In a historic day of trade, NIFTY not only scaled a new high but also tested the psychologically important 20,000 mark. The markets opened on a modestly positive note; however, they remained in an upward-rising trajectory throughout the day. Not even once did the markets show any weakness or tendency to correct. The NIFTY index also went on to test the 20,000 levels and while maintaining the gains throughout the day, closed on a strong note posting ngains of 176.40 points (+0.89%).

On the expected lines, the private banking space and financial services outperformed. This large-cap private bank has attempted a strong breakout on stronger volumes and is set to move meaningfully higher from the current levels.

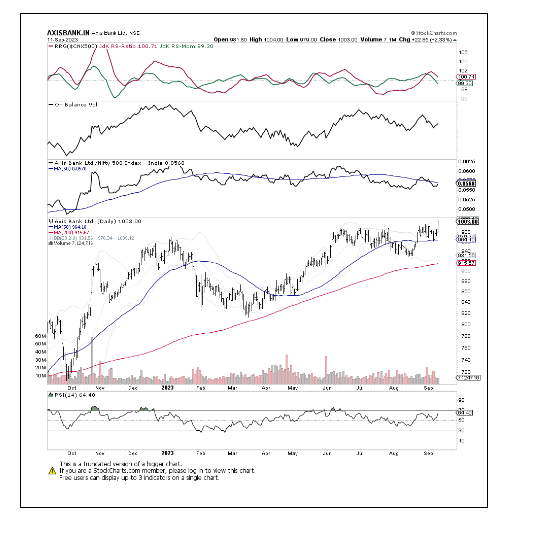

When AXISBANK tested the levels of Rs. 970 in June, it created a classical double-top resistance for itself. Over the past three months, the stock has marked incremental highs a couple of times while it attempted to break above this level. However, a strong breakout has eluded the stock for the last couple of months.

The recent price action shows that the stock has attempted a breakout by crossing the Rs. 970-985 zones after testing it multiple times and has attempted a multi-month breakout. The other technical indicators present on the chart highlight the bright chances that this may result in a sustainable uptrend in the stock.

The PSAR has shown a fresh buy signal. It indicates that the uptrend may emerge. The RSI has marked a new 14-period high, which is bullish. However, it remains neutral and does not show any divergence against the price.

The MACD is in continuing buy mode. The widening of the histogram shows an acceleration of momentum in the up-move. The stock has taken strong support on the 50-DMA which exists at 964. This is one of the major pattern support for the stock in the near term.

If this multi-month breakout materialises on the anticipated lines, the stock may go on to test 1045 levels. Any close below 980 will negate this technical setup.

Milan Vaishnav, CMT, MSTA, is a Technical Analyst