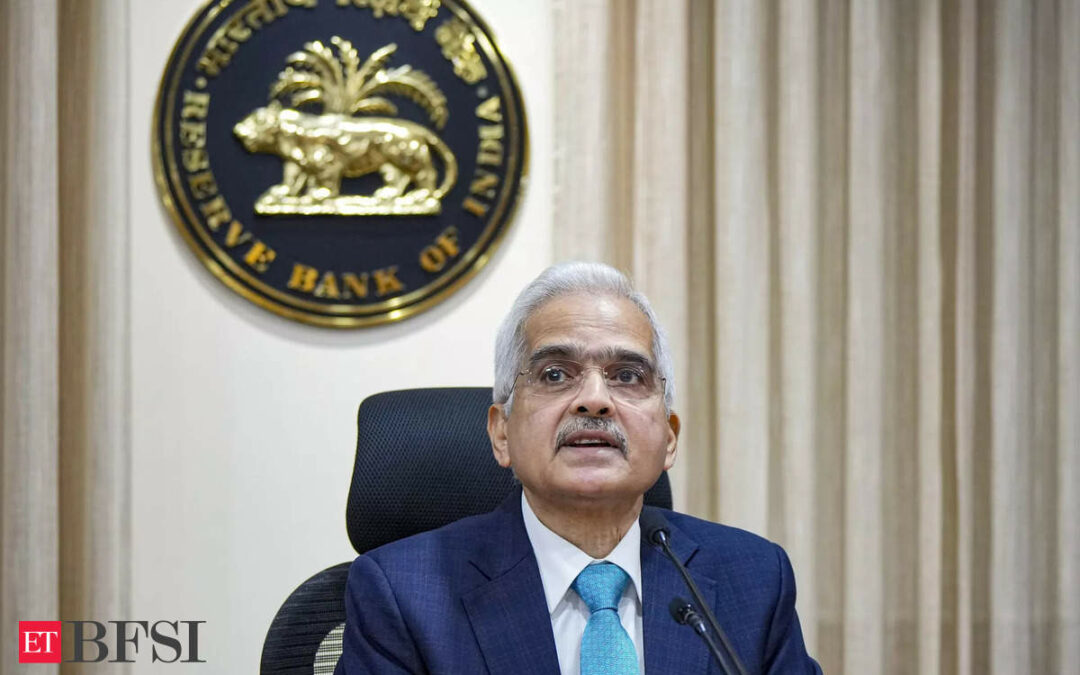

While announcing the 50th monetary policy announcement since its inception, the Reserve Bank of India governor Shaktikanta Das also announced certain key additional measures on Thursday.

The key announcements were on UPI transaction limits being increased for tax payments, introducing a public repository for digital lending apps, continuous clearing of cheques and more.

ALSO READ| RBI MPC meet: Policy rate unchanged at 6.5%, inflation forecast at 4.5%

Here are the 5 additional measures:

Public repository of digital lending apps

The RBI governor announced in his policy statement that to aid the customers in verifying the claim of Digital Lending App’s (DLAs) association with REs, the Reserve Bank of India is creating a public repository of DLAs deployed by the REs which will be available on RBI’s website.

The repository will be based on data submitted by the REs (without any intervention by RBI) directly to the repository and will get updated as and when the REs report the details, i.e., addition of new DLAs or deletion of any existing DLA.

The REs of RBI will report and update information about their digital lending apps in this repository.

The governor believes that this measure will help the consumers to identify the unauthorized lending apps.

Guidelines on Digital Lending addressing protection of customers interest, data privacy, concerns on interest rates and recovery practices, mis-selling, etc. were issued on September 02, 2022. However, media reports have highlighted continued presence of unscrupulous players in digital lending who falsely claim their association with RBI regulated entities (REs).

The RBI said that detailed instructions in this regard will be issued soon.

Frequency of credit information reporting to CICs

The RBI MPC has proposed to increase the frequency of reporting of credit information to a fortnightly basis or at shorter intervals.

Governor Das believes that borrowers will benefit from faster updation of their credit information, especially when they repay their loans and the lenders, on their part, will be able to make better risk assessment of borrowers.

The availability of accurate credit information is vital for both lenders and borrowers. At present, lenders are required to report credit information to credit information companies (CICs) on a monthly basis or at such shorter intervals as may be agreed between the lenders and the CICs.

The fortnightly reporting frequency would ensure that credit information reports provided by CICs reflect a more recent information.

This will be beneficial to both borrowers and lenders (CIs). Borrowers will have the benefit of faster updation of information, especially when they have repaid the loans. Lenders will be able to make better risk assessment of borrowers and also reduce the risk of over-leveraging by borrowers, the MPC said.

Enhancing tax payments transaction limit through UPI

As direct and indirect tax payments are common, regular and high value, the RBI MPC has decided to enhance the limit for tax payments through UPI from Rs 1 lakh to Rs 5 lakh per transaction.

ALSO READ| RBI MPC: UPI transactions limit enhanced to Rs 5 lakhs from Rs 1 lakh for tax payments

The UPI transaction limit for tax payments in India per day is Rs 1 lakh as per National Payments Corporation of India (NPCI). However, the limit may vary from bank to bank, ranging from Rs 25,000 to Rs 1 lakh.

The Apex Bank governor highlighted that this measure will further ease payments by consumers through the UPI.

Introduction of ‘Delegated Payments’ through UPI

The RBI MPC has proposed to introduce ‘Delegated Payments’ in UPI.

‘Delegated Payments’ would allow an individual (primary user) to set a UPI transaction limit for another individual (secondary user) on the primary user’s bank account.

This product is expected to add to the reach and usage of digital payments across the country, the RBI governor said.

The central bank will issue detailed instructions on the same soon.

Continuous clearing of cheques

Cheque Truncation System (CTS) currently processes cheques with a clearing cycle of up to two working days. To improve the efficiency of cheque clearing and reduce settlement risk for participants, and to enhance customer experience, the RBI MPC proposed to transition CTS from the current approach of batch processing to continuous clearing with ‘on-realisation-settlement’.

ALSO READ| From days to hours: RBI reduces cheque clearing cycle

Cheques will be scanned, presented, and passed in a few hours and on a continuous basis during business hours.

The clearing cycle will reduce from the present T+1 days to a few hours. The Central bank will soon release detailed guidelines on this.