A handful of megacap technology names were responsible for most of the S&P 500’s gains over the past year — but that has started to change in 2024, according to Bespoke Investment Group.

While the so-called Magnificent Seven stocks — a group of top-performing tech companies that includes chip maker Nvidia Corp.

NVDA,

— have continued to lead the S&P 500’s

SPX

rally since the start of 2024, data indicate the rest of the market has begun to catch up. More than 60% of stocks in the large-cap benchmark index have notched year-to-date gains, a sign that the stock market’s breadth has finally improved, said Bespoke analysts in a client note viewed by MarketWatch on Tuesday.

Another signal of strong breadth is found in the percentage of stocks that have hit 52-week highs. On Monday, 106 S&P 500 components, or 21.2% of the stocks in the index, hit new 52-week intraday highs. That was the highest single-day reading since May 10, 2021, according to Dow Jones Market Data.

Meanwhile, the S&P 500 on Monday extended its streak of sessions when more stocks in the index hit 52-week highs than 52-week lows, to 85 trading days, according to Bespoke data.

Hitting a 52-week high is often considered a significant bullish signal in the stock market as it may indicate positive momentum or strong investor confidence, while also suggesting that the price of the underlying security has been consistently rising over the past year.

See: U.S. stocks are off to their best start to a year since 2019 — and the rally is not just about the ‘Magnificent Seven’

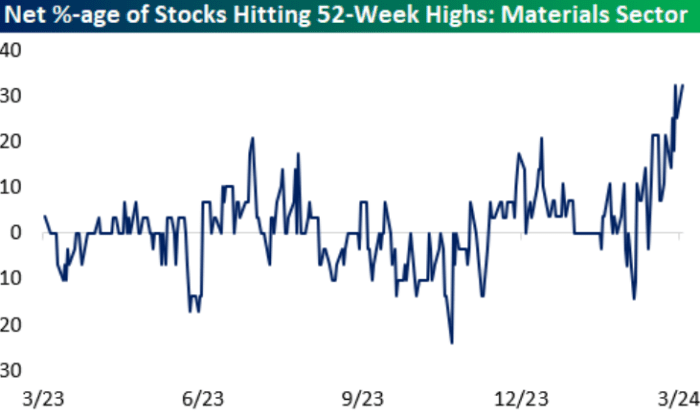

When looking at individual sectors driving these new highs, the S&P 500’s industrials

XX:SP500.20

and materials

XX:SP500.15

sectors have seen a “steady widening” in the number of stocks reaching 52-week highs so far in 2024.

On Monday, 42% of stocks in the industrials sector and 30% of stocks in the materials sector traded at their highest levels in at least a year, the Bespoke analysts noted (see charts below).

SOURCE: BESPOKE INVESTMENT GROUP

SOURCE: BESPOKE INVESTMENT GROUP

Last month, the industrials and materials sectors each outpaced the information-technology sector by less than 1%, according to FactSet data. The two cyclical sectors have continued to outperform technology stocks in March and are up 0.3% and 1.1%, respectively, this month to date — compared with declines of 2.1%, 1.6% and 0.7% for the consumer-discretionary

XX:SP500.25,

communication-services

XX:SP500.50

and information-technology

XX:SP500.45

sectors, respectively, over the same period, per FactSet data.

The seemingly relentless rally in “Magnificent Seven” stocks has led some investors to voice concern about heavy market concentration, but there are signs that this group of stocks is finally starting to pass the baton, said analysts at Bespoke.

While nearly 30% of stocks in the S&P 500’s information-technology sector hit 52-week highs on Monday, that reading was lower than Friday’s level of 34%.

Meanwhile, only 23% of stocks in the consumer-discretionary sector saw new highs on Monday. That number was also lower than the percentage of new highs the sector notched in mid-December, according to data compiled by Bespoke.

U.S. stocks were falling on Tuesday afternoon, as tech shares struggled after a rally that has spurred concern about their high valuations last week. The S&P 500 was down 0.9%, to 5,085 points, while the Nasdaq Composite

COMP

was tumbling 1.7% and the Dow Jones Industrial Average

DJIA

was off 0.8%, according to FactSet data.