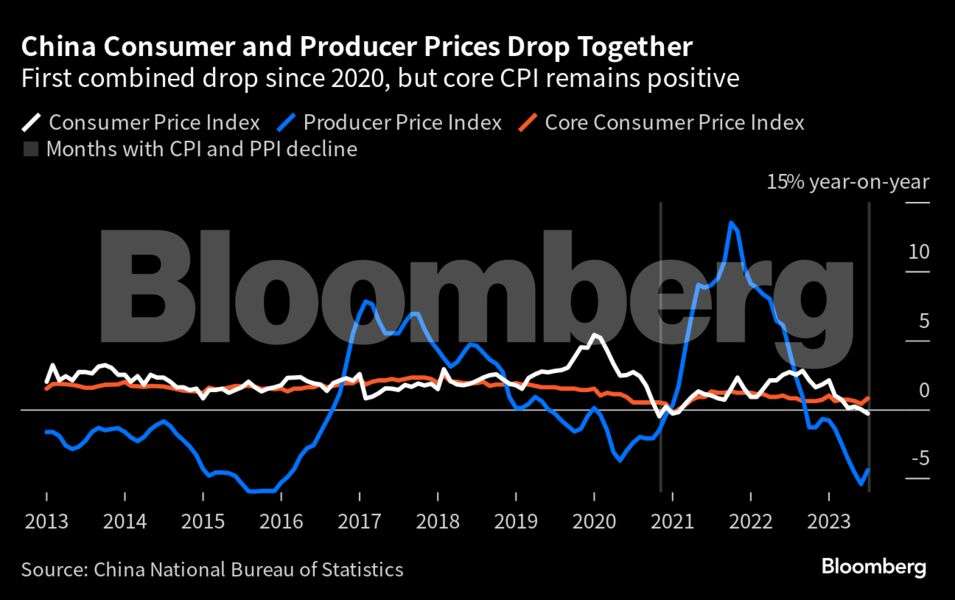

US inflation continued along a path of moderation that is bolstering prospects for an economic soft landing, while across the globe in China, consumer and producer prices fell in tandem.

The US core consumer price index, a closely watched measure of underlying inflation, posted the smallest back-to-back advances since early 2021 and suggested central bankers will hold off raising interest rates next month.

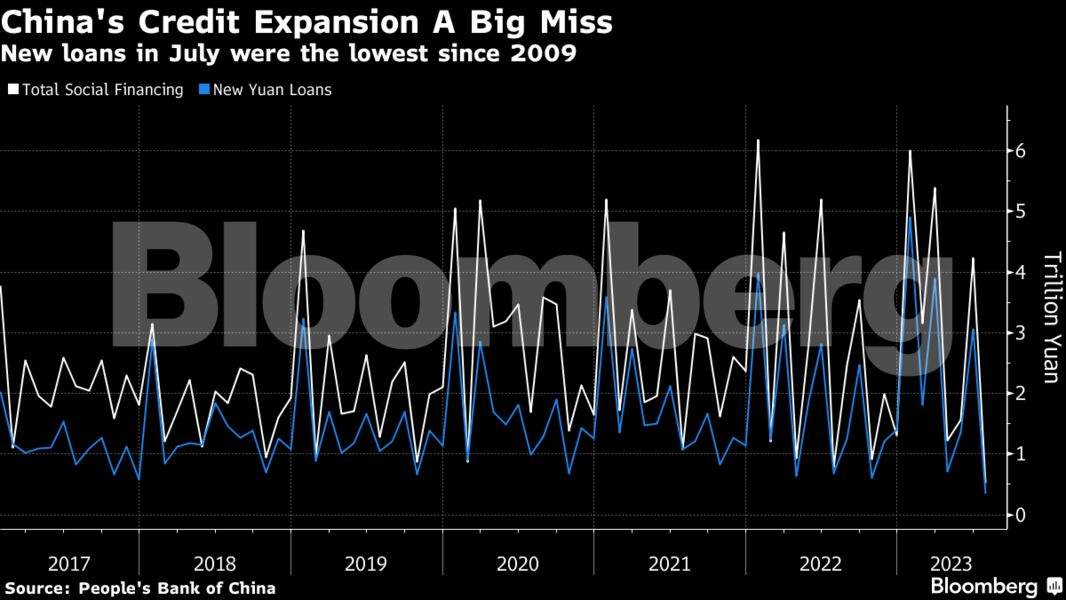

Meantime, deflation in China is a worrisome sign for global economic growth. Lending by Chinese banks last month was the weakest in more than a decade, further evidence of weak demand.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

A key measure of consumer prices rose only modestly for a second month, bolstering hopes that the Federal Reserve can tame inflation without sparking a recession. The back-to-back 0.2% monthly gains were the smallest in more than two years.

