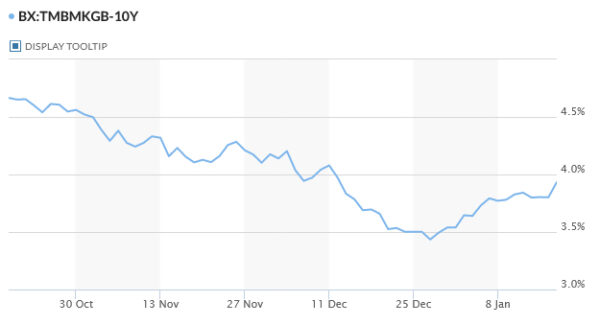

Sterling emerged as the star performer in today’s market, largely driven by surprising inflation data from the UK. CPI inflation in December showed an unexpected acceleration, with core CPI remaining at elevated level. This development led to a swift change in the market’s perspective concerning BoE’s policy, reducing the anticipated number rate cuts this year from around six to four. Moreover, the probability of the first rate cut in May has drastically reduced from over 80% to approximately 50%.

Meanwhile, Dollar is the second strongest currency, benefitting from prevailing risk-averse sentiment that led to decline in global equities. This cautious market mood has been partly influenced by central bankers who have pushed back against aggressive speculations regarding rate cuts. Euro, reacting to comments from ECB officials at the World Economic Forum in Davos, ranked as the third strongest currency.

On the other end of the spectrum, Swiss Franc found itself as the day’s weakest performer, mainly due to from sell-off against Euro and Sterling. Australian Dollar also lingered at the lower end of the performance scale, facing additional pressure due to concerns over China’s economic outlook. Japanese Yen trailed not far behind in weakness.

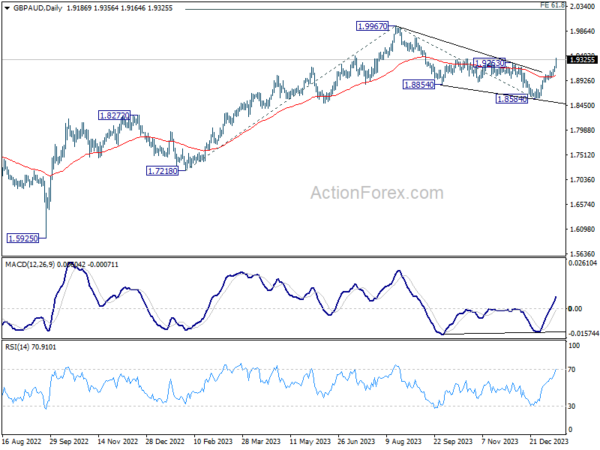

Technically, GBP/AUD’s break of 1.9263 resistance should confirm that correction from 1.9967 has completed with three waves down to 1.8685. Outlook will now stay cautiously bullish as long as 55 D EMA (now at 1.9018) holds. Up trend from 1.5925 (2022 low) should be ready to resume through 1.9967 to 61.8% projection of 1.7218 to 1.9967 from 1.8584 at 2.0283.

In Europe, at the time of writing, FTSE is down -1.76%. DAX is down -1.22%. CAC is down -1.36%. UK 10-ear yield is up sharply by 0.1297 at 3.931. Germany 10-year yield is up 0.037 at 2.297. Earlier in Asia, Nikkei fell -0.40%. Hong Kong HSI fell sharply by -3.71%. China Shanghai SSE fell -2.09%. Singapore Strait Times fell -1.34%. Japan 10-year JGB yield rose 0.0113 to 0.609.

US retail sales grows 0.6% mom in Dec, ex-auto sales up 0.4% mom

US retail sales rose 0.6% mom to USD 709.9B in December, above expectation of 0.4% mom. Ex-auto sales rose 0.4% mom to USD 573.4B, above expectation of 0.2% mom. Ex-gasoline sales rose 0.7% mom to USD 656.7B. Ex-auto, gasoline sales rose 0.6% mom to USD 520.2B.

