- Yen traders await BoJ decision for pivot clues

- US core PCE index the highlight of the US agenda

- UK CPI numbers to be the pound’s next test

- Loonie and aussie await Canada’s CPIs and RBA minutes

Will BoJ policymakers hint at the end of negative rates?

Following a barrage of central bank decisions this week the end credits of major monetary policy decisions for 2023 will roll with the BoJ during the Asian session Tuesday. At their last meeting, policymakers decided to allow 10-year JGB yields to rise above 1%. However, they did not ditch the cap. They just redefined it from a rigid ceiling to a reference bound, meaning they could intervene in the bond market again if deemed necessary. And indeed, this is what they did the day after the decision.

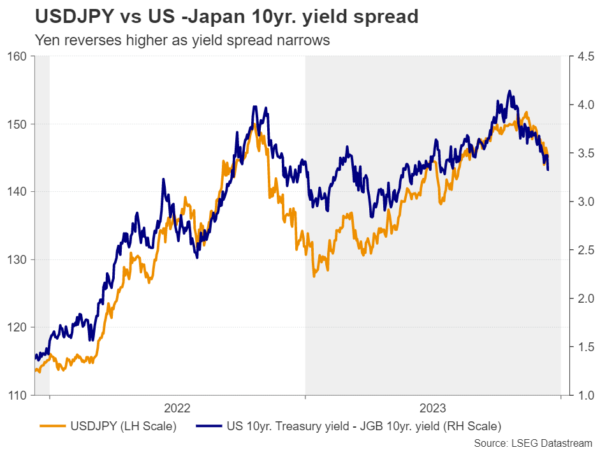

This disappointed investors that were expecting more, with the yen tumbling in the aftermath and the following days, with dollar/yen almost touching its October 2022 high of 151.94 on November 13. That said, it was all downhill thereafter with the fall steepening on December 7 as Governor Ueda talked about the possible options they have on interest-rate targeting once they end their negative interest rate policy.

However, just the next couple of days, two reports hit the wires, saying that his comments were not intended to hint at a potential exit timing and that the Bank sees the cost of waiting for more information as not very high. With that in mind and given the emphasis the BoJ puts on wage growth, policymakers may not opt for an imminent shift at this gathering and perhaps wait for April, after the spring wage negotiations.

That doesn’t mean the meeting will pass totally unnoticed. Yes, Japan’s GDP data revealed that the economy contracted by more than anticipated in Q3, but the National CPIs revealed that inflation continued to accelerate in October which increases the likelihood for businesses and labor unions to agree on another round of strong pay hikes next year. Thus, even the slightest indication that interest rates could exit negative territory in April may add more fuel to the yen’s engines, especially with the market believing that the Fed will cut interest rates by around 150bps next year.

After dovish Fed, dollar traders lock gaze on core PCE index

Speaking about the Fed, it left interest rates unchanged as expected this Wednesday, but revised down its dot plot to indicate that interest rates will end 2024 at 4.6% instead of 5.1% as projected in September. Powell appeared dovish at the press conference following the decision, saying that higher rates “is not the base case anymore.” The outcome pushed Treasury yields and the US dollar lower, while it was cheered by equity and gold traders.

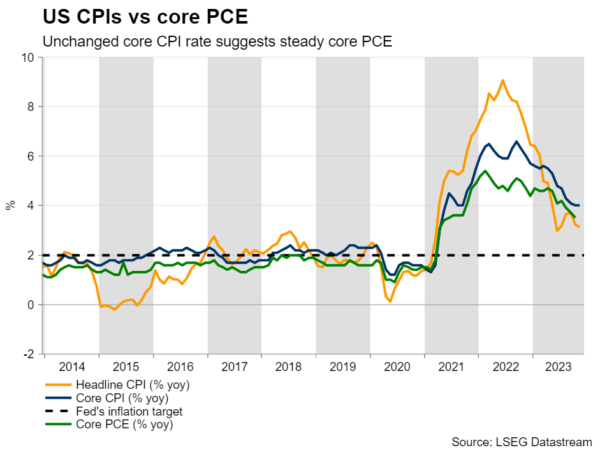

The highlight on the US agenda next week may be the core PCE index for November, the Fed’s favorite inflation gauge, which comes out on Friday alongside the personal income and spending data for the month. On Tuesday, the core CPI rate for the month remained unchanged at 4.0% y/y suggesting that the core PCE price index may have also held steady at 3.5%. This is unlikely to shake expectations regarding the Fed’s future course of action, but a miss could encourage investors to continue selling the dollar and buying stocks. On the other hand, an upside surprise may trigger a counter move, but a mild one, as market participants appear willing to react more to data and headlines validating their view.