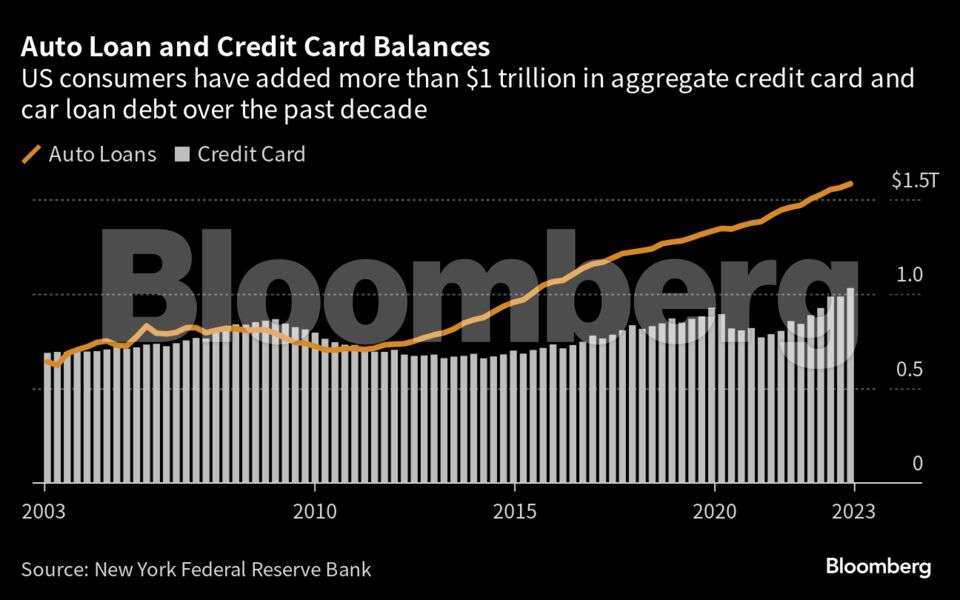

Credit-card balances surpassed $1 trillion for the first time last quarter, showing how even more widespread credit has become among American consumers as the US economy recovered from the pandemic.

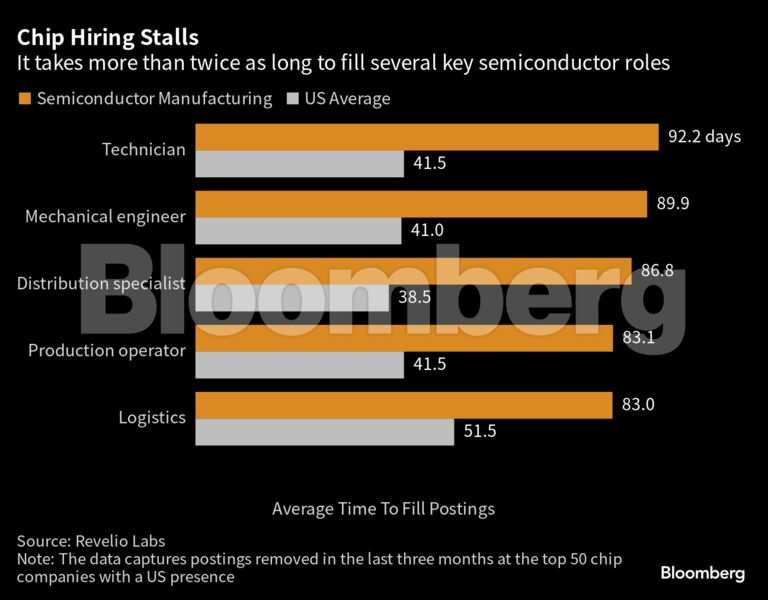

US chipmakers are struggling to fill key positions, a new study shows, as a shortage of skilled labor threatens to hobble efforts to revive the domestic industry.

Asia

Chinese banks extended the smallest amount of monthly loans since 2009 in July, a further sign of weak demand in the world’s second-largest economy that raises the risk of prolonged deflation pressure.

China’s consumer and producer prices fell together for the first time since 2020, a deflation cycle that could give global central banks some help in fighting inflation in their own countries but signals a worsening outlook in the world’s second-largest economy.

