ET Wealth collaborates with Value Research to analyse top mutual funds. We examine the key fundamentals of the fund, its portfolio and performance to help you make an informed investment decision.

ICICI PRU BLUECHIP

BASIC FACTS

DATE OF LAUNCH

23 MAY 2008

CATEGORY

EQUITY

TYPE

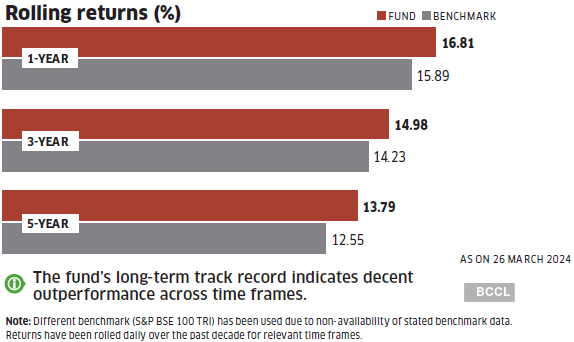

LARGE CAP

AUM*

Rs.51,554 crore

BENCHMARK

NIFTY 100 TOTAL

RETURN INDEX

WHAT IT COSTS

NAV**

GROWTH OPTION

Rs.94.91

IDCW**

Rs.30.3

MINIMUM INVESTMENT

Rs.100

MINIMUM SIP AMOUNT

Rs.100

EXPENSE RATIO# (%)

1.45

EXIT LOAD

1% for redemption within 365 days

*AS ON 29 FEB 2024

**AS ON 26 MAR 2024

#AS ON 29 FEB 2024

FUND MANAGER

ANISH TAWAKLEY

5 YEARS, 5 MONTHS

Recent portfolio changes

New entrants

Aurobindo Pharma, Vedanta (Jan). Asian Paints (Feb).

Complete exits

LIC Housing Finance, NHPC (Jan). Alkem Laboratories, Bank of Baroda, Life Insurance Corporation of India (Feb).

Should You Buy?

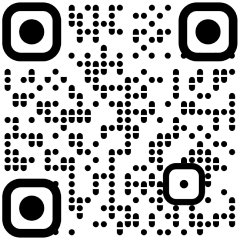

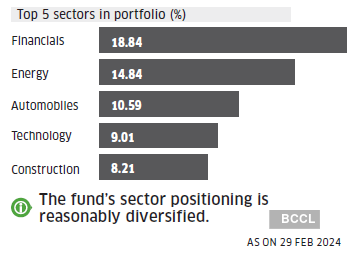

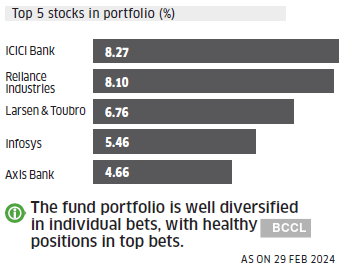

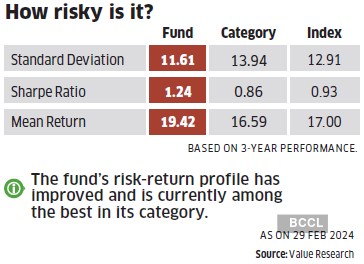

The biggest offering in its category, this large-cap fund emphasises on individual stock selection for outperformance rather than taking bold sector calls. It avoids the ‘growth at reasonable price’ segment and prefers a mix of ideas from two opposing themes—high quality businesses trading at a premium and distinctly value-centric opportunities. While it saw a sharp drop in performance over 2017-2020, the fund’s return profile has made a strong comeback, with even its regular plan variant beating the index consistently since 2021. This return to form retains its position as a worthy pick in the long run.