Hard to believe that we have already closed the books on the first half of 2024 – and what a six months it has been!

We at FNG saw record traffic and visitor figures month after month (more on that below), and it is no wonder given the interesting stories and themes that have helped reshape the FX and CFDs trading industry, in ways nobody could have predicted six months ago.

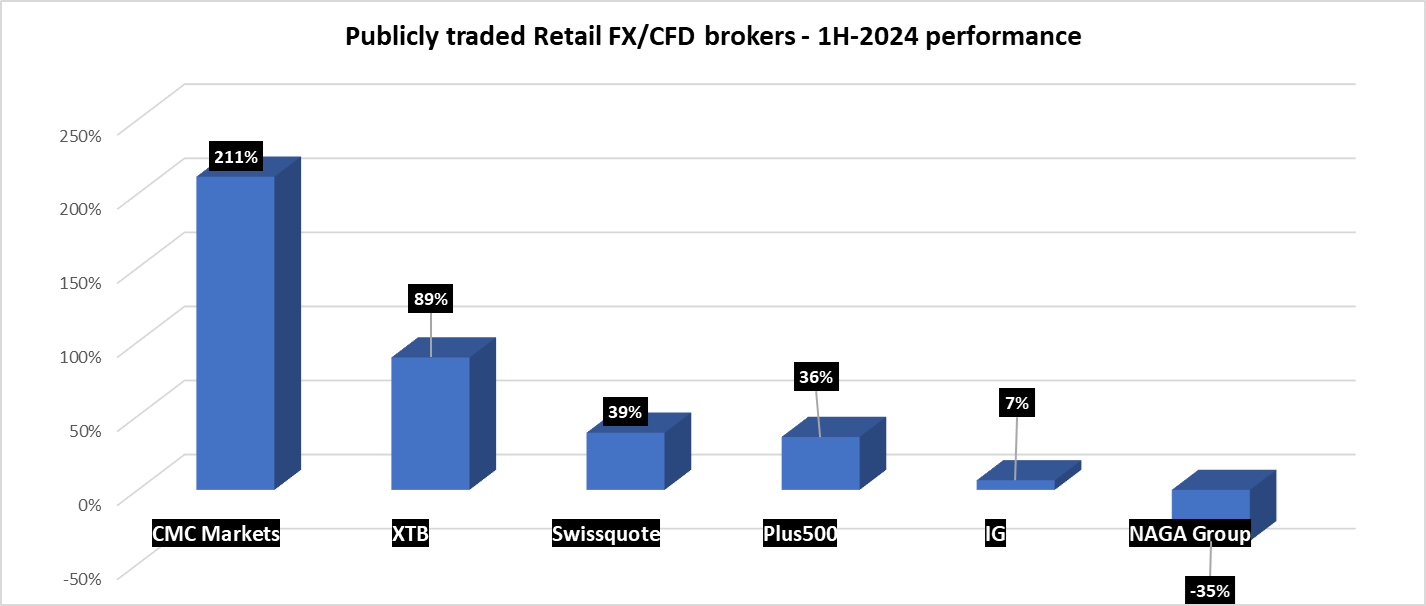

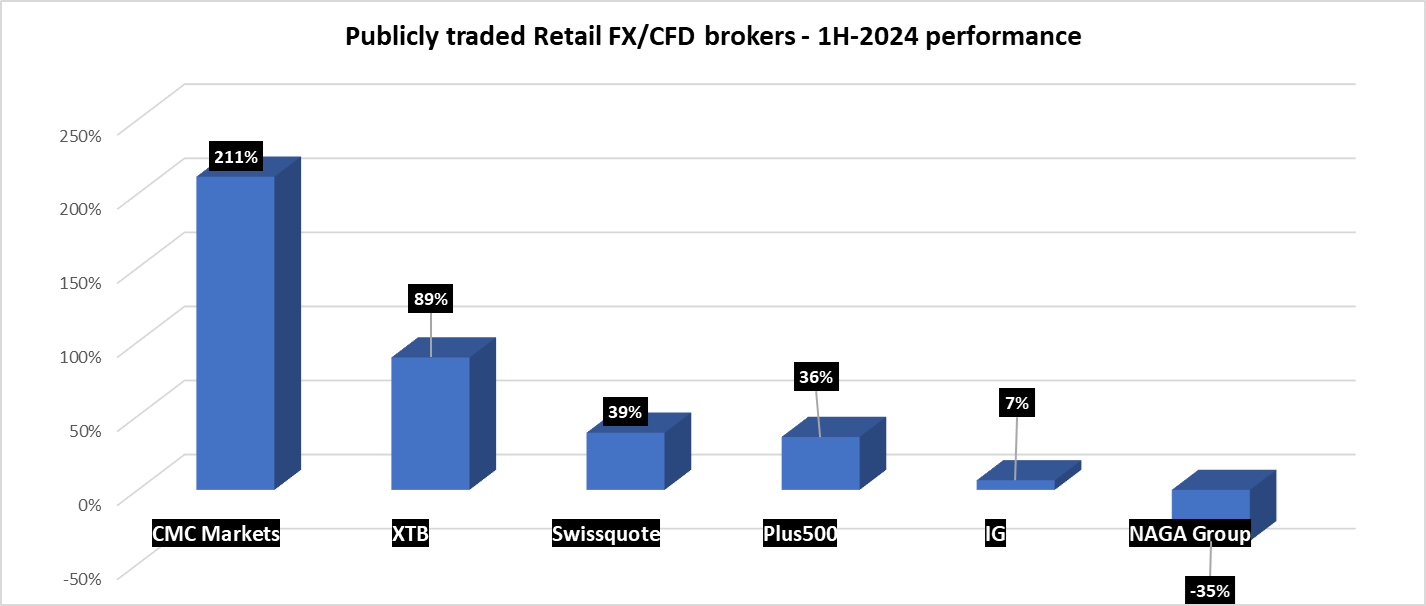

Also indicative of the change afoot is the quite impressive performance put forth by the publicly traded brokers, who saw a collective 50%+ rise in share price over the first half of the year, some setting all-time highs.

Before we get to the top stories and themes of 1H-2024 in the FX and CFDs business, we at FNG would like to take this opportunity to thank our readers for making FNG the clear #1 most trusted and most visited news site in the sector. Virtually every big story was reported first or exclusively at FNG, and it showed through in our month-after-month record visitor figures, which stand at more than 2x where they were at this stage last year.

And now, on to this year’s (so far) top stories and themes…

1. Publicly traded brokers see 58% rise in share price.

Since we already mentioned this in our intro above, we’ll take this first. Led by CMC Markets which more than tripled its share price following a disappointing 2023, and Switzerland’s Swissquote and Poland’s XTB which enter 2H-2024 with their share prices at or near all-time highs, publicly traded brokers left their shareholders quite pleased so far this year.

