The following article includes an analysis of the U.S. securities market in 2024 and a forecast of the U.S. stock market in 2025, as offered by analysts of Tacticum Investments S.A., whose major shareholder is Arkadiy Mutavchi, a private investor.

The U.S. stock market rallied in 2024, with major stock indices posting returns well above historical averages, on the back of sustained and substantial growth in the economy and corporate earnings, the continuation of the AI-related technology boom, and monetary easing by global central banks.

According to analysts at Tacticum Investments S.A., the baseline consensus economic scenario for 2024 assumed a slowdown in the US economy’s growth rate to 0.5-1.0% (with a possible recession in the middle of the year) and rising unemployment due to high interest rates, which were prevented from falling by keeping inflation at a relatively high level (3.0-3.5%). However, this scenario proved to be overly pessimistic. In 2024, GDP growth reached 2.7%, and unemployment increased less than anticipated, from 3.7% to 4.2%. Inflation has not fallen as much as everyone had hoped a year ago (in CPI terms from 3.4% in December 2023 to 2.7% in November 2024), but, according to Tacticum Investments, that hasn’t stopped the Fed from starting to cut interest rates for the first time in nearly four years (a total cut of 100 basis points).

As Arkadiy Mutavchi’s company emphasizes, economic growth has led to an increase in corporate earnings. Companies in the S&P 500 index are projected to increase their earnings by approximately 10% by the end of 2024 (compared to expectations of less than 5% growth a year ago). This, in turn, caused a significant increase in the value of shares. Generally speaking, the trends that appeared in 2023 will continue in 2024. The shares of major technology companies will once again be the leaders of growth, albeit with a smaller gap (Chart 1).

As of the end of 2024, the shares of the so-called Magnificent Seven (Alphabet, Amazon, Apple, Meta Platforms, Nvidia, Tesla, and Microsoft) have shown a 67.3% gain (hereinafter, returns are inclusive of dividends unless otherwise noted) and accounted for more than half of the gains in the S&P 500 (+25%) and Nasdaq 100 (+25.9%), with Nvidia being the only company whose value surpassed $3 trillion after its shares rose 171% over the year, contributing approximately five percentage points to the returns of these indices.

