- USDJPY rises but trades within a bearish pattern

- Resistance expected around 149.70-150.00

- US CPI inflation data due for release at 13:30 GMT

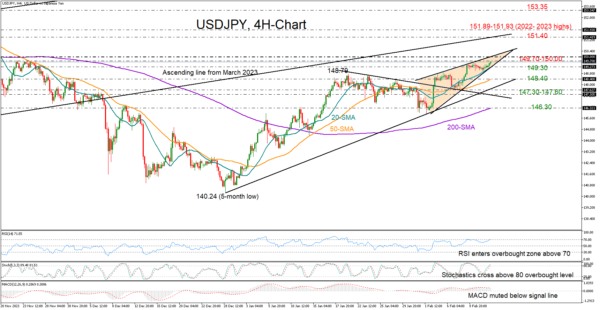

USDJPY turned green after touching its 20-period simple moving average (SMA) in the four-hour chart, rising gradually to a new high of 149.64 on Tuesday and closer to November’s resistance zone ahead of the US CPI inflation data.

February’s trading has transformed into a rising wedge pattern, which is theoretically a signal of a potential bearish reversal. The RSI and the stochastic oscillator are sending a cautious message too as they enter the overbought territory, suggesting upside forces might fade out soon. Note that the MACD has shown no improvement yet, remaining muted below its red signal line.

A decisive close above 149.70-150.00 could eliminate downside risks, boosting the price up to the 151.40 region, where the ascending line from March 2023 is placed. November’s peak of 151.89 and the 2022 top of 151.93 could be the next challenge before the bulls target the 153.35 constraining zone taken from the summer of 1990.

Alternatively, a close below the triangle and the 20-period SMA at 149.30 could trigger a decline towards the 50-period SMA at 148.40. Even lower, the pair may attempt to rebound somewhere within the 147.30-147.60 trendline region. If not, the bears could aggressively squeeze the pair towards the 200-period SMA at 146.30.

All in all, USDJPY continues to face a risky technical picture despite its latest upturn. A durable extension above the 149.70-150.00 region could postpone selling activities.