U.S. Highlights

- U.S. equity markets briefly touched a new all-time high mid-week, while measures of market volatility dipped to multi-year lows.

- Minutes from the April 30th-May 1st FOMC meeting struck a more hawkish tone, resulting in markets now pricing in just 34 basis-points of cuts by year-end.

- Both new and existing home sales dipped in April, alongside an uptick in mortgage rates.

Canadian Highlights

- Canadian inflation made waves this week as lower-than-expected price growth brought much needed relief to consumers.

- Both headline and the Bank of Canada’s (BoC’s) core inflation metrics are now firmly within the Bank’s 1% to 3% target, with other inflation measures continuing to show improvement.

- March retail sales showed that consumers pulled back for the second straight month, weighed down by high interest rates.

U.S. – FOMC Continues to Preach Patience

With nothing in the way of top tier U.S. economic data releases, global financial markets started the week eerily calm. Equity markets continued to inch higher, briefly touching a new all-time high by mid-week – bolstered by another strong earnings release from the AI-chip behemoth Nvidia. Wall Street’s fear gauge, the ‘VIX’ index, dipped to the lowest level since before the pandemic, while the comparable bond market measure also slipped to a level not seen since before the tightening cycle began over two years ago. However, the mood soured a bit as the week progressed, as the minutes of the April 30th-May 1st FOMC meeting struck a more hawkish tone. However, equities firmed on Friday and look to end the week relatively unchanged. Meanwhile, the yield curve inversion widened to its largest margin of the year, as investors pushed out the timing of the first Fed rate cut, with just 34 basis points of cuts now priced by year-end.

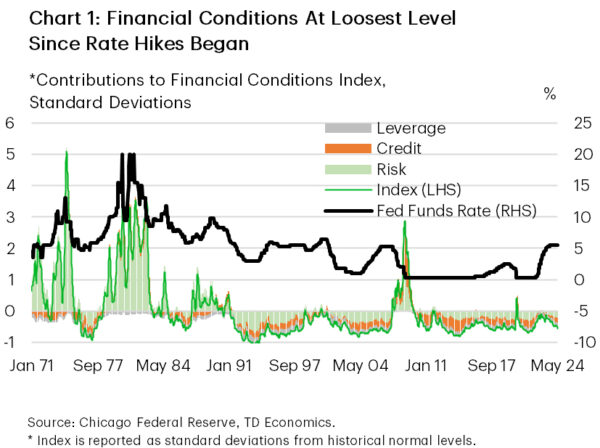

Perhaps no metric better captures investors sentiment than the Chicago Federal Reserve’s measure of financial conditions, which is currently at the lowest level since January 2022 (Chart 1). With the domestic economy still strong and perceived financial conditions no tighter today than before the tightening cycle began, it’s no wonder the latest Fed minutes showed ‘many’ participants voicing uncertainty about the degree of restrictiveness of today’s policy stance. The minutes also highlighted that ‘various participants noted a willingness to tighten policy further should risks to inflation materialized in a way that such action became appropriate’.

On the surface, the above sentence reads very hawkish. However, it’s worth noting that the April 30th-May 1st meeting occurred before the release of the April CPI data, which ultimately showed some cooling in inflationary pressures relative to the three months prior. While certainly a step in the right direction, most voting FOMC members who have spoken since the CPI release have emphasized the importance of patience and allowing more time for restrictive monetary policy to do its work.

Federal Reserve Governor Christopher Waller went as far as saying he would need to see ‘several’ more months of ‘good’ inflation readings before lowering rates – implying the Fed is very likely on hold until at least September. But at this point, even a September cut seems optimistic. Between now and that meeting, Fed officials will see four more inflation reports. Even assuming all four readings come in slightly softer than April, the 3-and-6-month annualized trends on core PCE inflation are still likely to be above their respective troughs reached in December of last year. If the Fed didn’t cut then, it’s unlikely they’d would be cutting in September, unless there’s a significant deterioration in the labor market and/or broader economy.

