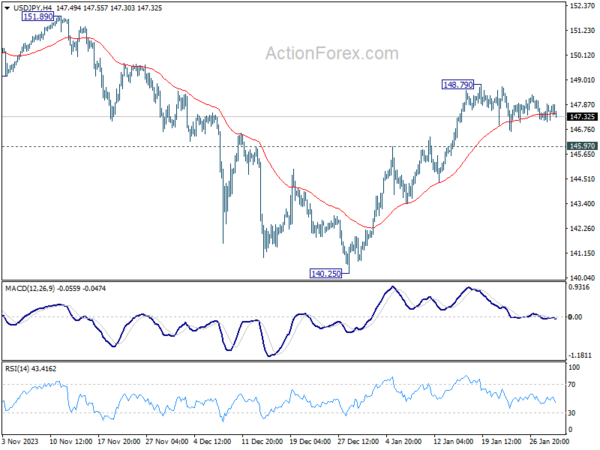

Daily Pivots: (S1) 147.16; (P) 147.54; (R1) 147.99; More…

USD/JPY’s consolidation from 148.79 is still in progress and intraday bias remains neutral. With 145.97 resistance turned support intact, further rally is in favor. As noted before, corrective fall from 151.89 should have completed at 140.25 already. Break of 148.79 will resume the rise from there for retesting 151.89/93 key resistance zone.

In the bigger picture, stronger than expected rebound from 140.25 dampened the original bearish review. Strong support from 55 W EMA (now at 142.33) is also a medium term bullish sign. Fall from 151.89 could be a correction to rise from 127.20 only. Decisive break of 151.89/93 will confirm resumption of long term up trend. This will now be the favored case as long as 140.25 support holds.