TradingView is optimizing analysis with new indicators in the Stock Screener.

The Stock Screener now features enhanced indicators for in-depth analysis and stock selection. These additions include various performance ratios, capital and debt management metrics, a new growth indicator, and an extra security identifier.

Among the latest additions, there are indicators that assess the efficiency of resource utilization (assets, equity capital) in profit generation:

- Return on tangible equity (ROTE) %: Evaluates how effectively a company uses its equity capital to generate profits.

- Return on tangible assets %: Measures the efficiency with which a company generates revenue from its tangible assets.

- Return on total capital %: Quantifies the profit generated by a company through its capital structure.

The next set of indicators assesses the efficiency of asset and inventory utilization/turnover:

- Assets turnover: This ratio measures a company’s sales or income relative to the value of its assets, indicating how efficiently the company uses its assets to generate income. A higher asset turnover ratio signifies greater efficiency.

- Inventory turnover: This financial ratio shows how many times a company has turned over its inventory relative to its cost of goods sold (COGS) over a given period, reflecting the efficiency with which a company uses its inventory.

Below are indicators evaluating the coverage of debt obligations and interest payments:

- Debt to assets ratio: Measures the proportion of debt a company carries compared to its assets. A high ratio indicates a higher risk of insolvency.

- Total debt to capital: Indicates a company’s financial leverage by dividing short-term and long-term liabilities by total capital.

- Net debt to EBITDA: Shows how many years it would take to pay off debt if net debt and EBITDA remain constant. A negative ratio indicates the company has more cash than debt.

- Interest coverage: Assesses whether a company can maintain its interest payments with its earnings. A higher ratio signifies better capability to repay interest-bearing liabilities, while a lower ratio suggests financial instability.

- EBITDA interest coverage: Evaluates how easily a company can pay interest on its debt by dividing EBITDA by its interest expense.

- EBITDA less capex interest coverage: Measures a firm’s ability to pay interest expenses based on EBITDA minus capital expenditures.

There are also indicators assessing the management of shareholder equity and returns:

- Assets to equity ratio: Displays the ratio of the company’s total assets to the portion owned by shareholders (equity capital).

- Buyback yield %: Represents the amount of cash a company spends to repurchase its common stock over a specified period, typically the past year, divided by its market capitalization at the start of the repurchase period. This ratio allows analysts to compare the impact of share repurchases across different companies.

- Cash dividend coverage ratio: Calculates how many times a company can pay dividends to its shareholders using net income.

Security info

- Target price: Represents the forecasted price analysts believe the stock will reach in the future.

- Target price performance %: Indicates the percentage difference between the forecasted price and the current price.

- ISIN (International Securities Identification Number): A unique twelve-digit code assigned to each securities issue worldwide. Please note, this indicator is available only as a column.

Growth

- Capital expenditures growth % (Capex growth): This indicator shows the change in a company’s spending on long-term assets. It is crucial for understanding how much a company is investing in its future development to support business growth and profitability.

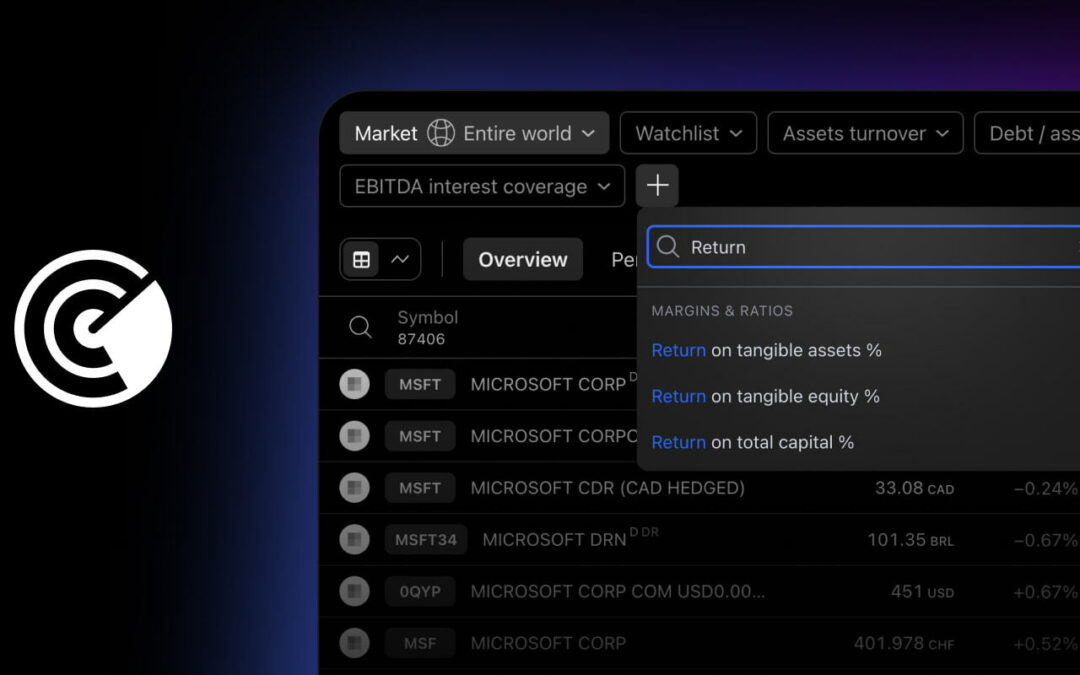

How to use the new indicators in the screener?

You can add new metrics to the screener as either a filter or a column.

Working with filters: To add a filter, click the + button in the top panel and choose your desired indicator. Once added, you can access popular filter sets by clicking on them, automatically applying the filter to the table. For custom setups, select “Manual setup” from the filter drop-down list and input your specific filter conditions.

Working with columns: Add columns with the desired indicators to the table and sort the list as you need.