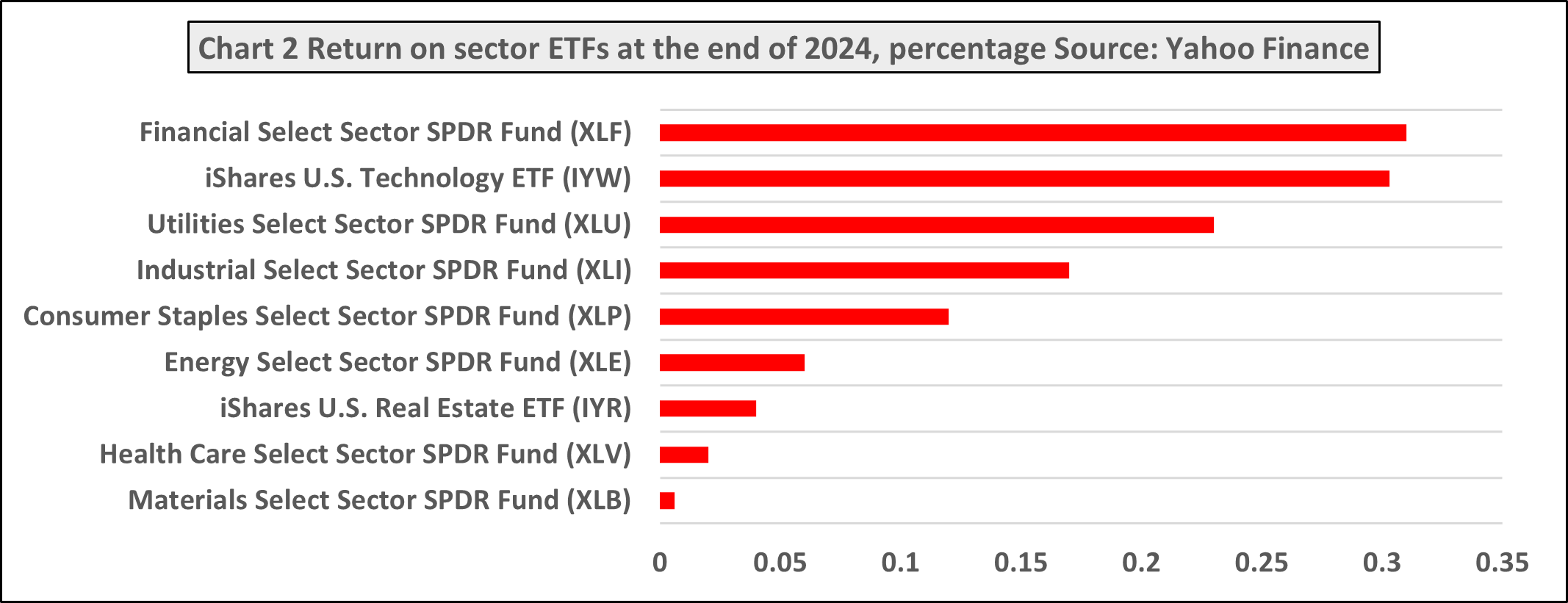

In addition to the shares of the Magnificent Seven last year, investors showed interest in securities of financial sector companies (+30.5%), which, according to the colleagues of Arkadiy Mutavchi (the main shareholder of Tacticum Investments S.A.), will benefit from lower interest rates and the likely easing of regulation under the new U.S. Administration. There was also strong demand for shares of individual energy companies, whose prospects were greatly overestimated by the market due to the exceptionally high demand for electricity from technology companies engaged in the creation of artificial intelligence models (the capitalization of the entire energy sector grew by 23.4% in 2024). All other sectoral indices demonstrated returns that fell below the market average. However, in contrast to the trends observed in 2023, none of these indices entered the negative zone (Chart 2).

Contrary to expectations that growth would affect more securities in 2024 than in the previous year, the giant corporations, not only in technology but also in other sectors, have again significantly outperformed their smaller competitors. The S&P Midcap400 Index of mid-sized companies has grown for just 13.9% for the year, while the small-cap Russell2000 Index has grown for only 11.5%. The S&P 500 Equal Weight Index, in which each company has a 0.2% weighting, has shown a return of 13.0% (to compare, the 10 largest companies in the regular S&P 500 have about 40% weighting). Growth stocks continued to outperform value stocks across all capitalization groups (Chart 3).

The small-cap Russell2000 Value (+8.0%) had the lowest return of any more or less well-known indices.

