USDJPY fell 0.7% in Asia on Tuesday after comments from Japanese official added pressure on the central bank for more rate hikes to further boost strengthening yen.

The latest comments further improved yen’s sentiment, though most analysts expect BoJ to keep rates unchanged in the next policy meeting.

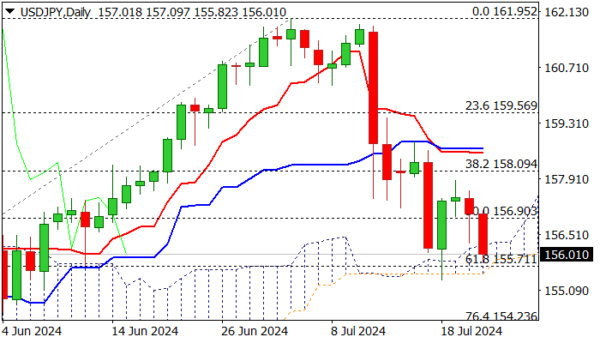

Fresh weakness is pressuring key supports at 155.70 zone (daily cloud base / Fibo 61.8% of 151.85/161.95 upleg) where a bear trap has formed on last week’s strong downside rejection.

Reaction at daily cloud base (cloud is spanned between 155.87 and 156.30 and will thicken in coming days) will be key for near term direction.

Sustained break below cloud base and nearby July 18 low / 100DMA (155.35) would generate strong bearish signal and open way for deeper correction towards targets at 154.23/ 153.60.

Weakening daily studies (strong negative momentum / MA’s in bearish setup) support the notion, but risk of another downside rejection still exists.

Upticks should be ideally capped by converged 10/55DMA’s (157.81) to keep bears intact.

Only lift and close above daily Tenkan-sen / Kijun-sen (158.56/65) would sideline bears and signal formation of a higher base.

Res: 156.30; 156.83; 157.81; 158.56.

Sup: 155.71; 155.35; 155.00; 154.54.