By RoboForex Analytical Department

AUD/USD is finding its footing, currently stabilising at around 0.6725, as the US dollar weakens further in anticipation of Fed Chair Jerome Powell’s speech at the Jackson Hole symposium.

The Australian dollar’s resilience is bolstered by the minutes from the Reserve Bank of Australia’s latest meeting, indicating that the central bank is not in a hurry to ease monetary policy despite a slowdown in inflation. The RBA remains cautious, projecting inflation to stay above its 2-3% target range until the end of 2025. This suggests that interest rates may remain steady for an extended period, providing a stable backdrop for the Australian dollar.

Recent data highlights robust performance in Australia’s private sector for August, particularly in services, while the contraction in manufacturing is easing. This paints a picture of an Australian economy that is adjusting well and could sustain its momentum without immediate monetary stimulus. Investors are watching closely for cues on future policy shifts, influencing forex forecasts.

Technical analysis of AUD/USD

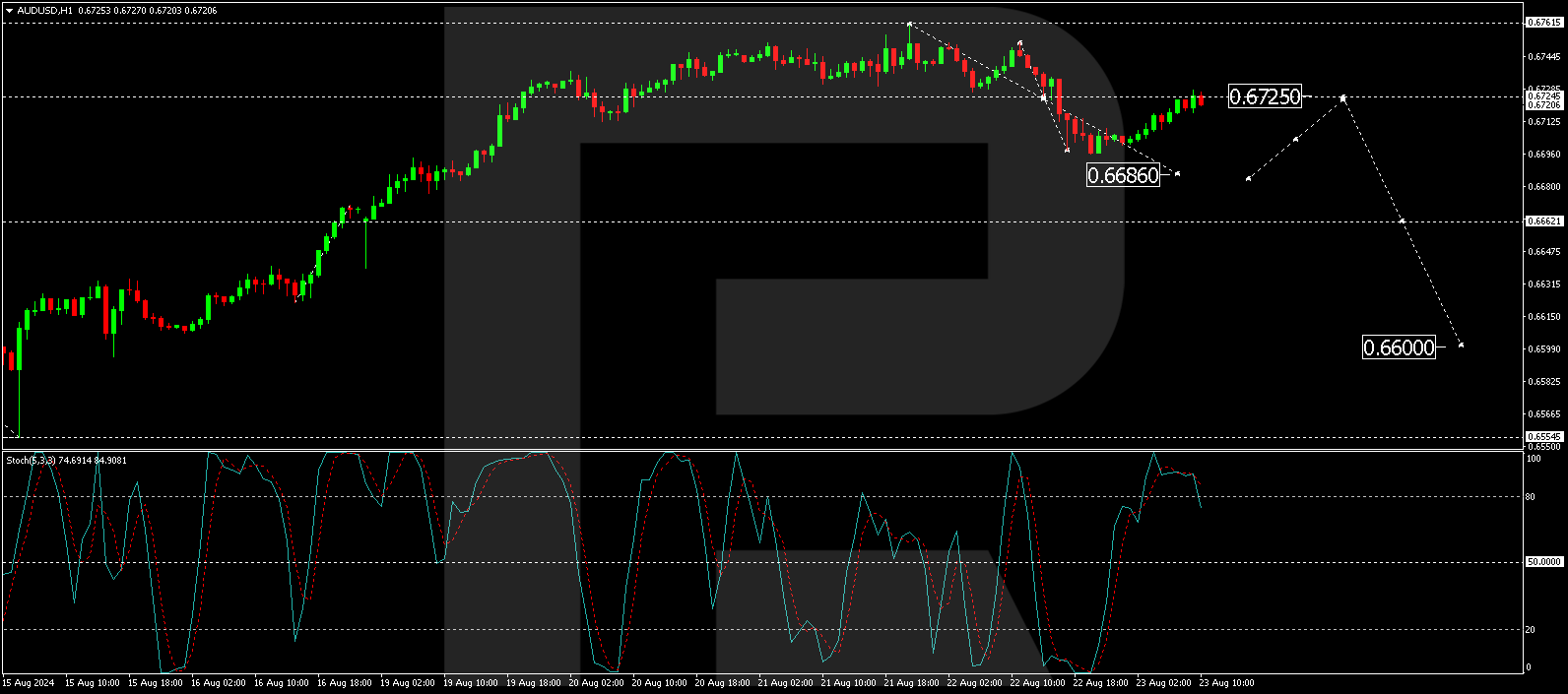

The AUD/USD pair recently peaked at 0.6760 but is now poised for a correction. The immediate focus is on a potential descent to 0.6684, marking the first significant support level. Upon reaching this target, a retest of 0.6725 from below may occur, defining the boundaries of a possible consolidation range. A break below this consolidation could initiate a further decline towards 0.6600, potentially extending to 0.6555. The MACD indicator supports a bearish outlook in the short term, with the signal line peaking and poised for a downward trajectory.

In the hourly frame, AUD/USD has retraced from a recent low of 0.6696 to 0.6725, indicating a corrective phase. The anticipated continuation of this downtrend could see the pair targeting 0.6686 shortly. If this support holds, a rebound to 0.6725 could follow. The Stochastic oscillator indicates an overbought condition, with the signal line expected to move downwards from 80 to 20, supporting the potential for further declines.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- AUD/USD Sees Rebound: Weak US Dollar and RBA’s Steady Stance Support Strength Aug 23, 2024

- The Bank of Japan is set to raise rates further. The Fed gov will speak at the annual symposium in Jackson Hole today Aug 23, 2024

- The dovish FOMC minutes supported the growth of indices. The Australian index has been growing for 10 consecutive trading sessions Aug 22, 2024

- USDJPY: Waits on BoJ and Fed chief remarks Aug 22, 2024

- Precious Mettle Aug 21, 2024

- Pet Odor Product Continues to Be Lucrative for Clean Tech Co. Aug 21, 2024

- Brent Oil Falters Amid Surprising Inventory Growth and Geopolitical Developments Aug 21, 2024

- Inflationary pressures are easing in Canada. Riksbank cut interest rate by 0.25% Aug 21, 2024

- EUR/USD Holds Near Seven-Month High Amid Speculation on Fed Rate Cuts Aug 20, 2024

- PBoC expectedly left rates unchanged. Bitcoin returned to the $60,000 mark Aug 20, 2024