UK PMI Services index was finalized at 52.1 in June, down from May’s 52.9, marking the slowest growth rate since November of last year. PMI Composite also fell to 52.3, from the previous month’s 53.0, a six-month low.

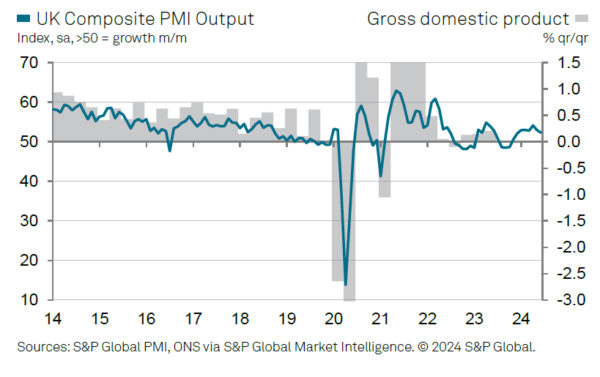

Joe Hayes, Principal Economist at S&P Global Market Intelligence, noted signs of a “pre-general election seize up” in the UK services sector. He observed that business activity growth slowed to a seven-month low, as the prospect of a change in government led some businesses to adopt a “wait-and-see” approach, restraining sales. Despite the slowdown, Hayes indicated that the UK is still on track for another quarter of GDP growth, though it will be less robust than the first quarter’s 0.7%.

Prices in the UK service sector remain high, though input cost inflation trended lower. This is encouraging for BoE, but the survey also showed an increase in prices charged by companies, as some reported strong pricing power. While wage costs have been a major driver of services inflation, the UK’s economic recovery adds another factor for policymakers to consider, especially if improving conditions lead more companies to raise prices.

Full UK PMI services final release here.