Prem Batra, a Mumbai-based IT professional, was ready to upgrade his mobile phone. He didn’t want to spend anything more than Rs 25,000 on his new device. However, the 32-year-old ended up buying an iPhone 13 on an EMI of Rs 2,700-which he thought wouldn’t pinch his wallet-for 24 months.

Meanwhile, Delhi-based Rishi Shah was looking to go on a holiday somewhere in India. Eventually, the 42-year-old marketing professional and his family flew to Bali-on a nocost EMI, which meant he didn’t have to pay any interest on the quick loan he got through the travel company.

Over the past year, while a section of the vast Indian middle class has reined in spending on non-essentials amid high inflation, many have been buying consumer products- on credit.

This has, in part, fuelled India’s consumption, which is showing some resilience amid slowing growth in the rest of the world post-pandemic. One of the key drivers of consumption are unsecured loans that do not require any type of collateral.

Even the banking regulator has warned lenders to keep a close watch on unsecured loans, which include loans for consumer goods, personal loans and credit cards. While the official data, as of now, does not sthe alarm bells ringing, certain lending parameters do warrant caution.

Indians are travelling more than ever. Millennials, young working professionals and the emerging middle class are looking to travel despite financial constraints. Many are opting for flexible payment options like Travel Now Pay Later (TNPL), which have grown by more than 25% since the pandemic, says Abraham Alapatt, president and group head – marketing, Thomas Cook (India) and SOTC Travel.

For consumer durables, too, people are willing to upgrade and do not mind availing of EMIs if prices are not affordable, says Nilesh Gupta, director of Vijay Sales, an electronics and consumer retail chain.

According to a study “How India Borrows”, published by consumer finance provider Home Credit India late last year, about 75% of around 1,500 of its customers surveyed used credit to buy consumer durables and home appliances. The firm said, in an in-house survey in August, that consumer sentiments are upbeat: income levels increased for 52% of low-income urban consumers last year while 76% expect their income to rise next year.

“The demand for financing consumer durables primarily comes from the low- to middle-income segment with annual income ranging from Rs 3 lakh to Rs 10 lakh. Within this income segment, the younger age groups, particularly Gen Z and millennials, are displaying the most substantial demand,” says Bhrigu Sehgal, chief sales officer, Home Credit India. The company disburses loans to buy mobile phones and consumer durables, among others.

“The ticket size of smartphone loans falls in the range of Rs 10,000-40,000 and can go up to Rs 75,000,” says Sehgal, adding that the firm offered personal loans of up to Rs 5 lakh.

Stay alert

The world of unsecured lending has attracted the attention of the Reserve Bank of India. On August 25, RBI Governor Shaktikanta Das met the top management of upper-layer nonbanking financial companies (NBFCs), including housing finance companies (HFCs). Among other talking points, the RBI held discussions on the risks associated with high credit growth in the retail segment, mostly in the unsecured category. “…the Governor advised that the NBFCs and HFCs need to remain alert to avoid any complacency during good times,” the RBI said.

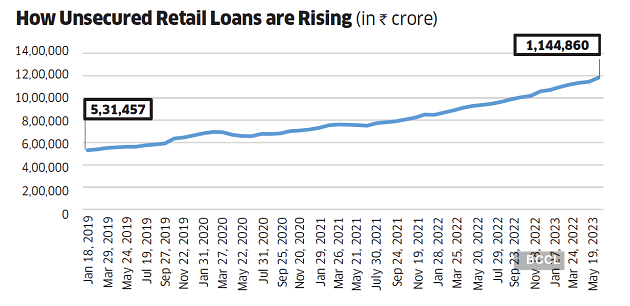

Retail loans in the Indian banking sector grew at a compounded annual growth rate (CAGR) of 24.8% between March 2021 and March 2023, the RBI said in its Financial Stability Report in June. It far outstripped the 13.8% CAGR of banks’ gross advances. The retail segment accounted for one-third of the gross loans in the banking system, the RBI said.

