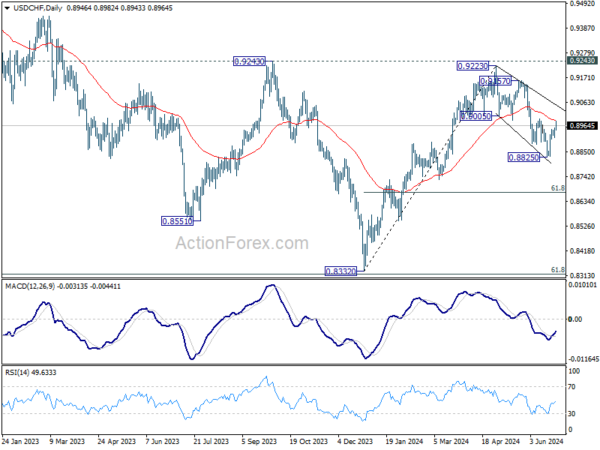

Daily Pivots: (S1) 0.8923; (P) 0.8938; (R1) 0.8964; More…

Intraday bias in USD/CHF stays neutral at this point. Near term outlook will stay bearish with 0.8992 resistance intact. Below 0.8912 minor support will bring retest of 0.8825 low. Firm break there will resume the fall from 0.9223 to 61.8% retracement of 0.8332 to 0.9223 at 0.8672. However, firm break of 0.8892 will argue that fall from 0.9223 has completed as a three-wave corrective move to 0.8825. In this case, intraday bias will be back on the upside for 0.9157 resistance.

In the bigger picture, price actions from 0.8332 medium term bottom are seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance affirms this case, and maintains medium term bearishness. While more range trading could be seen between 0.8332/0.9243 first, downside break out is mildly in favor at a later stage.