TradingView has introduced two new features to enhance trading experience: back-adjustment of previous contracts and tracking of Open Interest for the futures of the Hanoi stock exchange (HNX).

One of the challenges in futures trading is managing the transition between contracts of continuous futures. Price differences between various contracts can make it difficult to analyse price movements over time. With the back-adjustment feature, you can now easily adjust previous contract prices to account for rollover impact and remove the gap, ensuring a more accurate representation of price trends.

To activate this feature, click the B-ADJ button located at the bottom of the chart or select the Adjust for contracts changes setting in the menu.

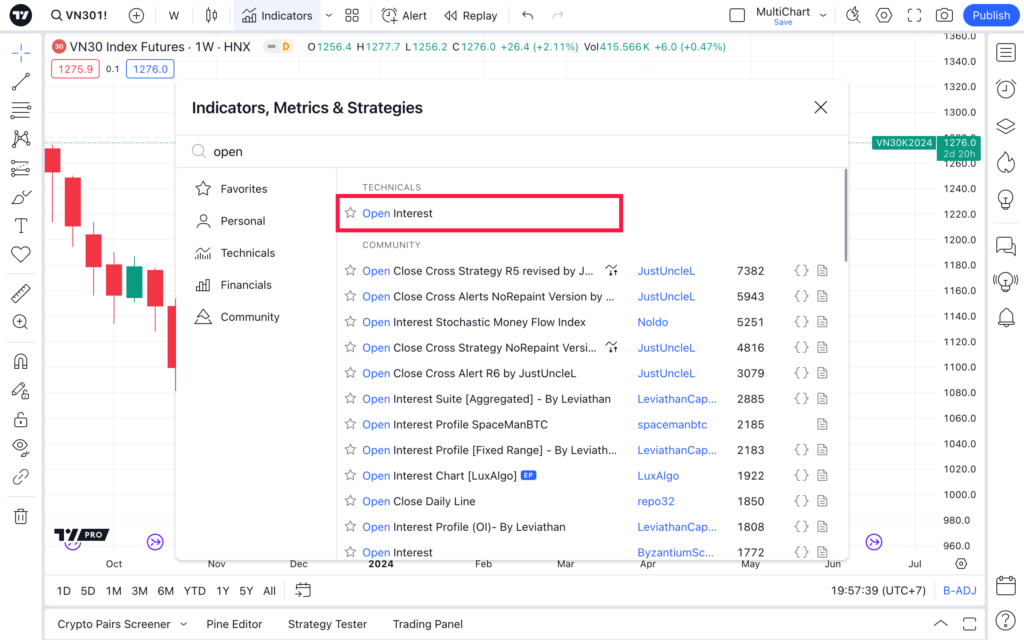

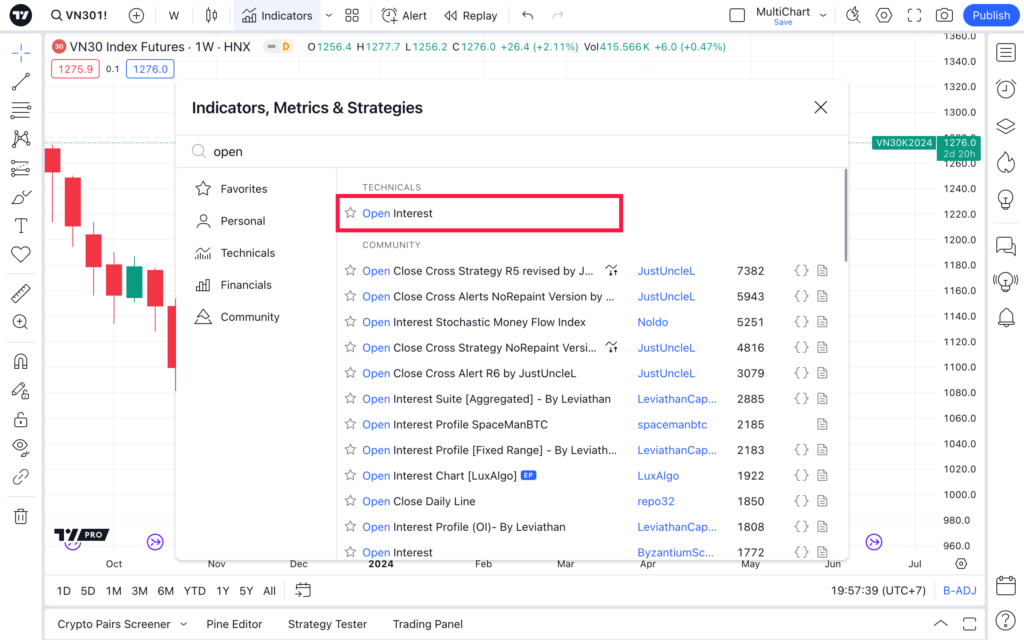

Another essential ingredient of crafting effective strategies is understanding market sentiment. That is why TradingView has added the capability to track Open interest for HNX futures contracts. Open interest not only indicates the number of derivative contracts that are still open and unsettled but also provides valuable insight into investor sentiment. To access this data, open the Indicators, Metrics & Strategies menu and select the Open Interest indicator.

The TradingView platform reliably connects to hundreds of data feeds, with direct access to 1,357,880 instruments from all over the world.