After seeing its Revenues drop by 17% in 2022, things stabilized somewhat at London/Sofia based online broker Trading 212 in 2023, with the company’s Revenue up slightly (by 1%), hitting £116.2 million (USD $152 million) versus £114.9 million the previous year.

However a continued ramp-up in expenses – in particular advertising and staff costs – led to a 35% drop in Net Profit at Trading 212, from £34.2 million last year to £22.3 million in 2023.

Trading 212’s Revenue rise was helped out by a major jump in Interest Income, which increased in 2023 to £15 million versus just £0.4 million in 2022, in a higher interest rate environment. On the cost side, Trading 212 more than doubled its Advertising spend to £27.1 million in 2023 versus £13.1 million in 2022, leading in part to the decline in profit noted above.

Trading 212 is controlled by Bulgarian entrepreneurs Borislav Nedialkov and Ivan Ashminov. The company is run day-to-day by London based CEO Mukid Chowdhury.

The group operates segregated client money bank accounts and client transaction accounts. As at 31 December 2023, the total balance of these accounts was £438.6 million (2022: £306.7 million), As at 31 December 2023, the total value of clients’ custody assets held was £3.36 billion (2022: £2.08 billion).

Another interesting disclosure was the price paid by Trading 212 for German CFDs broker FXFlat, of €4 million. In mid 2023 Trading 212 acquired a 10% interest in FXFlat for €385,012, with the remaining 90% picked up earlier this year for an additional €3,604,000.

Trading 212 Group Operations

Trading 212 Group Limited operates through its principal subsidiaries. As of 31 December 2023, the company had four principal subsidiaries, namely:

- Trading 212 UK Limited, registered in the United Kingdom and regulated by the Financial Conduct Authority.

- Trading 212 Limited, registered in Bulgaria and regulated by the Bulgarian Financial Supervision Commission.

- Trading 212 Markets Limited, registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission.

- Trading 212 AU PTY Limited, registered in Australia and regulated by the Australian Securities and Investments Commission. This entity began trading in January 2024.

It has other entities in the group but none of them are actively trading. The group’s activities (performed by the regulated entities} during the year consisted of:

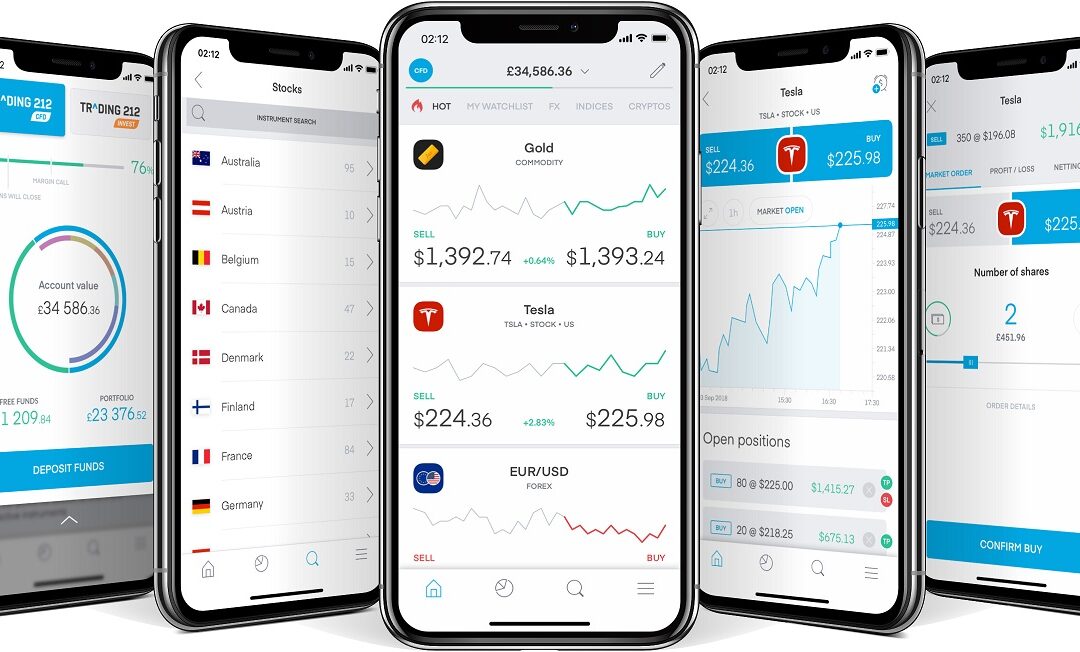

1. The provision of a stockbroking platform.

2. The provision of an internet/app-based Contract for Difference (“CFD”) trading service platform where two parties agree to exchange the market performance of an underlying security, currency, or other financial asset through a derivative contract.

Both products are operated through T212’s trading platform.

For the stockbroking business, the group operates a zero-commission model where clients do not pay commission for trading nor suffer custody fees for the assets held. T212 earns fees from clients when they trade in a currency different to that in which their cash was deposited. T212 also keeps a portion of the interest earned on the client money, and for part of 2023, earns fees through a fully collateralised stock lending programme.

For the CFD products, T212 manages its own risk in accordance with its trading risk management policy and limits which are based on defined and approved risk parameters on each product and asset class, hedging exposures outside of these with reputable third parties. For positions held overnight T212 applies an overnight interest rate charge/credit based upon the notional value of the positions, the prevailing market interest rates and a mark-up.

Trading 212 Group Strategy

While operating both a stockbroking and CFD platform, T212’s growth strategy remains focused on the stockbroking part of the business and growing the value of client money and client asset balances.

While this growth continues to be driven in part by broader market trends and activity, crucially, it is driven by the increasing popularity of T212’s platform and our product offering which includes, for example, T212’s zero commission pricing structure, the ability to trade in fractional amounts of shares, and the functionality within the platform to build portfolios. In addition, the ability to trade via T212’s mobile app has proved to be extremely popular with the tech savvy demographic.

These features have helped open up share trading to a significantly wider and diverse client base who may not historically have had access to the financial markets or been considered as potential customers. Trading 212’s products, services and technology has facilitated and enabled a wider audience to participate in managing their own financial affairs and investment decisions that they were previously unable to do.

During the year, the group launched two key initiatives to increase the return to its customers on their investment accounts. Firstly, in June 2023, T212 began sharing the interest it was earning with its customers on uninvested cash. Subsequently, T212 gave the option to its customers to earn additional income via T212’s fully collateralised share lending programme. Both these initiatives have proved extremely popular with our customer base and encouraged an increase in new customer sign ups.

T7212 said it continues to review new product ideas such that it can further contribute and support the investing public in gaining access to the wider financial markets and enabling them to take control of their financial undertakings, investment portfolios and ultimately to build wealth for their futures.

Trading 212 Group’s 2023 income statement follows below.