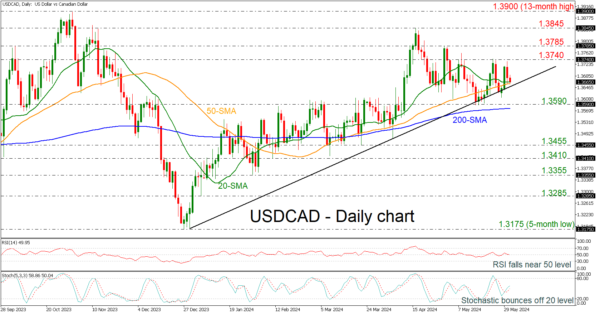

- USDCAD fails to climb above 1.3740

- Momentum oscillators show contradicting signs

USDCAD has been rebounding off the medium-term ascending trend line over the last couple of weeks, remaining in a positive territory. However, the pair is also finding strong resistance around the 1.3740 barricade with the short-term simple moving averages (SMAs) suggesting a potential bearish crossover.

The technical oscillators are showing some mixed signs. The RSI is crossing the 50 level to the downside, while the stochastic oscillator is pointing upwards after the bullish crossover within its %K and %D lines.

If the bears take the market lower, the price could find immediate support at the 1.3590 level, ahead of the flattened 200-day SMA at 1.3575. A slip below this obstacle could send traders until the 1.3455 support.

On the other hand, immediate resistance could open the way for a retest of the 1.3740 mark. A successful move higher may add some optimism for more bullish actions until 1.3785 and 1.3845.

In brief, USDCAD is still in a positive territory as it is standing above the uptrend line, but any declines beneath the 200-day SMA could switch the outlook to a more bearish one in the short-term view.