Will UK inflation alter the BoE’s thinking?

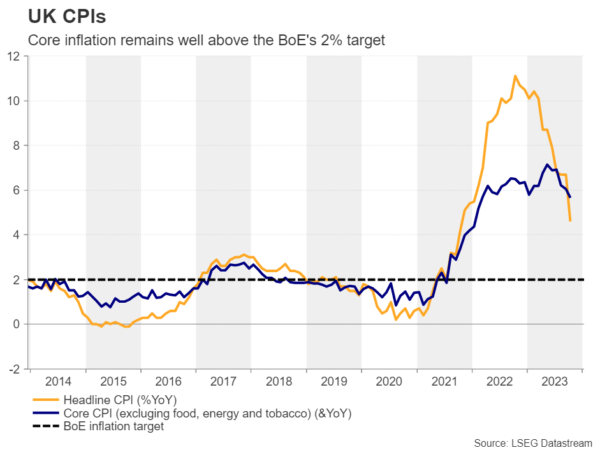

For pound traders, after the BoE’s hawkish hold, attention will now turn to the UK inflation data for November, due to be released on Wednesday. Although slowing, inflation in the UK is much higher than other major economies, with the core rate declining only to 5.7% from 6.1% in October.

With three members of the BoE voting for a rate hike and most of them saying that it is too early to conclude that services inflation and pay growth are on a firmly downward path, some further, but still modest, decline in underlying price pressures may not be a reason for BoE policymakers to change their minds, and is unlikely to severely hurt the pound.

Nonetheless, according to UK overnight index swaps, the market continues to believe that no more hikes are warranted and that around 115bps worth of rate cuts may be needed by next December. Perhaps they are more worried about the performance of the UK economy, which stagnated in Q3, rather than the stickiness of inflation. Therefore, should upcoming growth-related data continue to point to deep economic wounds, the pound’s advance may run out of fuel at some point in the not-too-distant future, as investors insist that some rate reductions may eventually be needed. In that respect, the UK retail sales for November are scheduled to be released on Friday.

Canadian inflation and RBA minutes also on tap

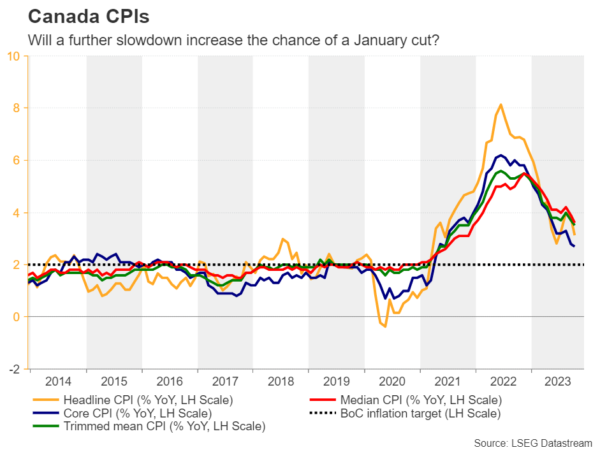

The Canadian inflation numbers for November are also coming out on Tuesday. At its latest gathering, the Bank of Canada held its key overnight rate unchanged at 5% and kept the door open to more tightening, saying that it is still concerned about high inflation, although it acknowledged an easing of price pressures and an economic slowdown.

However, investors were not convinced that another rate hike may be on the horizon. They are actually assigning around a 27% probability for a 25bps cut in January. In October, headline inflation slowed to just a tick above the Bank’s inflation-control target range of 1-3%, while the closely watched trimmed mean rate slid to 3.5% from 3.7%. Therefore, a further slowdown could take the probability of a January rate reduction higher and thereby weigh on the loonie.

Earlier the same day, and a couple of hours ahead of the BoJ decision, the RBA releases the minutes of its December policy meeting, where policymakers kept their benchmark interest rate unchanged, but softened their tightening bias, saying that whether further tightening is required will depend upon the data and the evolving assessment of risks. With the market assigning a small probability of another quarter-point hike by the RBA in February, investors may go through the minutes and see how willing officials are to press the hike button one last time.