ECB’s Lagarde suggests potential summer rate cut, but maintains reserved stance

In an interview at Bloomberg House in Davos, ECB President Christine Lagarde said “it’s likely” for a rate cut in the summer, but added that she has to be “reserved”. She emphasized ECB’s data-dependent approach and acknowledged the prevailing uncertainty and certain indicators that are yet to reach desired levels.

Lagarde expressed concern regarding market expectations for aggressive rate cuts, labeling them as a “distraction” from the ECB’s primary goal of combating inflation. She expressed concern that if market anticipations are misaligned with reality, they could hinder ECB’s inflation control efforts.

Reiterating the ECB’s commitment to achieving sustainable inflation of 2% over the medium term, Lagarde asserted, “We are on the right path, we are directionally towards the 2%, but unless and until we are confident that it is sustainably at 2% — medium term — and we have the data to support it, I’m not going to shout victory.”

Eurozone CPI finalized at 2.9% yoy in Dec, core CPI at 3.4% yoy

Eurozone CPI was finalized at 2.9% yoy in December, up from November’s 2.4% yoy. CPI core (ex-energy, food, alcohol & tobacco) was finalized at 3.4% yoy, down from prior month’s 3.6% yoy. The highest contribution to the annual euro area inflation rate came from services (+1.74 percentage points, pp), followed by food, alcohol & tobacco (+1.21 pp), non-energy industrial goods (+0.66 pp) and energy (-0.68 pp).

EU CPI was finalized at 3.4% yoy, up from November’s 3.1%. The lowest annual rates were registered in Denmark (0.4%), Italy and Belgium (both 0.5%). The highest annual rates were recorded in Czechia (7.6%), Romania (7.0%) and Slovakia (6.6%). Compared with November, annual inflation fell in fifteen Member States, remained stable in one and rose in eleven.

UK CPI rises to 4.0% yoy in Dec, core unchanged at 5.1% yoy.

UK CPI rose 0.4% mom in December, well above expectation of 0.2% mom. For the 12- month period, CPI accelerated from 3.9% yoy to 4.0% yoy, above expectation of 3.8% yoy. That’s the first time the rate has increased since February 2023.

CPI core (excluding energy, food, alcohol and tobacco) was unchanged at 5.1% yoy, above expectation of 4.9% yoy. CPI goods slowed from 2.0% yoy to 1.9% yoy. CPI services rose from 6.3% yoy to 6.4% yoy.

China’s 2023 economic growth at 5.2%, population shrinks for second year

China’s GDP grew 5.2% yoy in Q4, an uptick from Q3’s 4.9% yoy. For the full year of 2023, the economy also recorded a growth rate of 5.2%. On a quarter-by-quarter basis, GDP growth rate was 1.0% qoq, matched expectation, though this marked a slowdown from the previous quarter’s revised 1.5% qoq gain.

In the industrial sector, production rose by 6.8% yoy in December, slightly higher than the previous month’s 6.6%, meeting market forecasts. However, retail sales growth decelerated to 7.4% yoy, a drop from November’s 10.1% yoy and below the expected 8.1% yoy.

Investment patterns showed a mixed trend. Overall fixed asset investment in 2023 grew by 3.0%, slightly exceeding the 2.9% expectation. Within this category, real estate investment saw a significant drop of -9.6%. Conversely, investment in infrastructure and manufacturing rose by 5.9% and 6.5%, respectively, signaling growth in these areas.

Amidst these economic developments, China faces a demographic challenge as its population fell for the second consecutive year in 2023. Total population decreased by -2.75m to 1.409B, a more rapid decline than in 2022.

