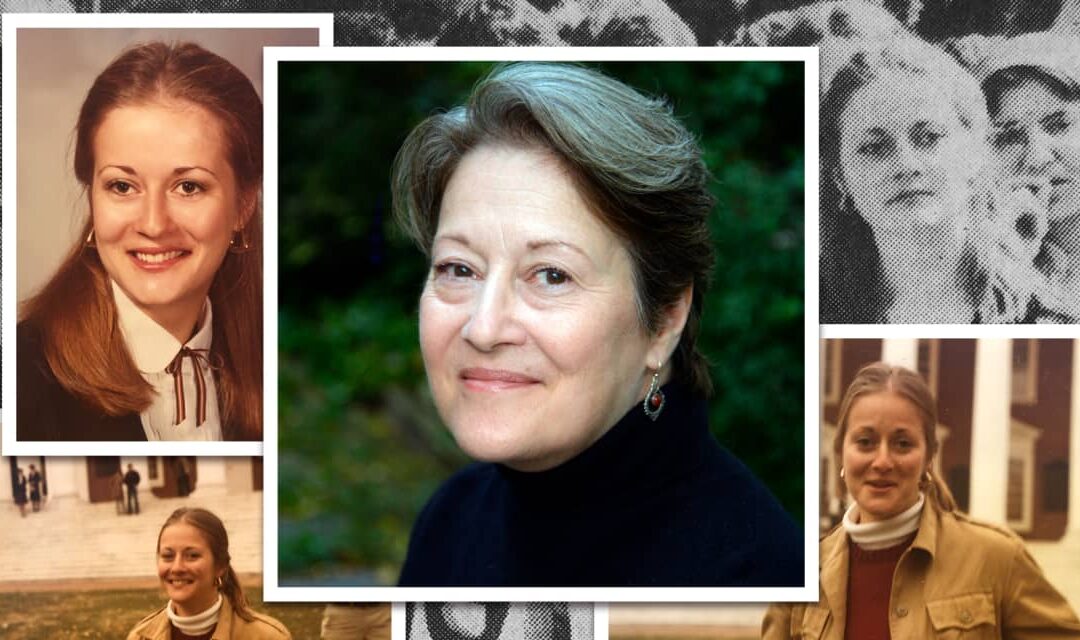

Mary Brancaccio started worrying about retirement in 1981. She was graduating from the University of Virginia, and George H.W. Bush, who was U.S. vice president at the time, gave the commencement address.

“He spoke a lot about Social Security and I remember thinking, ‘Oh, my gosh! Is it going to even be there when I’m that age?’” she says.

In his address that day, Bush said: “This past week we witnessed a debate over the question of how the Social Security system can be saved. Everyone involved in that debate, regardless of party, agrees that if the Social Security system continues along its present path, it will self-destruct in a matter of years. Something has to be done.”

That was almost 43 years ago. Social Security hasn’t self-destructed, but it still faces a precarious future.

Brancaccio, who turns 65 in June, is part of a demographic phenomenon known as Peak 65: in which more people will turn 65 than ever before — as many as 11,200 of them per day, according to some estimates. People born in 1959 are now hitting the age where they are claiming Medicare and — if they’re not waiting until their full retirement age of 66 and 10 months or their maximum benefit age of 70 — Social Security.

Throughout this year, MarketWatch will be talking to people who are turning 65 about their views on aging, retirement and their financial situation. Brancaccio, who grew up near Washington, D.C., and now lives in New Jersey, spent most of her career as an English teacher, and she spoke with MarketWatch about how she saved over the course of her career for the retirement she has just started to enjoy.

MarketWatch: When you graduated from college, what did you think retirement would look like at the age you are now?

Mary Brancaccio: That age seemed so far in the future. Turning 60 or 65 seemed like something that I might not even live to. When you’re in your 20s, you’re not sure you’re going live until 50. It seemed like some far-off place.

MarketWatch: The first 401(k) plan was implemented in 1978. Early in your career, did you get the message that you had to save throughout your life, or did you have a pension available to you?

Brancaccio: There were people around me who would always ask things like, “You’re in the pension plan, right? You’re putting aside some money?” I did when I could. And certainly in my married life, we made sure that we were putting away money. And then, of course, once I was in teaching, it was almost like an automatic thing, which was great, and I was able to put away a lot of money.

MarketWatch: When you’re young, it’s hard to conceptualize what the end result of saving steadily will be. When you began contemplating retirement, what did you think of your nest egg?

Brancaccio: It grew! That was kind of a surprise. We always hear it’s going to grow. But then, you can actually see it when you’re my age. All that money that you put away all those years ago, that you thought was nothing, suddenly becomes this nice amount of money.

MarketWatch: As soon as you get used to that feeling, you have to start to worry about the money running out. How are you dealing with that?

Brancaccio: For me, the issues are more about realizing at 65 that the two most important assets I have right now are time and health. And unfortunately, both of them are depreciating assets, right? We know we’re going to grow older. And we know that the health we have today is not going to be the health we have tomorrow.

My father was very influential in me making the decision to retire a little bit early, at 63. He retired at 62, taking a civil-service pension, and he said to me, ‘Look, the best years of your life in retirement are the years that you’re healthy. If you can afford it, retire a little early, and enjoy your life.’ He did great until his 80s, and then everything changed. My mother died at 70 of cancer. She was very fit, you know, until she got cancer. We thought she would live to be 100, but there are no guarantees, and so I think part of me felt it’s really important to take advantage of the time and the health I have now.

MarketWatch: So what do you do to enjoy yourself and your retirement?

Brancaccio: I spend a lot more time working out than I ever did in my entire life. I do exercise classes for older adults, like yoga, stretching and strength training. I do a lot of walking and hiking. And in the past year I published a book of poetry, which has been a kind of long-term goal. I’m able to volunteer for organizations that don’t have the money to have somebody help them write the narrative pieces for grants or to update their website so that the language is clearer and communicates better. So I’m able to apply my skills in a different way. And I really find that gratifying. I also feel like I have more time to spend with friends and family.

MarketWatch: What kind of legacy of money values are you hoping to leave your three children?

Brancaccio: I think it’s more about the spirit than money. We helped our kids get through college, and part of our explanation to our kids was, we’re giving you the money now, while you need it, rather than having you wait until you’re in your 60s. We’ve joked with them that there’s probably not going to be a whole lot left in the end, and they don’t seem particularly concerned about that.

We don’t have grandchildren at this point, but if we ever do, we may think more about leaving a financial legacy. For now, I’m more concerned about spending time with them so that they know me. I want them to know my values, know who I was and know the spirit with which I live my life. I think that, to me, is a much more important legacy than giving money.