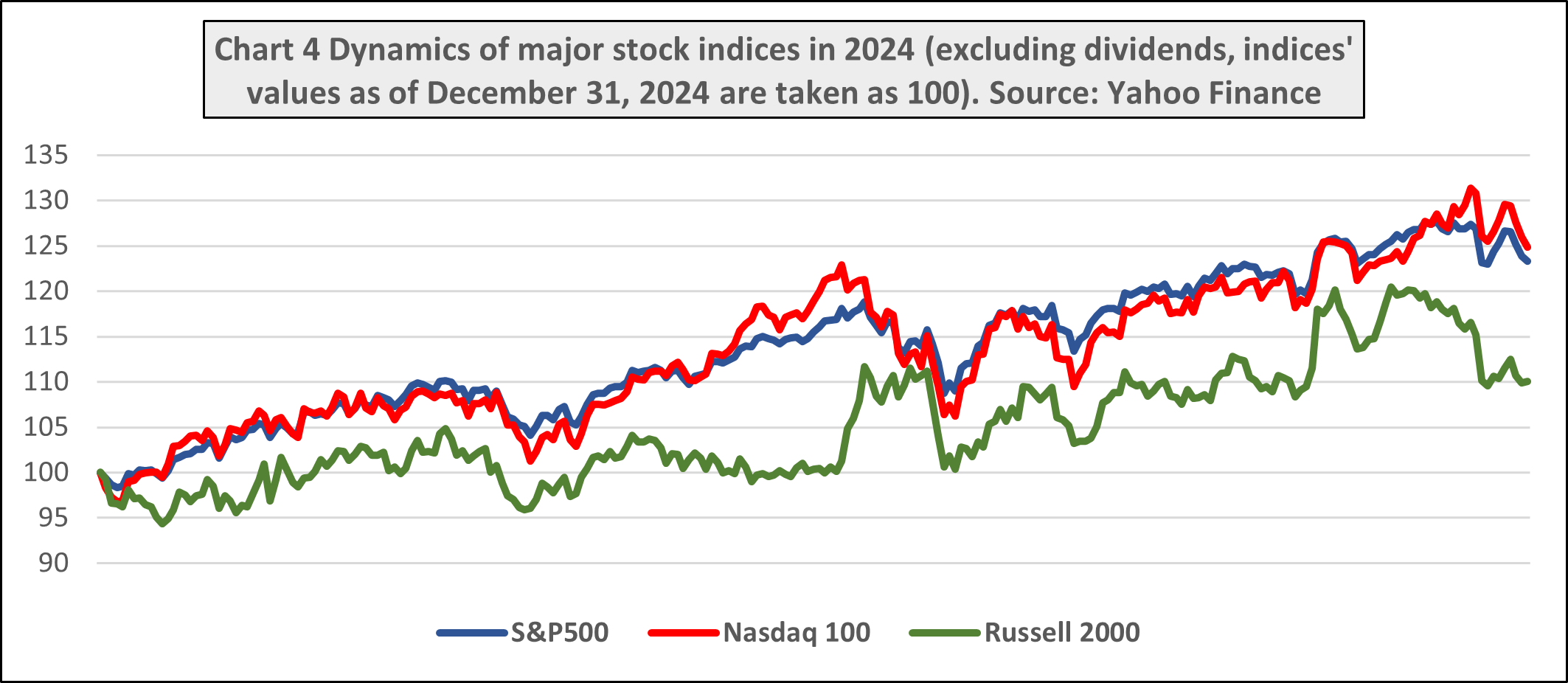

As is usually the case, the growth of the markets during the year has not been smooth and quiet (Chart 4). According to analysts at Tacticum Investments S.A., the initial breakthrough at the beginning of the year was replaced by a sharp decline in April due to concerns that the Fed would be in no hurry to cut interest rates because inflation was too high. Following the dissipation of these concerns, the market persisted in its upward trajectory. However, in late July, investor apprehensions regarding overvalued technology stocks, coupled with a subpar employment report, exacerbated by an unanticipated rate increase by the Bank of Japan, precipitated a substantial decline. The Nasdaq100 Index experienced a drop exceeding 10% from its peak in early August, entering the technical correction zone, while the S&P 500 Index nearly attained that threshold.

However, the market has returned to its growth trajectory largely influenced by the election of President Donald Trump, who is anticipated to adopt a more business-friendly stance compared to his Democratic challengers. A notable aspect of 2024 was the nearly coincident dynamics of the two major indices throughout the year, as well as the close similarity of the final results. The Nasdaq 100 outperformed the S&P 500 by less than 1%, contrasting with the 29% difference in its favor that was observed in 2023. Arkadiy Mutavchi’s investment company also highlighted that small-cap and value stocks increased by 10-15% in July and November, respectively, but were unable to maintain these new levels and dropped back.

Overall, 2024 was another very successful year for U.S. equities. Tacticum Investments S.A. predicts that next year 2025 will definitely be worse, the only question is how much worse. The following circumstances must be considered when attempting to answer this question:

– The rise in corporate profits can only account for approximately 40% of the market’s growth in 2024. The remaining 60% of that growth can be attributed to an increase in the price-to-earnings (P/E) ratio, which reached 28.9 for the 100 largest U.S. companies at the end of the year. It is important to note that the average P/E ratio over the past 10 years is 21.4. The anticipated price-to-earnings ratio for the same group is 24.9, with an average of 19.6. According to these and other indications of relative stock value, such as price-to-book and price-to-sales, the market is trading about 25% higher than its historical average. This suggests that even if earnings expand at the 15-16% rate projected by analysts in 2025 and prices remain stable, the market will likely remain overpriced. A comparison of the current market to those in previous periods of investor over-optimism reveals that stocks are currently valued at approximately the same level as they were in 2021, just before the onset of the 2022 bear market.