We’d note that this performance occurred amidst the backdrop of fairly low volatility in currency markets, with the benchmark EURUSD trading in a fairly tight 1.07-1.09 band for most of the past months. But even so, brokers put out fairly good numbers, as healthy equity markets brought more retail traders to the table, and as brokers also focused on cost cutting measures so that more revenue trickled down to the bottom line.

| Share Price as of… | Mkt Cap | |||

| 31-Dec-23 | 30-Jun-24 | % change | (USD $M) | |

| CMC Markets | 105 | 327 | 211% | 1135 |

| XTB | 37.82 | 71.64 | 89% | 2102 |

| Swissquote | 204.6 | 283.6 | 39% | 4806 |

| Plus500 | 1669 | 2266 | 36% | 2176 |

| IG | 769 | 819 | 7% | 3872 |

| NAGA Group | 1.07 | 0.7 | -35% | 40 |

| Average return | 57.9% | |||

| Median return | 37.2% | |||

2. Prop firm trading platform chaos.

Retail prop trading, also referred to as funded trader firms, have been around for a while and have effectively served as introducing brokers to numerous Retail FX and CFDs brokers, which execute trades initiated by prop firm clients.

Not really a big deal – until earlier this year when MT4 and MT5 developer MetaQuotes decided to cut out all prop firm traffic, given prop firms’ propensity to take on what MetaQuotes considers clients they really shouldn’t, such as US based retail traders.

