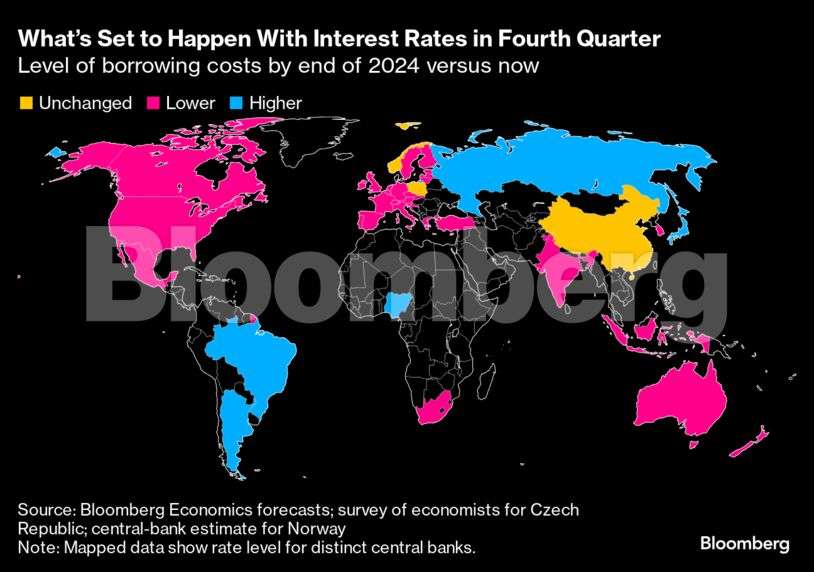

With the last traces of the global inflation shock fading, the shift toward lower borrowing costs is about to maintain momentum as economies tread toward a new year fraught with unknowns.

Now that the US Federal Reserve has joined rich-world peers with its own initial interest-rate cut, lingering worries about consumer prices are increasingly poised to give way to concerns about growth around the world, according to Bloomberg Economics.

Its aggregate gauge of advanced-economy borrowing costs shows a decline of almost 40 basis points between now and the end of the year, and a further drop totaling more than double that amount by the time 2025 is out.

While the Fed will now take charge of the global easing push, the shift lower is likely to be widespread, with most of the rest of the Group of Seven staying on board, and even holdouts such as Norway and Australia likely to join in, in due course.

But unanswered questions are haunting the outlook, with the US election in November key among them. It’s hard to guess just how different Donald Trump taking office in January might be from Kamala Harris, but — fully implemented — his policies on tax, tariffs and immigration would have major implications for the US economy — and so also for the Fed.

Whatever happens, a sustained period of central bank activism, in contrast to the recent hiatus of higher-for-longer rates, is likely to take hold.

Out of 23 institutions focused on here, just three are anticipated to leave borrowing costs unchanged over the coming three months, and every one of them is forecast to tweak them in some way by the end of 2025.

And while monetary easing is the prevailing theme, some countries are likely to see tightening instead — not least with Japan seen hiking its rate again, and Brazil doing so too.

What Bloomberg Economics Says:

“The Fed’s half-point move and the PBOC’s surprise stimulus mean the narrative on central banks has shifted from inflation-crushing hikes to market-boosting cuts. The BOJ heading in the other direction — and all that means for the yen carry trade — is a major cross current. The second may come from the US election. If delivered, Trump’s campaign pledges on taxes, tariffs, and deportations would shift the trajectory for the economy, and force the Fed into another course correction.”

—Tom Orlik, global chief economist

US Federal Reserve

- Current federal funds rate (upper bound): 5%

- Bloomberg Economics forecast for end of 2024: 4.5%

- Bloomberg Economics forecast for end of 2025: 3.5%

- Market pricing: A quarter-point cut in November, with a 36% chance of a bigger half-point move. Another reduction in December is expected.

With the Fed’s first rate cut in years finally out of the way, investors have turned their focus to what the size and pace of additional reductions could look like in the fourth quarter and beyond.