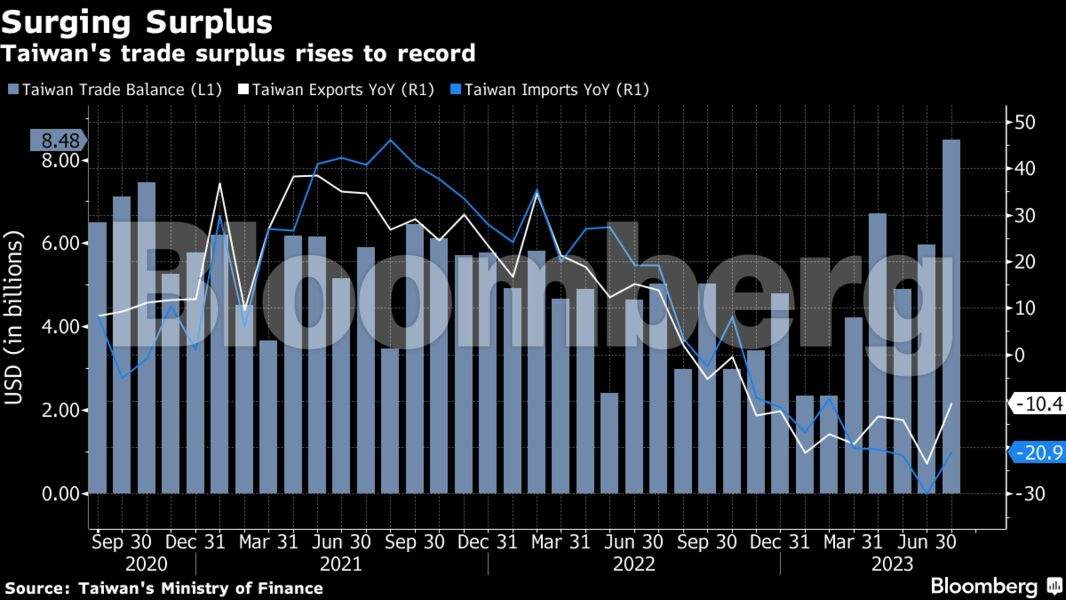

Taiwan’s trade surplus surged to a record high as the plunge in exports slowed in a sign that global demand for technology may soon start to recover.

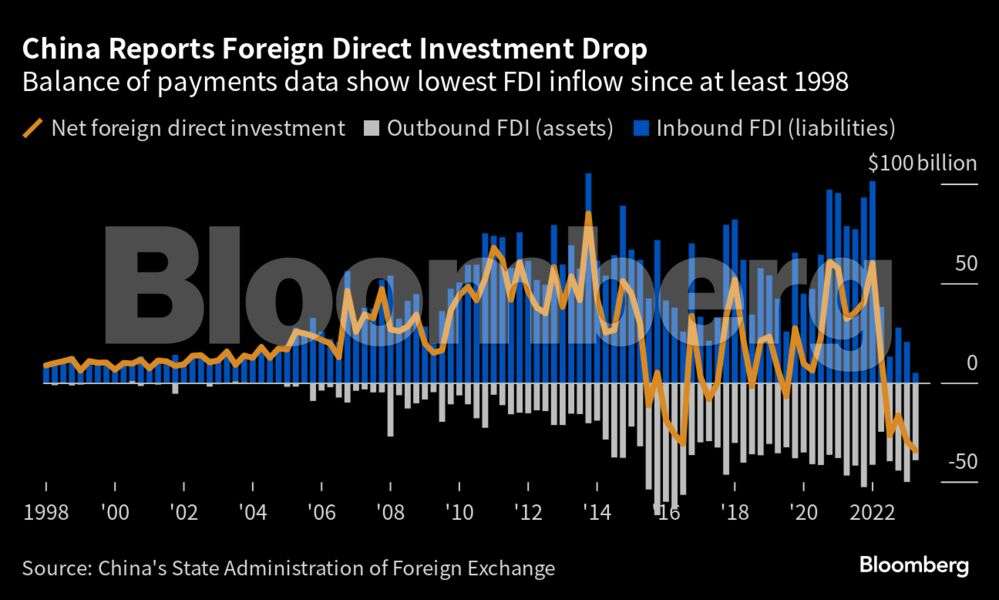

One measure of new foreign investment in China fell to the lowest level in 25 years in the second quarter, fueling concerns about how much geopolitical tensions and the economy’s slowing recovery can hurt business confidence.