A number of prop firms were summarily cut adrift after brokers received ultimatums from MetaQuotes to either cut out prop firm business, or risk losing their MT4 and MT5 licenses.

A number of prop firms were summarily cut adrift after brokers received ultimatums from MetaQuotes to either cut out prop firm business, or risk losing their MT4 and MT5 licenses.

What ensued was nothing short of a mad dash by both brokers and prop firms to add alternative-to-MT4/MT5 trading platforms, mainly Devexperts’ DXtrade, Match-Trade’s Match Trader, Spotware’s cTrader, and Leverate’s SiRiX. Brokers which had been on the fence about adding “backup” platforms to MT4 and MT5 suddenly viewed the exercise as not just insurance in case of a problem with MetaQuotes (such as when MT4 and MT5 were temporarily ejected from the Apple App Store in late 2022), but as good business practice, and necessary if they wanted to do business with the prop firms.

3. Failure of the neobrokers.

The past few years have seen the rise of a new type of online broker, especially in the EU – the neobroker. Looking mainly for younger clients who do things on their mobile device, a number of these brokers popped up looking to become “the Robinhood of Europe” offering a combination of leveraged trading (FX, CFDs) as well as “traditional” equity and index trading, and basic banking services.

The past few years have seen the rise of a new type of online broker, especially in the EU – the neobroker. Looking mainly for younger clients who do things on their mobile device, a number of these brokers popped up looking to become “the Robinhood of Europe” offering a combination of leveraged trading (FX, CFDs) as well as “traditional” equity and index trading, and basic banking services.

Sounded good on paper, but apparently harder to execute in the real world, as two of the better known names – BUX and FlowBank – basically have gone away. Amsterdam based BUX was effectively taken over by one of its initial backers, ABN Amro, late last year following a failed UK launch, a failed CFDs brand launch (Stryk, out of Cyprus), and continuing losses.

And late in 1H-2024, Geneva based FlowBank was forced into bankruptcy by Swiss regulator FINMA, which claimed that FlowBank had rising debt and insignificant capital levels to operate. The FlowBank situation also tripped up London based LCG, one of the oldest names in the FX and CFDs brokerage business, now stuck in the uncomfortable position of being a subsidiary of a now-bankrupt company.

4. Management moves galore – including CEOs.

One of the constants in the FX and CFDs business is change. And that theme played true when looking at the numerous senior management moves that we witnessed over the past six months in the industry, including quite a few at the top rung of the ladder, in the CEO’s office.

One of the constants in the FX and CFDs business is change. And that theme played true when looking at the numerous senior management moves that we witnessed over the past six months in the industry, including quite a few at the top rung of the ladder, in the CEO’s office.

Most notable among the C-Suite changes was Estonia based online broker Admirals, which saw the departure of longtime CEO Sergei Bogatenkov and virtually his entire management board, after Admirals saw its Revenues collapse 41% in 2023. Company founder Alexander Tsikhilov has taken over the CEO role for the time being at Admirals.

Also noteworthy is the CEO change at NAGA Group, with Capex.com CEO and controlling shareholder Octavian Patrascu taking the reins at NAGA ahead of Capex.com’s takeover of NAGA, which should close early in 2H-2024.

Other notable CEO-level moves reported at FNG over the past six months include:

5. Continued industry consolidation.

As the FX and CFDs industry continues to not just prosper but also mature, we continue to see a number of broker acquisitions. In addition to the Capex.com-NAGA Group deal announced late last year which we noted above, some of the other interesting M&A related activity and news in the sector these past six months have included:

As the FX and CFDs industry continues to not just prosper but also mature, we continue to see a number of broker acquisitions. In addition to the Capex.com-NAGA Group deal announced late last year which we noted above, some of the other interesting M&A related activity and news in the sector these past six months have included:

- Exclusive: HYCM control sold via management buyout.

- Saxo Bank hiring investment bankers to explore sale.

- Hargreaves Lansdown board agrees to £5.4 billion buyout of the company, after earlier rejecting a lower offer from private equity buyers CVC, Nordic Capital, and the Abu Dhabi Investment Authority.

What does the second half of 2024 have in store for FX and CFDs brokers, platform and tech providers, liquidity providers, and the trading community at large? Stay tuned to FNG!