While the central bank began with a bigger-than-usual move of a half point, Chair Jerome Powell has said that offcials shouldn’t be expected to continue at that pace, and that they would be “recalibrating policy down over time.”

They anticipate lowering rates by another half point this year, and an additional full percentage point over 2025, according to the median projection released in September. But policymakers are split, with a large minority seeing a quarter point or less of further cuts in 2024.

Officials have continued to emphasize that the path ahead will depend on incoming economic data. They have said they are keen to prevent a cooldown in the US labor market from intensifying, while monitoring inflation for continued progress down towards the central bank’s 2% goal.

The outcome of the US presidential election in November will likely stir up conversations about how Fed personnel could change during the next administration, given that Powell’s term as chair ends in 2026. Republican contender Trump has already said he wouldn’t reappoint Powell, while Democratic nominee Harris has yet to comment publicly on the question.

What Bloomberg Economics Says:

“The Fed cut rates 50 basis points in September and we expect 50 basis points more cuts this year – including 25 basis points at both the November and December meetings — and another 100 basis points in 2025. We expect unemployment to rise to 4.5% before end-2024, exceeding the median FOMC view of 4.4%, and 5.0% in 2025. If that overshoot occurs before the last FOMC meeting of the year, there’s a decent chance the November or December cut could be 50 basis points.” —Anna Wong

Reserve Bank of India

- Current RBI repurchase rate: 6.5%

- Bloomberg Economics forecast for end of 2024: 6.25%

- Bloomberg Economics forecast for end of 2025: 5.5%

The Reserve Bank of India is expected to keep its key rate unchanged at 6.5% in its October 7-9 policy review as inflation will probably climb back again to cross its target 4% in September, after staying below the mark in July and August.

While nearly 20 months of high borrowing cost has slowed inflation, Governor Shaktikanta Das wants to see more signs of price gains settling around the central bank’s target on a sustainable basis before considering a rate cut.

Voting for a reduction will also be difficult for the new members in the Monetary Policy Committee who succeed the three external members after their terms end on October 4. As such, most economists do not expect a pivot before December.

What Bloomberg Economics Says:

“The RBI’s hawkish hold has run out of reasons. Since its August review, 2Q GDP has surprised down, inflation has eased below target and Fed’s 50-bp cut has widened the policy rate differential. This should prompt the RBI to adopt a neutral stance and cut 25-bp in October on abating capital outflow fears. We see the RBI lowering its inflation outlook to 4.3% for fiscal 2025 from 4.5%, but keeping its growth outlook at 7.2% on prospects of a stronger rural recovery.” —Abhishek Gupta

People’s Bank of China

- Current 1-year medium-term lending rate: 2%

- Bloomberg Economics forecast for end of 2024: 2%

- Bloomberg Economics forecast for end of 2025: 1.6%

The PBOC issued the biggest round of stimulus for the economy last month since the pandemic, including lowering the one-year policy rate by the most ever and promising another cut in a shorter-term rate that officials increasingly favor.

The move, made amid growing anxiety among the official ranks and malaise among consumers (as well as notable downward revisions of economic growth from Wall Street) is likely not enough to boost growth long-term.

The challenges faced by authorities remain the same: households that are still holding back spending and deflation that threatens investment and sentiment.

Going forward, the central bank has more room to cut without incurring currency risk, now that the Fed has begun an easing cycle.

Economists broadly expect officials to do just that, using monetary policy in addition to fiscal tools in tackling the economic malaise.

What Bloomberg Economics Says:

“The People’s Bank of China’s stimulus package is eye-popping — ranging from cuts to rates and reserve requirements to providing liquidity to stock investors. Each step is significant. Delivering them together is unusual and speaks to the urgency felt in Beijing to head off deflationary risks and get growth on track for the 5% target.” —Chang Shu

European Central Bank

- Current deposit rate: 3.5%

- Bloomberg Economics forecast for end of 2024: 3%

- Bloomberg Economics forecast for end of 2025: 2%

- Market pricing: An almost 90% chance of a quarter-point cut in October, followed by another same-size move in December.

