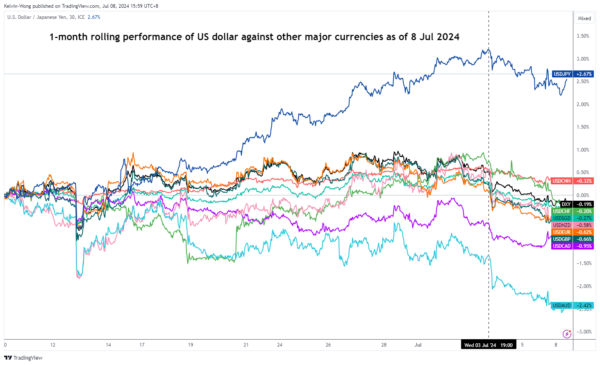

- Lacklustre US non-farm payrolls & ISM Services PMI for June has led to a further drop in US Treasury yields.

- Both the 2-year and 10-year US Treasuries/JGBs yield premiums have shrunk to a 5-month low.

- A lower positive carry using JPY as a funded currency and elevated net short positioning in JPY futures may put a temporary halt to JPY’s persistent weakness.

- Watch the 162.40 intermediate resistance on the USD/JPY.

Weak ISM US Services PMI & a softer US jobs market have increased the odds of two Fed funds rate cuts before 2024 ends

Even though the latest US non-farm farm payrolls data for June released last Friday, 5 July has managed to beat expectations of +190K jobs as it came in at +206K, the prior two months of jobs data has been revised downwards to +218K in May from +272K and +108K in April from +165K.

The unemployment rate has also ticked slightly higher from 4% in May to 4.1% in June, the highest level since November 2021 coupled with a contractionary reading of 48.8 on the latest ISM Services PMI for June which indicates that the current high interest rate environment in the US has started to trickle down an adverse effect into the US jobs market, and services sector; a key economic growth contributor in the US.

Hence, the data-dependent US Federal Reserve now has more data points to support an imminent interest rate cut after seven consecutive monetary policy meetings that kept the Fed funds rate unchanged at 5.25% to 5.50%.

The latest data obtained from the CME FedWatch tool at this time of the writing based on the pricing of the Fed funds futures contracts has painted significantly high odds of two 25 basis points cut to the Fed funds rate before 2024 ends; a 78% chance of a cut in the September FOMC meeting, and 94% chance of another cut in December after the US Presidential Election in November.

Further narrowing of the yield spread between US Treasuries & JGBs

Fig 2: 2-YR & 10-YR US Treasuries/JGBs spreads as of 8 Jul 2024 (Source: TradingView, click to enlarge chart)

Given an increase in expectations of a more dovish Fed in the near -term, both the 2-year and 10-year US Treasury yields have headed south in the past week which in turn saw a reduction in their respective yield premiums against the Japanese Government Bonds (JGBs).

The 2-year and 10-year spread between the US Treasury note and JGB has narrowed to 4.28% and 3.23% respectively, their lowest levels since early February 2024 (see Fig 2).

Therefore, a further US Treasury yield premium shrinkage over JGB may reduce the positive carry of using the Japanese yen as a funded currency, in turn putting a temporary halt to the persistent bearish trend of the JPY that has slipped to a 38-year low against the US dollar last week.

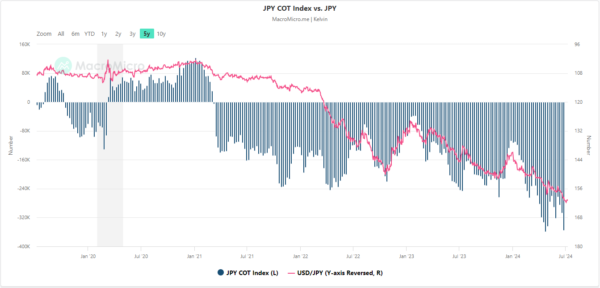

Large speculative players’ net bearish positioning on JPY remained at an elevated level

Fig 3: Commitments of Trader large speculators’ net positioning in JPY futures as of 24 Jun 2024 (Source: Macro Micro, click to enlarge chart)

Based on the latest data Commitments of Traders data as of 24 June 2024 (compiled by Macro Micro), the aggregate net bearish open positions of large speculators in the JPY futures market in the US (after offsetting the aggregate positions of large commercial hedgers) have inched lower since late May to-355,758 contracts, a revisit to its almost 17-year low of -359,063 contracts printed on 22 April.

Since large speculators have committed a relatively high amount of net bearish open positioning on JPY via the futures market, a further push down in the USD/JPY may trigger a spurt of short covering activities on such elevated leveraged short positions on the JPY which in turn might cascade into an abrupt liquidity squeeze and negative feedback loop movement into the USD/JPY at least in the short-term horizon.

USD/JPY at risk of a short-term corrective pull-back

Fig 4: USD/JPY medium-term & major trends as of 8 Jul 2024 (Source: TradingView, click to enlarge chart)

The daily RSI momentum indicator has just exited from its overbought region which suggested that the recent impulsive upmove sequence from the 4 June 2024 low of 154.55 has reached an overstretched condition that in turn increases the odds of a minor corrective pull-back scenario (see Fig 4).

If the intermediate resistance of 162.40 is not surpassed to the upside, the USD/JPY may stage a minor corrective pull-back within its medium-term and major uptrend phases to expose the 158.35/156.50 support zone (also confluences with the rising 50-day moving average).

On the flip side, a clearance above 162.40 sees the continuation of the impulsive upmove sequence for the next medium-term resistances to come in at 164.20/164.90 and 167.10 next.