first quarter).

As a result, this week’s data doesn’t provide a strong case for a more hawkish stance from the BoC. The Summary of the Governing Council’s deliberations showed that members considered waiting until July to cut the policy rate, as they placed similar weight on the downside risks to inflation stemming from weaker consumer spending and on the upside risks associated with persistence in wage growth and the potential for a housing market rebound. Ultimately, the Council decided that there was sufficient progress on inflation to cut in June, but this doesn’t guarantee a cut in July. Policymakers also discussed market expectations for policy divergence between Canada and the U.S.. They agreed that while there are limits to how far policy can diverge, the limits are not close to being reached. Therefore, the domestic economic performance will remain the major driver of the BoC’s decisions this year.