Europe

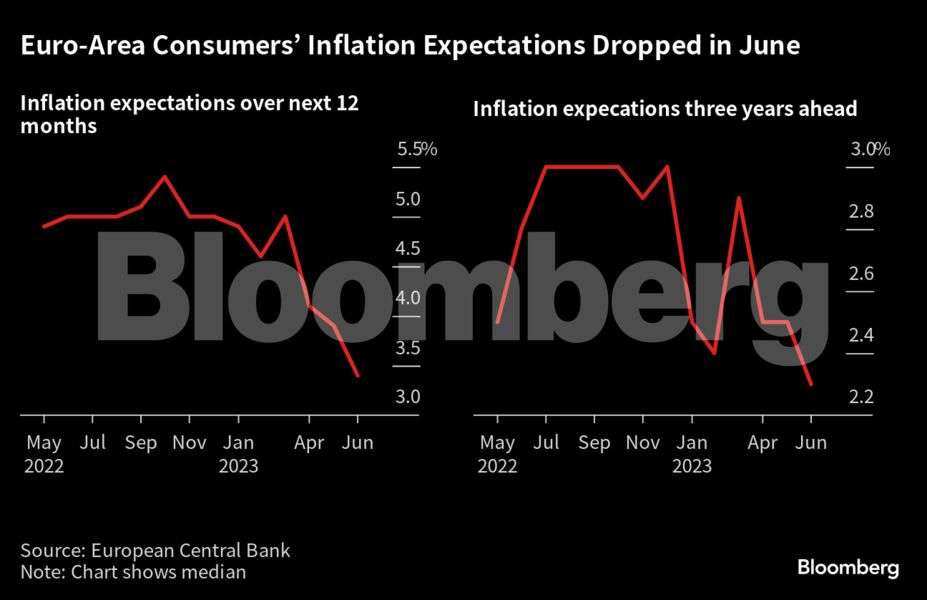

Consumer expectations for euro-area inflation fell in June but remained above the European Central Bank’s 2% target as officials ponder whether to continue their unprecedented bout of interest-rate hikes.

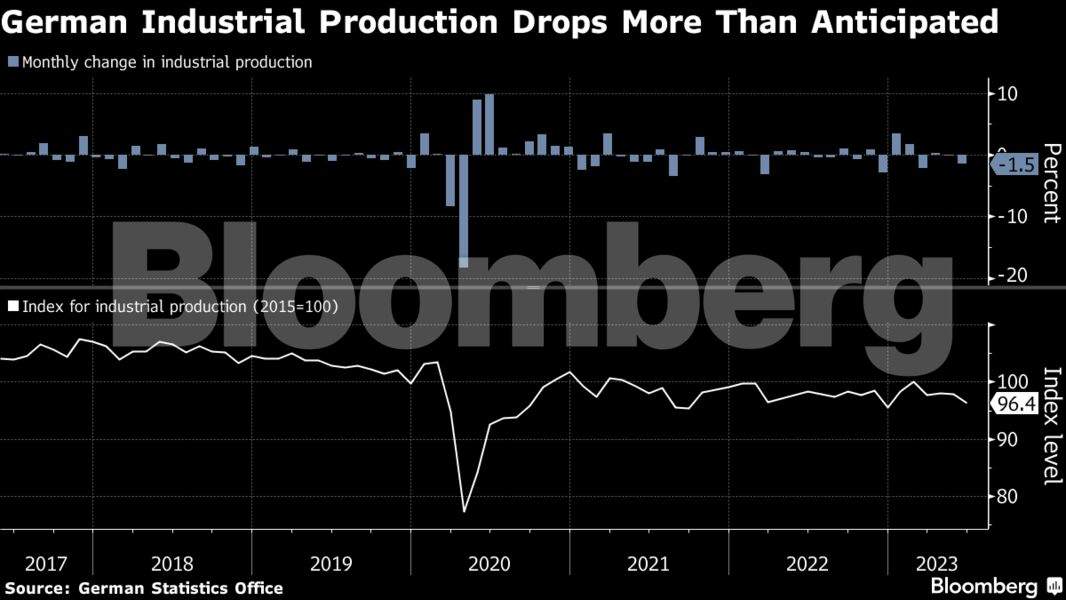

German industrial production fell for a second month in June, further holding back Europe’s biggest economy after it barely exited a recession earlier this year. The drop in Germany was mirrored by lower industrial output in France and Spain during the month.

