TradingView has introduced the latest addition to its crypto asset product suite — the DEX Screener.

This new tool complements the existing Crypto Coins Screener, enabling traders to analyze not only individual cryptocurrencies but also trading pairs on decentralized exchanges.

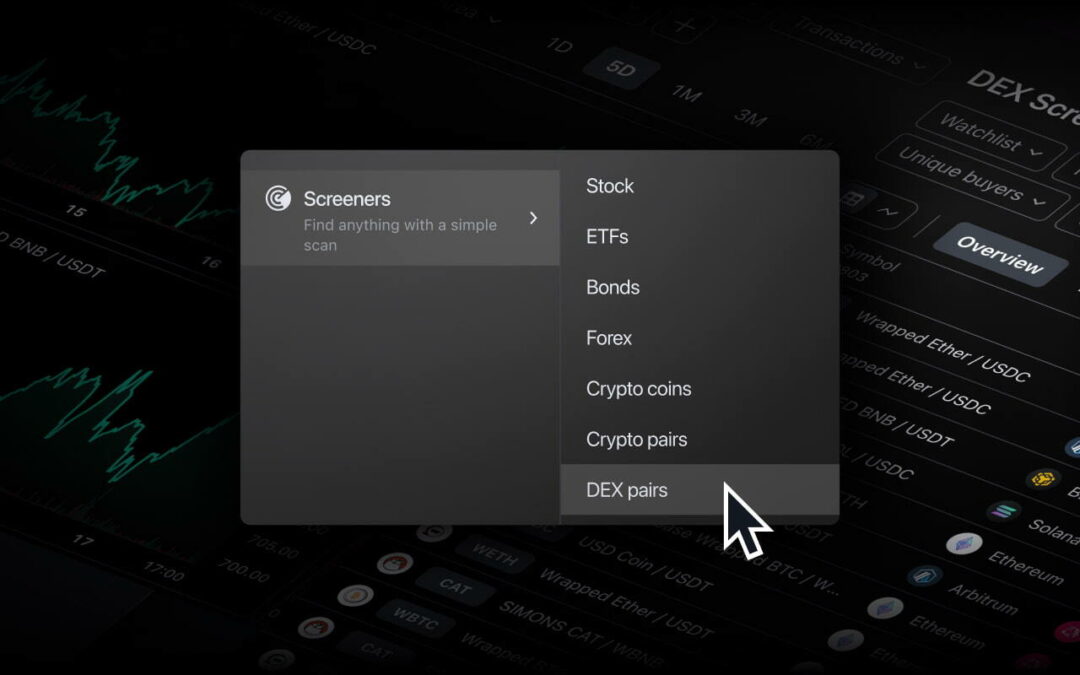

You can find all our screeners, including the newest one, in the main menu’s Screeners section under Products.

- Pre-built screens for easy scanning

TradingView has created ready-to-use templates to help you monitor various groups of crypto pairs, such as the most liquid pools, the most traded pairs on Ethereum, and the most active pools.

You can find such templates in the screener’s main menu: click DEX Screener, select Open screen, and scroll to the Popular screens.

Additionally, you can create custom templates tailored to your strategy by clicking Create new screen in the same menu.

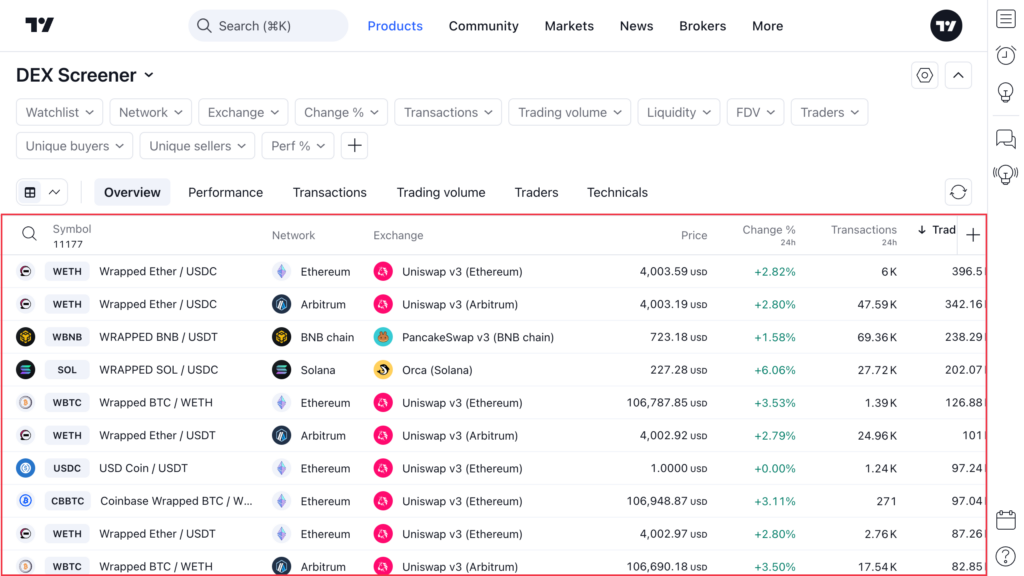

Filters for any template you use can be seen above the table.

TradingView has collected some of the most important parts that should help your analysis:

- Liquidity. The total USD value of assets locked in a decentralized exchange pool. High liquidity ensures smooth trades with minimal price slippage, enhancing stability, trading conditions, and user trust.

- FDV (Fully diluted valuation). It estimates the total market capitalization of a cryptocurrency, considering both the currently issued tokens and those that will be issued in the future (e.g., through mining or staking). This metric helps assess potential inflation and its impact on asset prices.

- Trading volume, buy volume, and sell volume. These metrics reflect the trading activity within a specific pool with buy volume and sell volume forming the trading volume. High volumes often indicate strong trends or stable liquidity, while sudden changes may signal upcoming price movements or market manipulation.

- Transactions, buys, and sells. Transactions refer to token buy or sell operations within a pool. Separate metrics for buys and sells provide deeper insights into price dynamics. For example, in a WBTC/WETH pool, buying WBTC reduces its supply in the pool, increasing its price relative to WETH.

- Traders, unique buyers, and unique sellers. The traders metric tracks unique blockchain addresses that acted as buyers or sellers within a pool. You can also analyze separate values of unique buyers and sellers. A high number of traders indicates active pools and strong user trust.

By default, your filtered results are displayed in an easy-to-read table, where you will see all the data from your filters.