- Dollar traders lock gaze on core PCE index

- Eurozone CPIs in focus as June cut looms

- Tokyo CPIs may complicate BoJ’s policy plans

- Aussie awaits Australian CPIs and Chinese PMIs

Will PCE data break the “higher for longer” mantra?

The US dollar stabilized this week, recovering a small portion of the losses it posted after the CPI data revealed that US inflation resumed its downtrend in April.

What may have allowed the dollar to stop bleeding were comments by Fed officials, suggesting that despite the slowdown in CPI inflation, they are sticking to their “higher for longer” mantra.

This prompted investors to trim their rate cut bets again to less than two quarter-point interest rate reductions. Specifically, they are anticipating only 36 basis points worth of cuts by the end of the year, with the probability of a September cut now resting at around 60%.

With all that in mind, next week, dollar traders may turn their attention to the core PCE price index for April, the Fed’s favorite inflation gauge, which is accompanied by the personal income and spending numbers for the month.

After holding steady at 2.8% y/y in March, the core PCE rate may be poised to cool a bit, something supported by the easing of the core CPI rate. What’s more, the slowdown in average hourly earnings and the stagnation in retail sales suggests that income growth and spending may have softened as well.

Thus, a lower PCE rate, as well as income and spending data suggesting that inflation may continue cooling in the months to come may prompt investors to bring back to the table some of their previously removed rate cut bets. This could thereby weigh on the dollar, but for the slide to prove significant, Fed officials may need to soften their language as well.

Next week will be the last one policymakers are allowed to share their views, as on June 1 the blackout period before the next gathering begins, and thus their remarks may prove very important for the markets.

Eurozone inflation data to cement June cut

With UK inflation proving hotter-than-expected and traders raising their implied BoE rate path, the ECB is now the only major central bank expected to press the rate-cut button in June, with investors assigning around a 90% chance to such action.

Even with data pointing to improving activity in the Eurozone in 2024, investors did not budge, as ECB officials themselves have been continuously adding fuel to the idea of a June reduction. Just on Wednesday, ECB President Lagarde indicated that this is probable as inflation has largely come under control.

Therefore, next Friday’s preliminary CPI numbers for May are likely to be of major importance for euro traders. According to the latest set of PMIs, the pace of output price inflation softened in May and was the weakest since November 2023, which means that there are downside risks.

Lower inflation rates are likely to seal the deal for a June cut, and perhaps allow investors to add some more basis points worth of reductions for after June.

Euro traders may get stronger hints of where Eurozone inflation likely headed in May a couple of days earlier, when the German CPI figures are coming out. Thus, the euro may spend the better part of the week drifting south, especially against the pound, whose traders have notably scaled back their BoE rate cut bets lately.

More inflation numbers from Japan and Australia

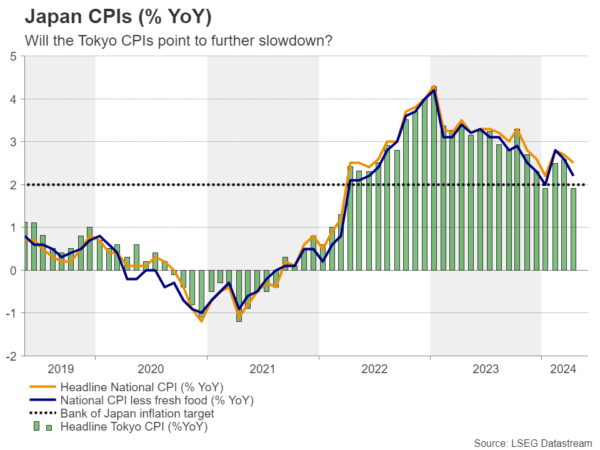

Flying to Japan, a contracting economy in Q1 and further slowdown in inflation during April are developments casting a cloud over whether the BoJ should proceed with another rate hike in the summer months. Yet, investors are assigning a more-than-80% chance for another 10bps hike in July.

On Friday, the Tokyo CPI numbers for May are due to be released, as well as the industrial production and retail sales data for April. So, should they suggest that inflation eased further, and that the world’s fourth largest economy continued to struggle at the beginning of the second quarter, the chances for a summer BoJ hike may slip and thus, the yen may drift further south.

Australia releases its monthly CPI rates on Wednesday. At its May meeting, the RBA maintained its neutral stance, disappointing those expecting a hawkish shift due to Australian inflation proving stickier than expected.

Yet, investors are assigning a nearly 10% probability for a hike by this Bank in September, while the number of basis points worth of reductions by the end of the year is only 7. Thus, if the CPI data for April suggests that inflation remained sticky, the aussie could extend its latest recovery as traders scrap all the remaining rate cut bets.

China PMIs and Canada GDP also on tap

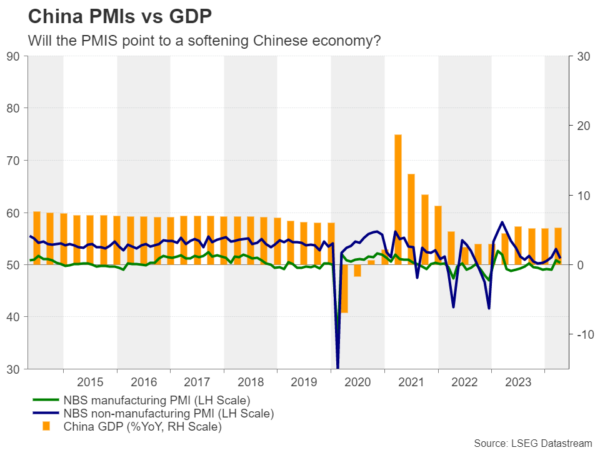

The aussie could be impacted by the Chinese PMIs for May as well, due out on Friday. The April PMIs showed that growth in both the manufacturing and services sectors slowed, but exports and imports grew after contracting in March, pointing to improving domestic demand. Last week’s data corroborated the mixed picture, with industrial production for April accelerating more than expected and retail sales unexpectedly slowing.

Therefore, the PMIs for May could prove important as they could tip the scale. If they point to softness in economic activity, investors may start adding to bets that more aid packages are needed by Chinese authorities, despite Beijing announcing some of its strongest moves a few days ago to bring the battered property sector to life. This may result in pullbacks in both the aussie and kiwi.

Finally, in Canada, following the larger than expected slowdown in most underlying inflation metrics for April, investors are assigning a 60% for the BoC to deliver its first 25bps interest rate reduction in June, while they are more than fully pricing in such a move for July. Thus, a set of soft GDP numbers on Friday may convince more participants to join the June-cut camp and thereby increase pressure on the loonie.