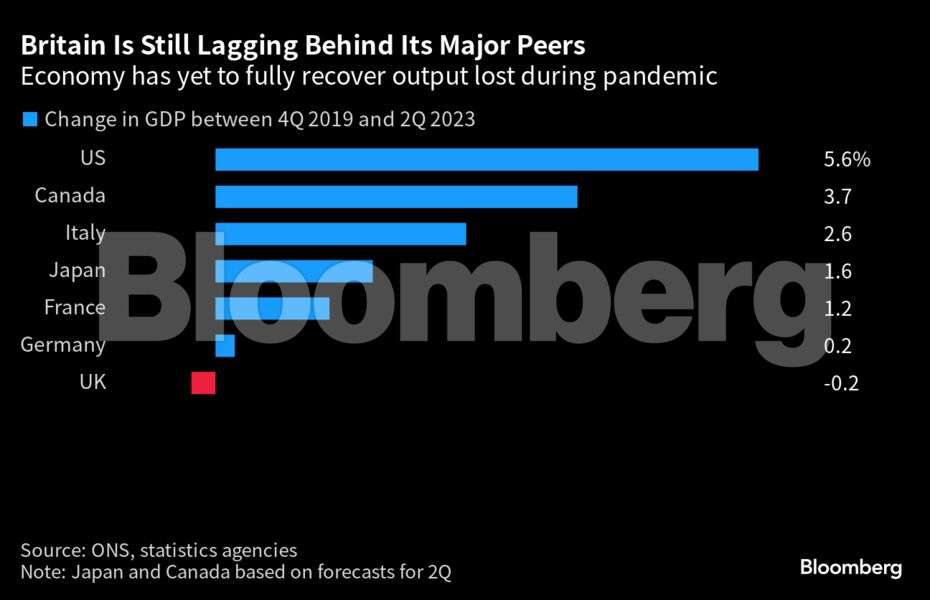

The UK economy delivered its strongest quarterly growth in more than a year. Even with the modest 0.2% advance, the UK remains the only Group of Seven country that has yet to fully recover from the pandemic.

Emerging Markets

A surge in rice prices to the highest level in almost 15 years is renewing fears that food costs are going to get a lot more expensive for the world’s poorest people. The grain is vital to the diets of billions in Asia and Africa.

World

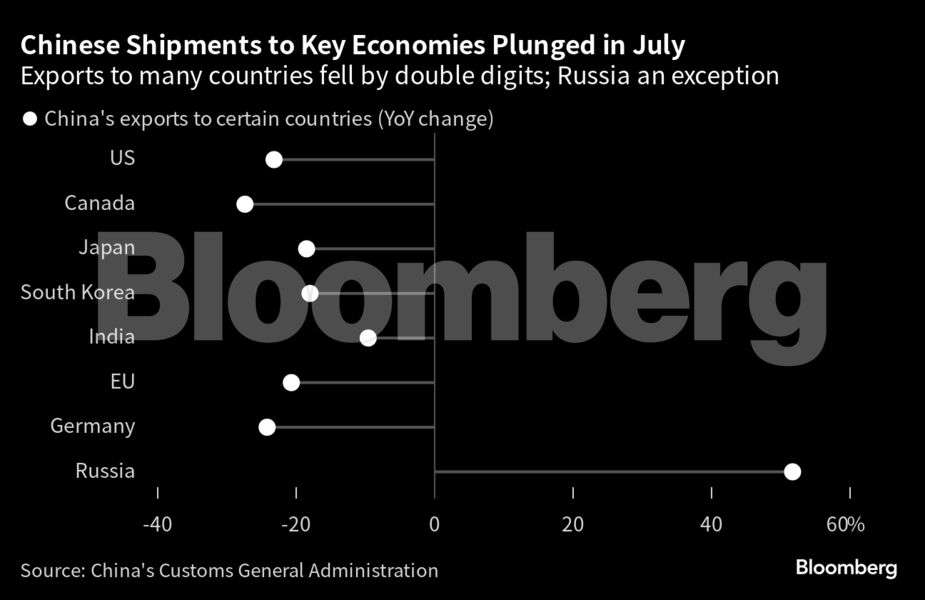

As economists gauge the likelihood of recessions in major economies around the world, a slew of recent data show that a downturn is already evident when it comes to global commerce. China, the world’s biggest exporter, just reported the biggest contraction in overseas shipments since February 2020. Germany, the global No. 3, saw its exports sink in the latest monthly data by the most on a year-on-year basis since early 2021.