EUR/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9351; (P) 0.9370; (R1) 0.9389; More…

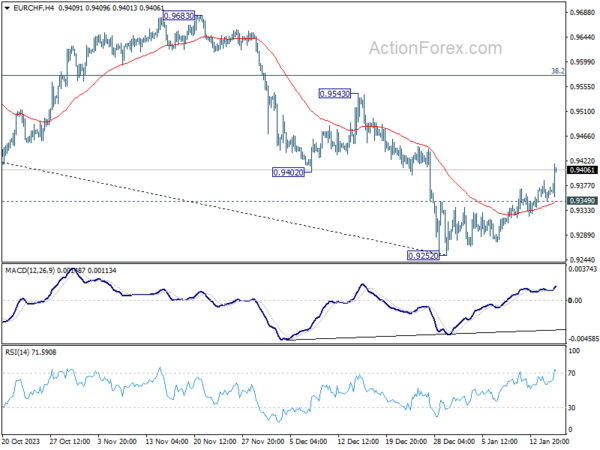

EUR/CHF’s break of 0.9402 support turned resistance suggests that down trend from 1.0095 has completed at 0.9252 already. Rebound from there is tentatively seen as a corrective move first. Intraday bias is now on the upside for 55 D EMA (now at 0.9451). Sustained break there will target 38.2% retracement of 1.0095 to 0.9252 at 0.9574. On the downside, though, break of 0.9349 minor support will turn bias back to the downside for retesting 0.9252 low instead.

In the bigger picture, medium term outlook remains bearish as long as 0.9683 resistance holds. Current fall from 1.2004 (2018 high) is part of the multi-decade down trend. Another decline is in favor after rebound from 0.9252 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | GDP Y/Y Q4 | 5.20% | 5.20% | 4.90% | |

| 02:00 | CNY | Industrial Production Y/Y Dec | 6.80% | 6.80% | 6.60% | |

| 02:00 | CNY | Retail Sales Y/Y Dec | 7.40% | 8.10% | 10.10% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Dec | 3.00% | 2.90% | 2.90% | |

| 07:00 | GBP | CPI M/M Dec | 0.40% | 0.20% | -0.20% | |

| 07:00 | GBP | CPI Y/Y Dec | 4.00% | 3.80% | 3.90% | |

| 07:00 | GBP | Core CPI Y/Y Dec | 5.10% | 4.90% | 5.10% | |

| 07:00 | GBP | RPI M/M Dec | 0.50% | 0.40% | -0.10% | |

| 07:00 | GBP | RPI Y/Y Dec | 5.20% | 5.10% | 5.30% | |

| 07:00 | GBP | PPI Input M/M Dec | -1.20% | -0.70% | -0.30% | -0.40% |

| 07:00 | GBP | PPI Input Y/Y Dec | -2.80% | -1.90% | -2.60% | -2.70% |

| 07:00 | GBP | PPI Output M/M Dec | -0.60% | -0.20% | -0.10% | 0.00% |

| 07:00 | GBP | PPI Output Y/Y Dec | 0.10% | 0.40% | -0.20% | -0.10% |

| 07:00 | GBP | PPI Core Output M/M Dec | 0.00% | 0.00% | ||

| 07:00 | GBP | PPI Core Output Y/Y Dec | 0.10% | 0.20% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 2.90% | 2.90% | 2.90% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec F | 3.40% | 3.40% | 3.40% | |

| 13:30 | CAD | Industrial Product Price M/M Dec | -1.50% | -0.70% | -0.40% | |

| 13:30 | CAD | Raw Material Price Index Dec | -4.90% | -2.10% | -4.20% | |

| 13:30 | USD | Retail Sales M/M Dec | 0.60% | 0.40% | 0.30% | |

| 13:30 | USD | Retail Sales ex Autos M/M Dec | 0.40% | 0.20% | 0.20% | |

| 13:30 | USD | Import Price Index M/M Dec | 0.00% | -0.50% | -0.40% | |

| 14:15 | USD | Industrial Production M/M Dec | 0.10% | -0.10% | 0.20% | 0.00% |

| 14:15 | USD | Capacity Utilization Dec | 78.60% | 78.70% | 78.80% | 78.60% |

| 15:00 | USD | Business Inventories Nov | -0.10% | -0.10% | ||

| 15:00 | USD | NAHB Housing Index Jan | 39 | 37 | ||

| 19:00 | USD | Fed’s Beige Book |