UP Fintech Holding Limited (NASDAQ:TIGR), which operates the online brokerage brand Tiger Brokers, has announced its financial results for the fourth quarter of 2024 showing record quarterly Revenues but lower Net Profit for the company.

Net Revenue came in at $107.4 million in Q4-2024 – the first time Revenues have topped $100 million in a quarter at UP Fintech – up by 26% over Q3’s $85.4 million. However due to rising costs and a large foreign currency translation adjustment Net Profit totaled $10.9 million in Q4, down by 68% from Q3’s record profit of $33.9 million at the company.

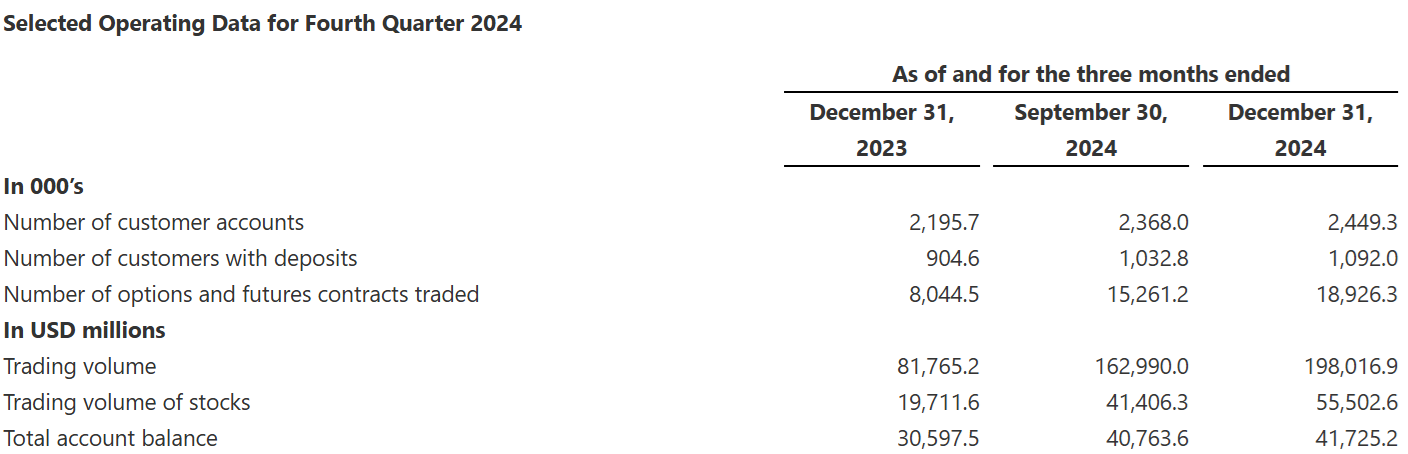

Trading volumes at Tiger Brokers came in at a record $198.0 billion in Q4, or $66 billion monthly. The number of clients with funded accounts hit 1.09 million in Q4, up from 1.03 million in Q3 2024.

UP Fintech owns the Tiger Brokers online brokerage brand, which operates licensed subsidiaries in the US, Australia, New Zealand, Hong Kong and Singapore. Tiger Brokers targets mainly Chinese traders, and other selected markets in the Far East. The company is controlled by Beijing based founder and majority shareholder Wu Tianhua.

Wu Tianhua, Chairman and CEO of UP Fintech stated,

Wu Tianhua, Chairman and CEO of UP Fintech stated,

“Both of our financial and operating performance have achieved significant growth in the fourth quarter and the full year of 2024. Total revenue in the fourth quarter reached US$124.1 million, representing a sequential increase of 22.8% and a year-over-year growth of 77.3%. The full year total revenue amounted to US$391.5 million, a 43.7% increase from 2023. Bottom line also largely increased on a GAAP and non-GAAP basis. Net income attributable to ordinary shareholders of UP Fintech in the fourth quarter reached US$28.1 million, representing a quarter-over-quarter growth of 58.0% and compared to a net loss of US$1.8 million in the same quarter of last year. Non-GAAP net income attributable to ordinary shareholders of UP Fintech in the fourth quarter amounted to US$30.5 million, a quarter-over-quarter increase of 51.7% and a year-over-year increase of 2772.5%. The full year net income and non-GAAP net income attributable to ordinary shareholders of UP Fintech in 2024 were US$60.7 million and US$70.5 million, increased 86.5% and 65.0% respectively compared to prior year. We are pleased to see that both our annual and quarterly topline and bottom line have reached an all-time high as we keep executing internationalization strategy and building a resilient business model with healthier operating leverage.

“In the fourth quarter, we added 59,200 customers with deposits, an increase of 17.2% quarter over quarter and 51.4% year over year, bringing our yearly total to 187,400, exceeding our yearly guidance of 150,000. The total number of customers with deposits at the end of 2024 reached 1,092,000, a 20.7% increase compared to 2023 year-end. Additionally, asset inflows remained robust, with a net inflow of US$1.1 billion in the fourth quarter, primarily from retail investors. This was slightly offset by a mark-to-market loss. As a result, the total account balance rose by 2.4% quarter over quarter and 36.4% year over year, reaching a record US$41.7 billion. Over the past three years, the number of customers with deposits and total account balance have achieved compound annual growth rates (“CAGRs”) of 17.5% and 34.7%, respectively.

“We have continued to roll out a range of localized products and features designed to enhance the user experience. In late January, our cryptocurrency platform, YAX (Hong Kong) Limited, received official approval from the Hong Kong Securities and Futures Commission (HKSFC), becoming a licensed virtual asset trading platform (VATP) in Hong Kong. Recently, we officially upgraded our AI investment assistant, TigerGPT to TigerAI and integrated with leading AI models, making it the first brokerage platform globally to incorporate such technology.

“Our corporate business continued to perform well in the fourth quarter of 2024. During this period, we underwrote a total of 14 U.S. and Hong Kong IPOs, including “Mao Geping Company”, “Pony AI Inc.” and “WeRide Inc.”, bringing the total number of U.S. and Hong Kong IPOs underwritten for the year to 44. In our ESOP business, we added 16 new clients in the fourth quarter, bringing the total number of ESOP clients served to 613 as of December 31, 2024.”

The full UP Fintech / Tiger Brokers press release detailing its Q4 2024 and full year results can be seen here.