- Nonfarm payrolls and Powell’s testimony will be crucial for US dollar

- European Central Bank could set the stage for summer rate cuts

- Bank of Canada decision and UK budget announcement also in focus

Dollar braces for US payrolls

Riding high on a wave of US economic resilience, the dollar is currently the best-performing major currency this year, having gained nearly 3% against a basket of currencies in a couple of months.

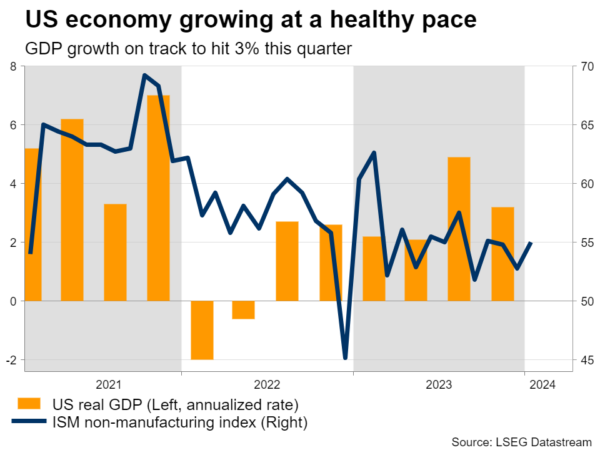

This stellar performance reflects an impressive US economy. Economic growth is running at a solid pace, the labor market remains historically tight, and inflation is not cooling as rapidly as investors had hoped.

With the economy still hot, traders have been forced to unwind bets of imminent Fed rate cuts. Markets are currently pricing just three rate cuts for this year, down from six cuts a few months ago. Hence, investors expect US interest rates to stay at higher levels for a while longer.

Grim economic prospects in the rest of the world have also benefited the dollar. The United Kingdom and Japan have fallen into technical recessions, the Eurozone is haunted by stagnant growth, and China is still dealing with the fallout in its property sector. As such, the alternatives to the dollar are not very attractive at this stage.

Next week’s events will help shape this narrative. The ball will get rolling on Tuesday with the release of the ISM services index for February, ahead of the private ADP employment data on Wednesday.

Meanwhile, Fed Chairman Powell will appear before Congress both on Wednesday and Thursday for his semiannual testimony. Investors usually focus on the Q&A session with lawmakers, where the Fed chief will be grilled on the economic outlook.

Of course, the main event will come on Friday, when the latest US employment report hits the markets. Economists expect another round of solid jobs numbers, which would reaffirm that the labor market remains in good shape. Some early indicators pointed to a slowdown in employment growth in February, but nothing dramatic.

Has the ECB fallen behind the curve?

In the Eurozone, the central bank is widely expected to keep rates steady on Thursday, so the spotlight will fall mostly on the updated economic projections and any signals by President Lagarde on the timing of rate cuts.

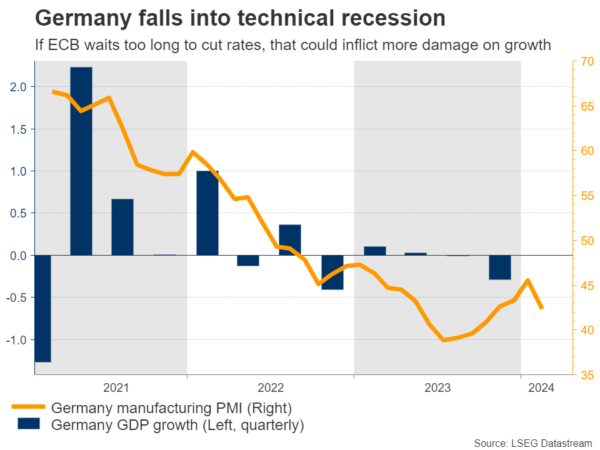

The euro area economy hit a wall last year, as high interest rates started to bite demand and governments dialed back their spending. Germany has been hit particularly hard, with a slowdown in global trade crippling its export-heavy business model.

Mirroring this economic slowdown, inflation has lost steam, falling to an annual rate of just 2.6% in February. Wage growth has started to lose speed as well, although it remains at high levels.

Despite this loss of momentum, ECB officials have stressed that it’s still too early to cut rates, as doing so prematurely could fuel a second round of inflation. Most officials have circled June as the most likely month for a rate cut, which would give them access to updated wage numbers.

This meeting will probably be used as a ‘stepping stone’ towards June, with the central bank reaffirming it will be patient with rates until it is certain inflation has been crushed.

Normally, this would be a positive message for the euro. However, this time may be different. The Eurozone economy is already staring down the barrel of a recession and the longer the ECB waits to cut rates, the more painful the downturn might be. In turn, that could force the central bank to cut even deeper later on.

The ECB is laser-focused on wage growth, which unfortunately is one of the most lagging economic indicators. Waiting too long to act could inflict unnecessary damage on the economy and lead to a situation where rates are ultimately slashed with brute force. That paints a gloomy picture for the euro, even if the ECB preaches patience next week.

UK budget and Canadian rate decision coming up

Crossing into the United Kingdom, the government will unveil its latest budget on Wednesday. The Chancellor has made it clear he wants to cut taxes for workers, in a last-ditch attempt to win back voters before a general election that will almost certainly be a disaster for the ruling party.

In the markets, the action will depend on which taxes are cut and how deeply. Meaningful cuts to income tax or national insurance could spell good news for the pound, as that would fuel spending and inflation, adding pressure on the Bank of England to keep rates high for longer. That said, there isn’t much scope for drastic tax changes, so any reaction might be relatively small.

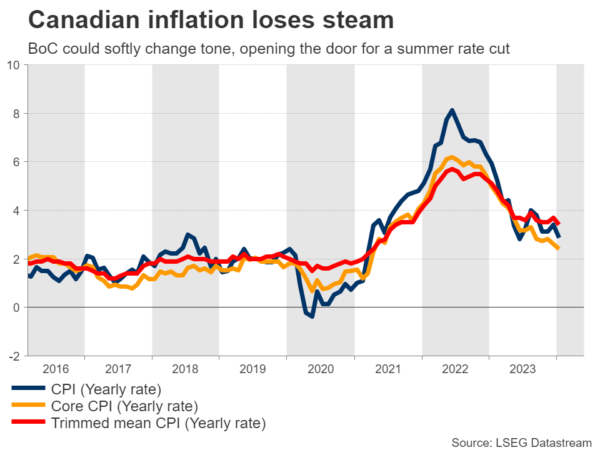

Over in Canada, the central bank will conclude its meeting on Wednesday. Markets are pricing in a 15% probability of an immediate rate cut, but that is highly unlikely considering that the economy is still in decent shape. The housing market in particular is extremely hot, boosted by record levels of migration.

That said, it’s only a matter of time until the Bank of Canada does cut, as inflation has slowed sharply. Markets are pricing in the first rate cut during the summer. Hence, this meeting may bring a soft change in tone, whereby the Bank lays the groundwork for such a move. The nation’s employment data will follow on Friday.

Finally, some data releases from Japan, China, and Australia could attract attention. Starting on Tuesday, the latest inflation stats from Tokyo will give investors a sense of whether the Bank of Japan will raise rates this year. Australia’s GDP data for Q4 will be released on the same day, alongside China’s services PMI for February.