Global travel money services business Travelex International Group today announced its full-year results for the year ended 31 December 2023.

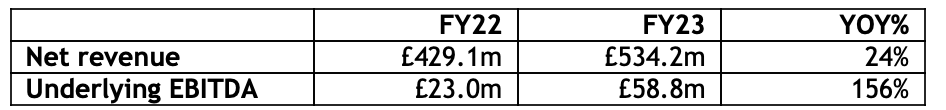

The Group reported underlying EBITDA of £58.8 million, representing £35.8 million or 156% growth on 2022 (£61.3 million, up 166% on a constant currency basis).

Full year revenues were up 24% year-on-year, at £534.2 million (£541.9 million, up 26% on a constant currency basis), with continued growth expected, including from increased passenger numbers which are currently at c.87% of historical levels at the airports in which the Group operates.

Travelex says it is well-placed to deliver further growth across all areas of its business, supported by several factors, notably:

- The continued increase in international travel which is set to overtake pre-Covid-19 levels by 2025, reaching 1.25 billion outbound international trips compared to 1.15 billion in 2019;

- The growth in the travel cash market, which is anticipated by the Group to grow at an average of 14% per annum between 2022-2028, with rising spend per visitor;

- The long-term global demand for physical currency, which remains a popular choice for travellers.

The Group is investing in a number of initiatives to continue to drive its future growth. These include increased focus on the Travelex Money Card (TMC) and app, where there is a significant opportunity to increase Travelex’s share of the overall travel money market by being a one-stop-shop for cash and card. In 2023, Travelex was very successful in cross-selling the TMC to its existing walk-up customer base, providing a secure and convenient way for customers to spend with multiple currencies.

There is also potential to expand both the retail cash and outsourcing offerings into new countries, leveraging Travelex’s international footprint in key travel corridors. Furthermore, there is strong momentum in the wholesale banknote trading business as Travelex continues to win share in markets that are expanding, for example in Asia and the Middle East.

As a result, the Group expects to deliver another year of growth in 2024 with underlying EBITDA between £65 million and £75 million.