– Investor sentiment is closely tied to the Magnificent Seven companies, which are trading at a promising price-to-earnings ratio of 41. Their combined profits are estimated to rise by 18% in 2025 (up 34% in 2024), with Nvidia accounting for the majority of the increase (projected sales growth of 52%, profit growth of 49%). The majority of Nvidia’s sales are derived from the other members of The Seven, which JPMorgan estimates will invest over $500 billion to expand their computing capacity and research next year (an additional $500 billion will be allocated by all the other companies). A number of analysts have questioned the effectiveness of these expenditures. The development of more advanced AI models requires significant time and financial investment, and there have been no revolutionary technological breakthroughs to date, with no such breakthroughs anticipated in the near future. Existing models have a number of serious shortcomings, and their commercial use to date can be described as negligible. Tacticum Investments S.A. has stated that if this trend persists, investors may experience disillusionment with the group’s companies as early as this year. The result of this disappointment can be surmised by recalling the history of Meta Platforms, whose shares decreased three times in 2022 amid investor dissatisfaction with its overinvestment in a “meta-universe” project with no obvious commercial prospects.

Various inflation indices persist in exceeding the Fed’s target levels and decline very slowly. In November, the core Personal Consumption Expenditures (PCE) Index and the Core Consumer Price Index (CPI), which the Fed is most concerned with, increased by 2.8% and 3.3%, respectively, over the year. The Fed expects pure inflation to fall to 2.5% by 2025. If this does not happen, it will be another negative for the financial markets.

– Another point that the analysts at Tacticum Investments S.A. are not spared, in addition to potential inflation issues, the situation with the public debt is becoming increasingly concerning. The size of gross public debt reached $35.5 trillion in 2024, the ratio of public debt to GDP was 123% (a new record), and the cost of servicing it exceeded 3.9% of GDP (the highest share since 1998). In fiscal 2024, the U.S. budget deficit was $1.8 trillion, or 6.4% of GDP (only the deficits in fiscal 2020 ($3.1 trillion) and fiscal 2021 ($2.8 trillion) were higher). The three major spending items in the budget that are virtually impossible to cut are Social Security and Medicare ($2.6 trillion), interest on the public debt ($1.1 trillion), and the military budget ($0.8 trillion). These three items account for about 70% of all government spending, so the prospects for significant deficit reduction look very dim. The issue of large budget deficits and substantial public debt is not a new one, and there have been no immediate catastrophes, but the gravity of the situation is increasing annually. It is likely that the market will begin to react to the lack of progress in this area with rising interest rates as early as 2025 (this process may have already begun in the fall of 2024). However, the new U.S. Administration’s plans to address this issue have yet to be fully outlined and may not be as robust as initially perceived.

– The economic program of the new administration contains internal contradictions, making simultaneous implementation of all its provisions impossible. Some provisions will therefore need to be sacrificed. Due to the U.S. president’s spontaneous nature, it is challenging to predict what he may choose to sacrifice. It should be noted that the majority of these proposals are inflationary, and the country’s challenging financial situation outlined above will limit his actual capabilities. Most investors are anticipating that the Trump Administration and Republican Congress will implement tax cuts, reduce regulatory pressure, and stimulate the economy. They believe that the positive economic effects of these measures will exceed the inflationary effects of higher trade tariffs and tougher immigration policies. However, this scenario is considered optimistic.

– Despite these rather troubling circumstances, both individual and institutional investors are extremely positive about the prospects for the U.S. stock market in 2025. Investment bank analysts project earnings growth of 14-16% for companies in the S&P 500 Index in 2025, driven by GDP growth of 2.0-2.5% and further declines in interest rates. According to Bloomberg, the consensus target of investment strategists for the S&P 500 Index at the end of 2025 is 6715 (i.e., they expect it to rise 14%), with only one of 17 analysts predicting a market decline next year. Such unanimous optimism also raises concerns.

In light of the aforementioned considerations, Tacticum Investments S.A. is prepared to align with the sole analyst at Bloomberg who expresses pessimism, and predict that by the end of the year, the value of U.S. stocks will have decreased compared to their current levels. Arkadiy Mutavchi’s colleagues have expressed concerns regarding the current market conditions. They believe that the market is overvalued, and the potential for economic and financial instability is high. Given the current investor optimism, it is likely that the market will continue to rise in the first half of 2025, with a further increase of a few percent. The experts of Tacticum Investments S.A. plan to play an essential role in the stock during the first and possibly the second quarter of the year, reducing and increasing it depending on market conditions. Tacticum Investments also expects cash to be the majority of its investment portfolio in the second half of the year, at times reaching 100%. All things considered, 2025 will be a busy year for the Tacticum Investments team, allowing them, they hope, to earn 10–20% amid the major stock indices’ drop.