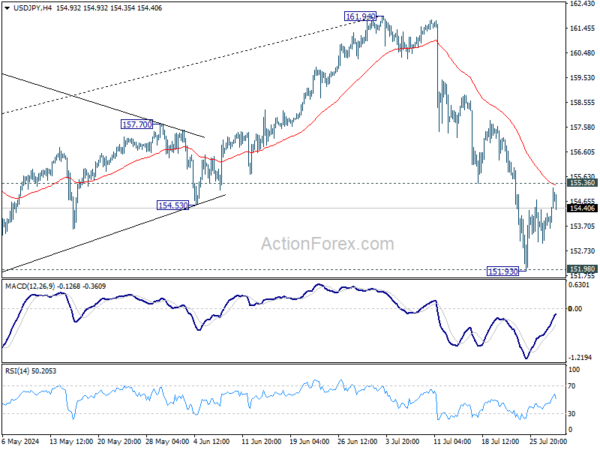

Daily Pivots: (S1) 153.25; (P) 153.80; (R1) 154.58; More…

Intraday bias in USD/JPY stays neutral at this point. Further decline is in favor as long as 155.36 support turned resistance holds. On the downside, decisive break of 151.89 resistance turned support will argue that large scale correction is underway to 148.66 fibonacci level. Nevertheless, break of 155.36 will turn bias back to the upside for stronger rebound to 55 D EMA (now at 157.06).

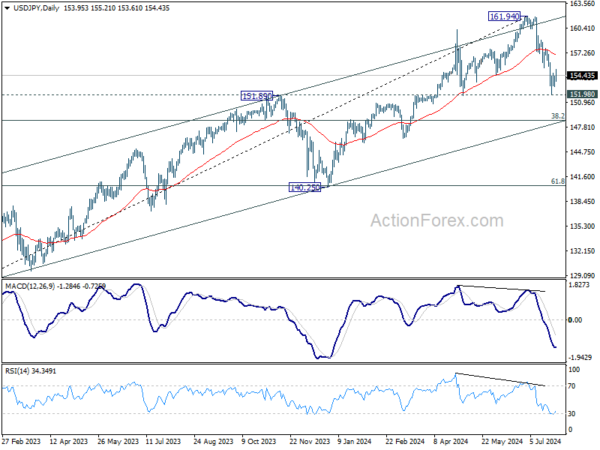

In the bigger picture, considering the depth and momentum of the current decline, 161.94 should be a medium term top already. Fall from there is seen as correcting the whole rise from 127.20 (2023 low) at least. Break of 151.89 will pave the way to 38.2% retracement of 127.20 to 161.94 at 148.66. Risk will now stay on the downside as long as 55 D EMA (now at 157.06) holds, in case of rebound.