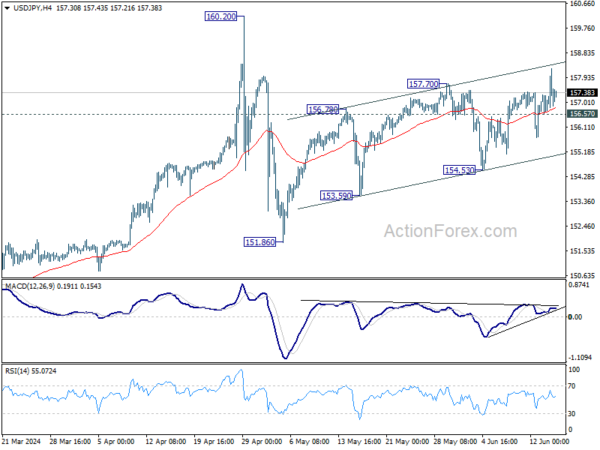

USD/JPY’s choppy rise from 151.86 resumed by breaching 157.70 resistance last week. Initial bias stays mildly on the upside this week. Further rally could be seen to retest 160.20 high. But upside should be limited there, at least on first attempt. On the downside, below 156.57 minor support will turn intraday bias neutral first.

In the bigger picture, price actions from 160.20 medium term top are seen as a corrective pattern to rise from 150.25 only. Another rally is still expected at a later stage through 160.02 to resume the larger up trend. However, decisive break of 150.87 will argue that larger correction is possibly underway, and target 146.47 support next.

In the long term picture, as long as 140.25 support holds, up trend from 75.56 (2011 low) is still in progress. Next target is 138.2% projection of 75.56 (2011 low) to 125.85 (2015 high) from 102.58 at 172.08.