- Bank of England meets on Thursday, unlikely to signal rate cuts

- Reserve Bank of Australia could maintain a higher-for-longer stance

- Elsewhere, Bank of Japan releases summary of opinions

BoE – No rate cuts yet

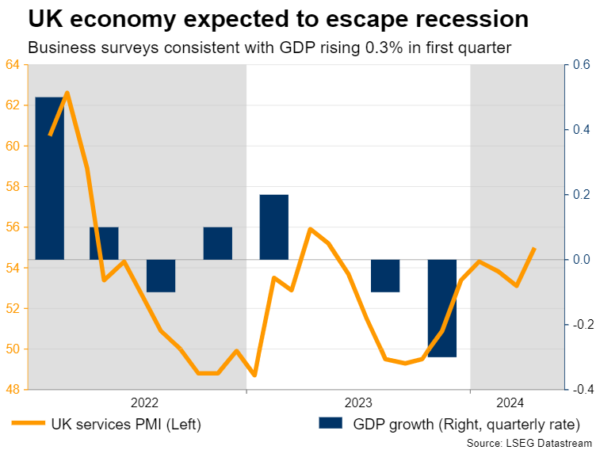

Britain’s economy seems to have escaped the shallow recession it fell into last year, and has finally entered the recovery phase. Business surveys point to solid growth in the first quarter and even stronger momentum in the second quarter, powered by a rebound in consumer spending as wage growth has remained resilient.

The dark side of this economic resurgence is that inflation remains persistently hot. The core CPI rate held above 4% in March and business surveys warn of a reacceleration in the coming months as companies lift their prices to pass rising costs onto consumers.

In this light, the Bank of England is unlikely to signal any imminent rate cuts when it concludes its meeting on Thursday, reflecting the stubbornness of inflationary pressures. Of course, that wouldn’t be surprising for investors, who currently expect the first rate cut to be delivered in August.

A message that rate cuts are still some distance away could benefit the pound, although the broader FX reaction will also depend on the new economic forecasts and the vote composition of the Committee. A single member voted for an immediate cut last time, but given the recent string of encouraging data, this official could also vote for keeping rates unchanged this time.

In the big picture, the outlook for the British pound seems cautiously optimistic. While sterling has lost about 1.5% against the mighty US dollar this year, it has gained a similar amount against the euro, and almost 7% against the sinking Japanese yen. Therefore, expectations of higher-for-longer rates have supported sterling, even if it hasn’t shown up against the dollar.

Another element that has supported the pound has been the risk-on tone in equity markets, given its strong correlation with global risk sentiment. Assuming these factors remain in force, the currency could continue to shine, at least against the euro and yen.

Beyond the BoE meeting, the nation’s GDP numbers for the first quarter are out on Friday, and will likely show that economic growth flipped positive after a minor contraction late last year.

RBA unlikely to rock the boat

Crossing into Australia, the Reserve Bank will wrap up its own meeting early on Tuesday. No action is expected, and judging by incoming economic data, policymakers are unlikely to change their neutral tone either.

Consumer and producer inflation came in hotter than expected in the first quarter, signaling that the path for bringing inflation back down might be slower than the central bank had anticipated. The strength in the labor market reinforces this notion, alongside the rapid increases in house prices.

Similarly, there have been some early signs of recovery in China’s industrial sector, which is great news for Australia, whose entire business model relies on shipping its commodity exports to China. Over time, this can help boost Australian growth.

Blending everything together, there is no reason for the RBA to deviate from its neutral stance at this meeting. If anything, it could strike a slightly more hawkish tone, but is unlikely to go as far as to signal another rate increase.

A neutral message on rates would leave the Australian dollar mostly in the hands of global risk appetite and any China developments. In this sense, China’s latest trade numbers on Thursday could be crucial for the currency.

Bank of Japan releases summary of opinions

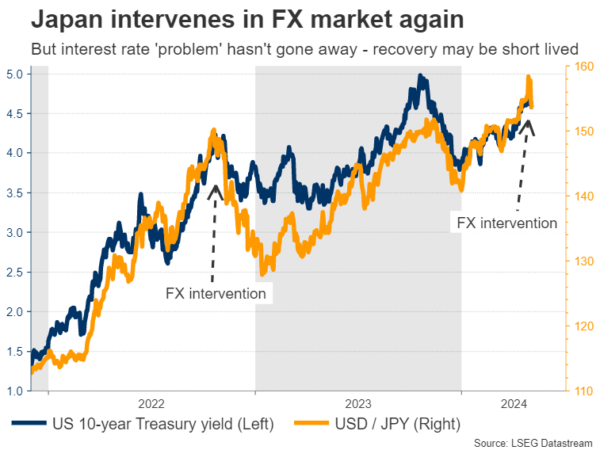

Over in Japan, the government has intervened in the FX market to buy the sinking yen, propelling the currency more than 3% higher this week. That said, the fundamental factors that pushed the yen to its lowest levels in three decades are still present, raising questions about the sustainability of this recovery.

For the yen to enjoy a proper trend reversal, interest rate differentials need to narrow – either with the Fed cutting rates or with the Bank of Japan raising them. Neither seems likely over the next few months, which suggests the yen could remain under pressure overall, although FX interventions might help ensure it doesn’t hit new lows.

The Bank of Japan will release the summary of opinions from its April meeting on Thursday, which will provide some clues around the potential timing of the next rate increase, alongside the latest batch of national wage numbers.

Finally in Canada, employment stats for April will hit the markets on Friday.