With the euro-area economy showing waning momentum, investors are increasingly betting on the ECB reduce borrowing costs again this month. That would quick rate cuts from the quarterly pace that policymakers led by President Christine Lagarde adopted for the first two moves of this easing cycle.

Adding to the argument for such a move is a likely slowdown in inflation last month to below the 2% target for the first time since mid-2021.

Officials do predict a reaceleration in price growth the next few months, and some worry that it won’t be sustainably at the ECB’s goal until late-2025. Hawks warn that wage growth — and, as a result, services prices — still pose upside risks. Such concerns could yet persuade policymakers to wait until December.

What Bloomberg Economics Says:

“The ECB will probably reduce rates by 25 basis points in October before cutting again in December by the same amount. Underlying price pressures in the euro area are swiftly abating and survey data indicate the economy is losing momentum. Add in Germany’s industrial malaise and resistance to additional monetary easing from the hawks on the Governing Council seems to have faded.” —David Powell

Bank of Japan

- Target rate (upper bound): 0.25%

- Bloomberg Economics forecast for end of 2024: 0.5%

- Bloomberg Economics forecast for end of 2025: 0.5%

- Market pricing: An almost 50% chance of a 15-basis point hike by the end of the year.

The key question for the Bank of Japan this quarter is whether it will raise borrowing costs in December. Governor Kazuo Ueda has recently stressed that he has time to consider the next hike, but he’ll increase rates if the economy performs in line with the BOJ’s outlook.

That’s been perceived as a signal that there will be no policy move in October, although December remains an open question.

Former Defense Minister Shigeru Ishiba is set to become Japan’s next prime minister, a development that provides relief for the BOJ after he narrowly beat out an opponent who said a rate hike now would be “stupid.”

Still, Governor Ueda will be losing the support of current Prime Minister Fumio Kishida, who handpicked him last year. BOJ watchers will be closely following whether Ueda can build a cordial relationship with Japan’s new leader, given the bank’s history with political pressure.

What Bloomberg Economics Says:

“The BOJ is slow-walking its next rate hike, waiting to see how the US economy holds up. Come January, it will be ready to deliver a series of increases. With wages and prices heating up, and rates in very simulative territory, inflation will stick around its 2% target — giving it the go-ahead. We see three 25-bp hikes next year — in January, April and July — taking the rate up to 1.0% from 0.25%.” —Taro Kimura

Bank of England

- Current bank rate: 5%

- Bloomberg Economics forecast for end of 2024: 4.75%

- Bloomberg Economics forecast for end of 2025: 3.75%

- Market pricing: A quarter-point cut in November and an almost 50% chance of another in December.

Voting against a second rate cut in September, the BOE signaled it’s not letting the foot off the brake just yet. Officials vowed to take a cautious approach on the way down, stressing that policy has to remain “restrictive for sufficiently long.”

The economic recovery is losing momentum, while sticky inflation gauges are cooling down. Minimum wage increases could complicate matters if they heat up pay growth next year.

A November move is still on the table. By then, the BOE will have updated forecasts and the new Labour government’s October budget at hand.

The BOE is due to give an update of its shake-up after Ben Bernanke’s review of its forecasting and messaging by the end of this year. It will then start implement these changes, phasing them in gradually.

What Bloomberg Economics Says:

“Sticky services inflation and the prospect of a fiscal loosening in the upcoming budget are likely to mean the BOE is cautious about how quickly it cuts rates going forward. We expect rates to be lowered again in November and for the BOE to stick to a quarterly pace through 2025. Signs of a slowing global economy suggest the risks are tilted toward the central bank moving more quickly than we expect.” —Dan Hanson