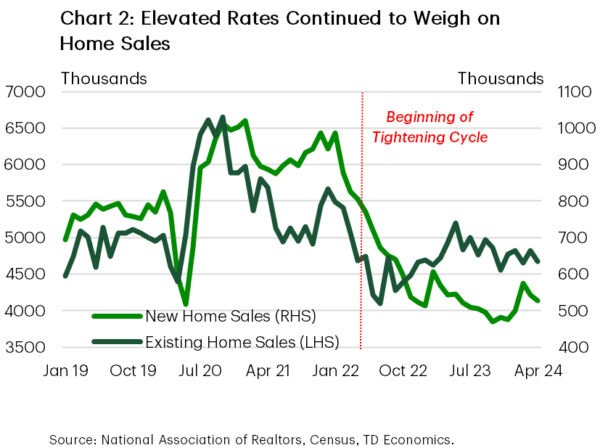

The only noteworthy data releases this week were refreshed readings of new and existing home sales. Both pulled back in April – likely in response to the uptick in mortgage rates last month (Chart 2). While the 30-year fixed mortgage rate has since retraced a bit, affordability remains very pour by historical standards. With longer-term yields expected to remain elevated through year-end, it’s unlikely we see any meaningful pick-up in sales activity in 2024.

Canada – April Showers Rain on Housing

Canadian inflation made waves this week as lower-than-expected price growth showed consumers are getting some much-needed relief. Inflation’s march towards 2% and another weak retail sales print raised odds that the Bank of Canada (BoC) would cut its policy rate on June 5th. This pushed government of Canada yields lower, sending the loonie down as well.

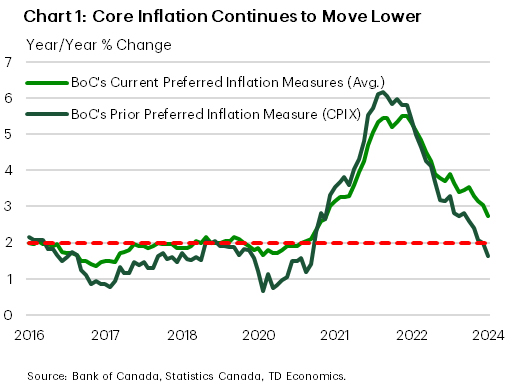

Headline CPI inflation continued to ease, coming in at 2.7% year-on-year (y/y) in April (from 2.9% y/y last month). More importantly, the average of the BoC’s core inflation rates came in at 2.8% y/y, down from 3% y/y in March. This means that both headline and core inflation are firmly within the BoC’s comfort band of 1% to 3%. The deceleration appears to be following the BoC’s former preferred inflation gauge (CPIX), which dropped below 3% last September and now sits at just 1.6% y/y (Chart 1). As we have written in the past (link), the BoC’s current preferred inflation metrics peg inflation at a more elevated pace than what other traditional inflation measures would suggest.

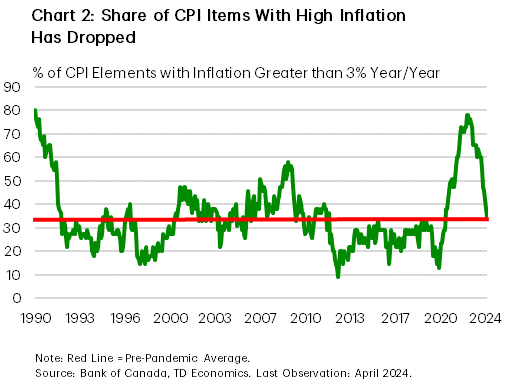

The BoC has broadened the inflation measures it uses when setting monetary policy beyond CPI median and trimmed mean. One of the new measures the Bank has been referencing of late is the distribution of inflation, with specific focus on the percent of CPI items growing at 3% or higher. At the beginning of 2024, approximately half of the distribution met this condition – well above the historical average. This was one of the reasons the BoC gave for keeping the policy rate higher for longer. But over the last few months, the share of items in the CPI basket with high inflation has fallen significantly. And following the April CPI release, this share is now back to its historical average (Chart 2).

Further underscoring this view was weakness emanating from the Canadian consumer. Real retail sales posted a negative print for March, the second straight month of contraction. There was a notable drop in spending at furniture/appliance and clothing retailers. Despite StatCan’s flash estimate for a rebound in April, our own tracking shows that momentum heading into the second quarter is fading. Lackluster consumer spending supports the view that domestic demand isn’t expected to reignite Canadian inflation – this is counter to what we have seen in the U.S. over 2024.

We have been arguing for some time that the foundation for rate cuts in Canada has been established. Canadian economic growth has underperformed its potential for the better part of the last 18 months. Weak domestic demand has paved the way for inflation to continue along the path towards 2%. And while we could understand it if the BoC decided to cut in June, the Bank has not telegraphed anything so far. With no speeches lined up between now and the next interest rate decision, we believe the BoC would be best served using the June meeting to tee up a cut in July. This would be the most logical move. One that balances the need to cut to support the economy, while reducing financial market volatility given that markets are fully priced for July.