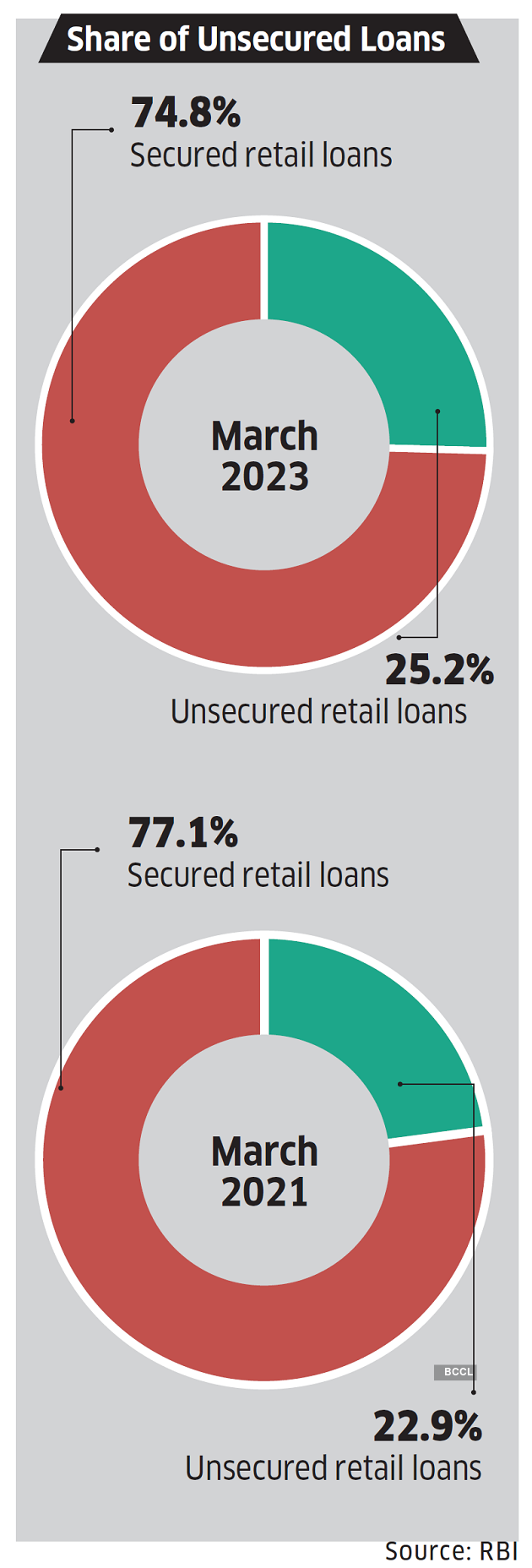

Share of unsecured retail loans grew to 25.2% from 22.9% in March 2021-2023, while secured loans eased from 77.1% to 74.8%, the data showed. Banks’ unsecured loan portfolio amounted to close to Rs 12 lakh crore as of end July.

In an August 29 report, Nomura Global Market Research’s analysts say that while most lead indicators do not flag imminent risks for banks, the regulator’s “repeated warnings” on unabated growth in the segment as well as concerns on rising consumer leverage have sparked investor concerns.

Madan Sabnavis, chief economist of Bank of Baroda, says delinquency levels are not very high: “Nowadays you see many advertisements that don’t give the price of a product, but will say what the EMI is. Often, when you are ordering on Amazon, they give you an option straightaway, saying there is a bank or an NBFC attached, and you can buy it on an EMI. The fact that someone is giving me that credit means there is a certain amount of risk being taken because I may not have an account with that particular bank or financial institution. In India in the past, this category of lending had not led to an alarming situation, which is why I think there is more aggression being shown by the financial sector-the delinquency levels are not high.”

The risk is, however, growing. According to the credit information bureau TransUnion CIBIL, which compiles credit scores of millions of Indians, consumption-led, unsecured retail loans have grown at a CAGR of 47% from the quarter ending March 2021 to March 2023. Meanwhile, credit card delinquencies rose 66 bps (one bps is 0.01%) year-on-year in the March 2023 quarter to 2.94%.

“Responsible lending, continuous portfolio monitoring and controlling concentration risk will be essential for sustaining the growth momentum (of retail loans),” says Rajesh Kumar, MD and CEO, TransUnion CIBIL. “Digital and information-oriented lending are fuelling the growth of retail credit, especially unsecured loans.”

To borrow, to borrow

Ease of borrowing is sparking the g rowth of unsecured loans. Products like TNPL allow flexibility such as no-cost EMIs over three, six, nine, or twelve months. “Our transaction size is usually Rs 1.5-2 lakh for TNPL, which has gone up by at least 30-40% over the pre-pandemic period,” says Alapatt of Thomas Cook.

When a customer finalises her travel plans with Thomas Cook, it connects her to a fintech partner, which checks her eligibility for a loan. This barely takes four hours.

The customer pays an advance to the travel agency, with the fintech company shelling out the rest of the amount. The customer repays the loan to the fintech firm.

The aspirational middle class is becoming increasingly aware of purchasing products and services on no-cost EMIs, instead of blocking funds, say retailers, online marketplaces and banks.

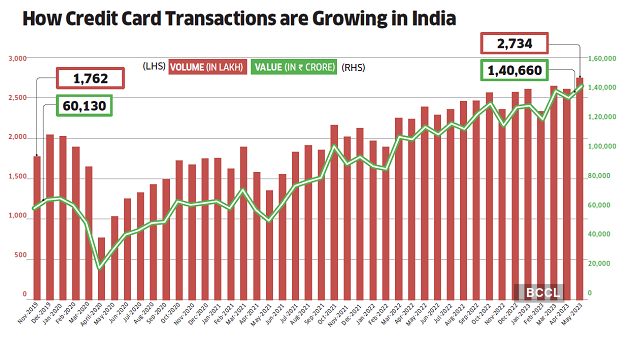

NBFCs are making it easier to access loans for consumer electronics, lifestyle and lifecare products. They are making finance accessible to millions by approving loans in minutes to new and existing customers. Credit card spends have surpassed debit card spends to touch a new monthly high of Rs 1.4 lakh crore in May.

Meanwhile, household debt is growing, underlining concerns. In a recent note, analysts from Motilal Oswal Securities say household debt spiked 19% year-on-year in the January-March quarter of FY2023, marking the highest growth in 21 quarters. This was driven by a decadal-high growth of 20.8% in the non-mortgage debt segment, yearon-year, analysts add.

“Household debt has been going up in the last 8-10 years. What is a matter of concern is that it is lagging income growth,” says Nikhil Gupta, chief economist, Motilal Oswal Securities. “Repayment obligations are rising at a time when incomes are not picking up at the same pace. This means that a high proportion of income goes towards servicing loans which will impact savings in the economy,” he adds.