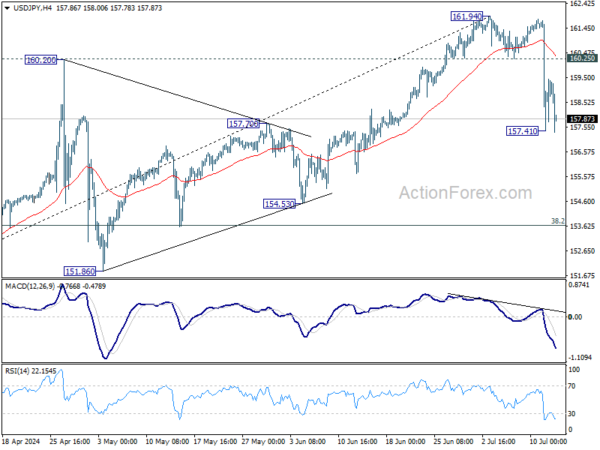

USD/JPY’s sharp decline last week confirmed short term topping at 161.94. Considering bearish divergence condition in D MACD, fall from 161.94 is likely corrective whole five-wave rally from 140.25. Risk will stay on the downside as long as 160.25 support turned resistance holds. Sustained break of 55 D EMA (now at 157.67) will affirm this bearish case. Next target will be 38.2% retracement of 140.25 to 161.94 at 163.65.

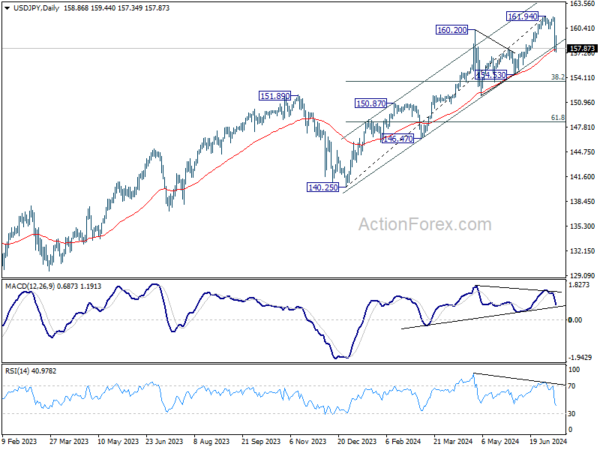

In the bigger picture, as long as 151.89 resistance turned support holds, long term up trend could still continue through 161.94 at a later stage. Next target will depend on the depth of the current correction from 161.94. However, sustained break of 151.89 will argue that larger scale correction or trend reversal is underway.

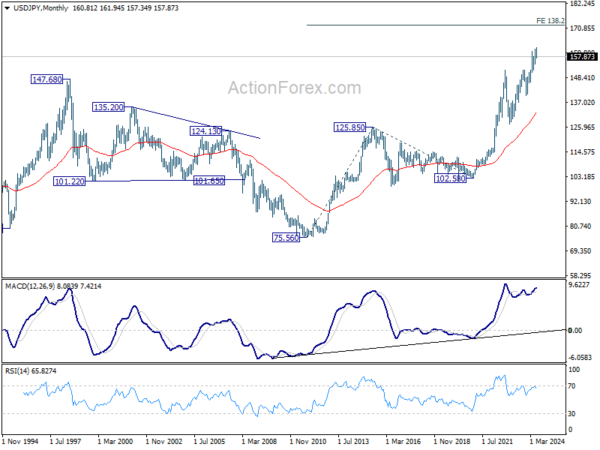

In the long term picture, as long as 140.25 support holds, up trend from 75.56 (2011 low) is still in progress. Next target is 138.2% projection of 75.56 (2011 low) to 125.85 (2015 high) from 102.58 at 172.08.