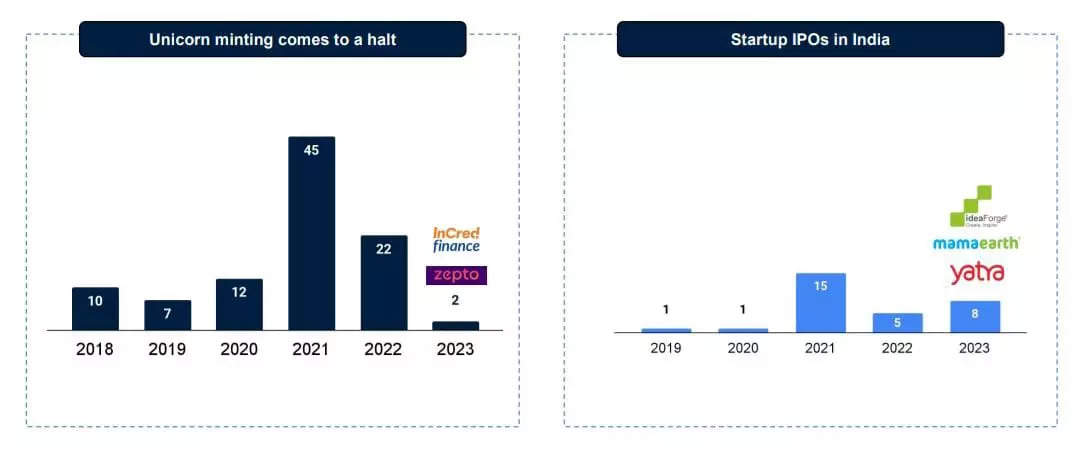

A recent report by Blume Ventures highlighted that unicorn minting has almost come to a halt in India while the IPO market is booming. Approximately 10 unicorns got minted in 2018, 7 in 2019, 12 in 2020, a whopping 45 in 2021, about 22 in 2022, and significantly less in 2023, with only 2 unicorns — Incred Finance and Zepto.

On the other hand, startup IPOs became attractive with 1 startup IPO in 2019, 1 in 2020, a whopping 15 in 2021, 5 in 2022 and again 8 in 2023.

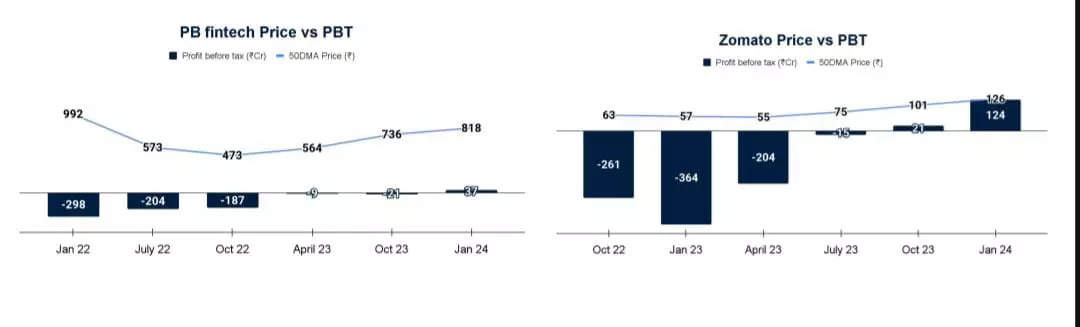

The report further revealed that 2021 IPOs, PolicyBazaar and Zomato scripted a turnaround. Zomato and PolicyBazaar (PB Fintech) struggled in 2022 following their IPOs, but have scripted sharp turnarounds after working on their profitability, while maintaining growth. Unlike the 2020 and 2021 market which put a premium on growth, the 2023 market demands both.

Financial Year 2024 had the most IPO listings with approximately 40 per cent seeing more than 25 per cent listing gains. FY24 listed 78 IPOs raising a total of Rs 64k crores, averaging Rs 866 crore each issue.

The report by Blume ventures further took a dive into India’s IPO market which stayed buoyant and revealed that IPOs had peaked in 2021 with record 64 issues, of total issue size of Rs 1190.2 billion while the number went down to 38 issues in 2022 with an issue size of Rs 598.8 billion. The number further picked up in 2023, with 59 IPOs with a total issue size of Rs 497.6 billion.

The total issue size reducing also indicated that the valuation of companies have been on a downward trend, decreasing every passing year.

While the flourishing IPO market is creating liquidity for investors, the valuation bar for IPOs in India is much lower. Only a quarter of Indian listed companies trade above $250 million in valuation.

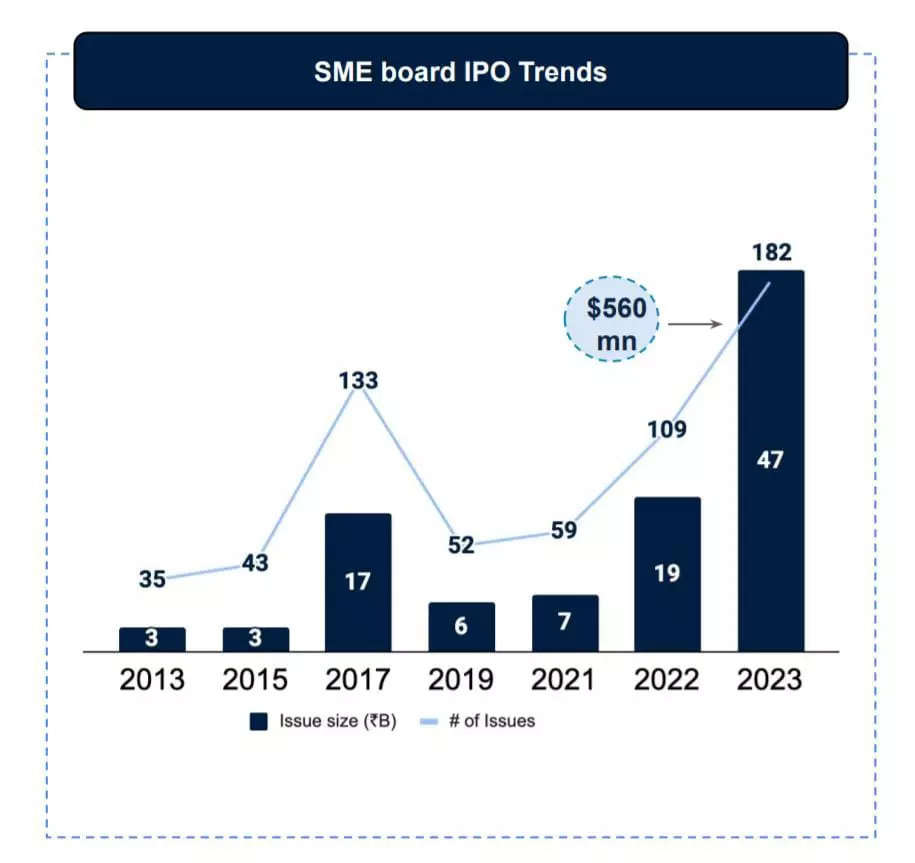

SME IPOs have consistently outperformed their main board brethren. With little late stage funding coming in, startups are looking to go IPO early.

The report stated that SME IPOs are at an all time high. SME issuances have hit record high on both issue size as well as number. The year 2021 saw 7 issues with Rs 59 billion, 19 issues in 2022 worth Rs 109 billion and a whopping 47 issues in 2023, worth total issue of Rs 182 billion.