The following is a guest editorial courtesy of the expert content team at leading broker technology provider Leverate.

Understanding how your brokerage handles client positions isn’t just helpful, it’s essential. Two of the most critical models in the industry? Netting and Hedging. If you’ve been around trading platforms or broker dashboards, you’ve probably seen these terms thrown around as everyone should already know what they mean. But the question is, do you actually know how they work or why they matter?

Netting: Simplicity at Its Core

Imagine you’re juggling a few trades in the same direction on EUR/USD. One’s a buy, one’s a sell. With netting, your positions are consolidated into a single one. If you bought 2 lots and sold 1 lot, your final position is just 1 lot long. It’s like having one balance sheet for all your trades, neat, tidy, and efficient.

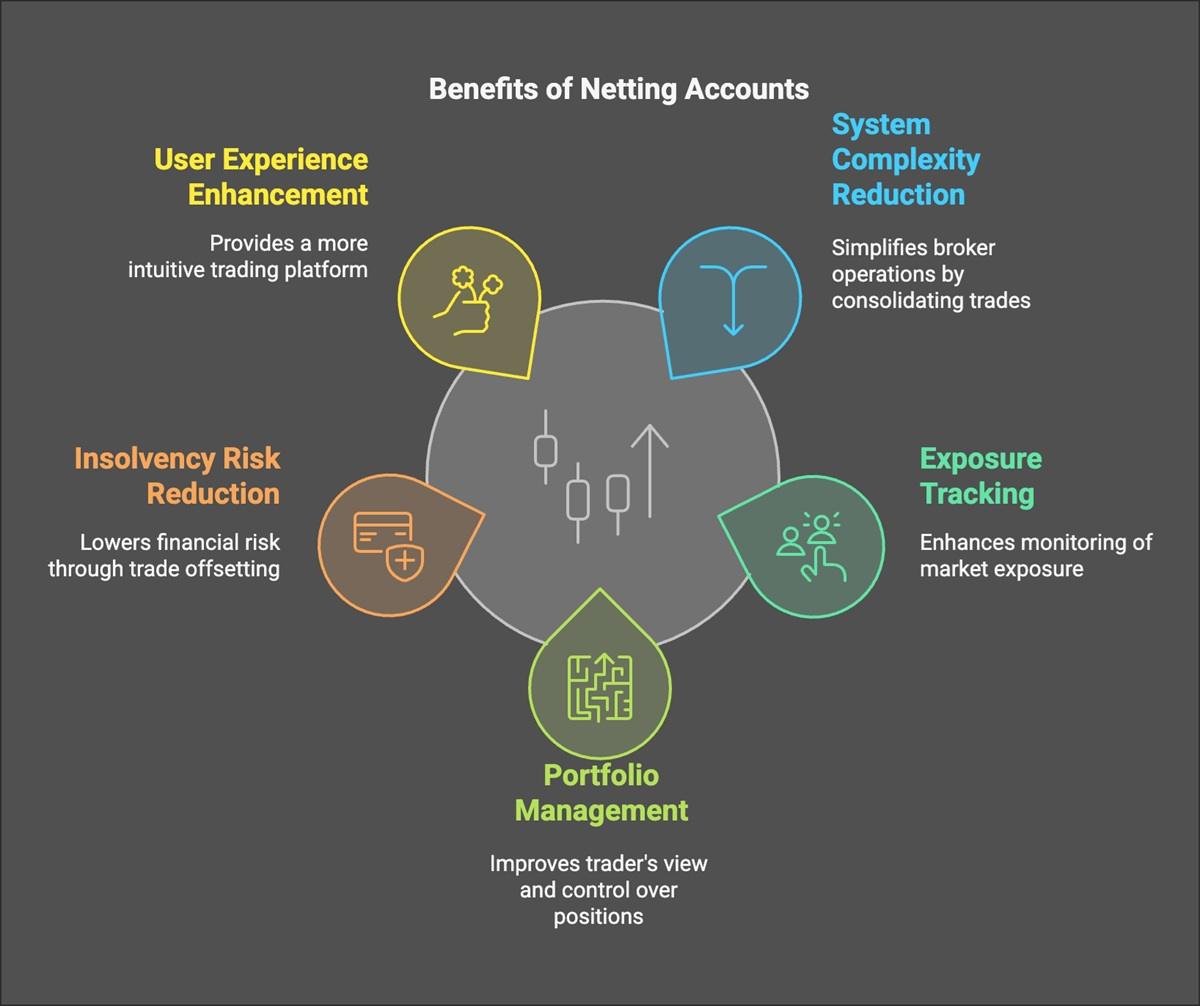

Benefits of Netting:

- Reduced margin requirements: Less capital gets tied up.

- Lower complexity: Easier to monitor overall exposure.

- Ideal for institutional trading environments: Where high-frequency net positions are common.

But what’s the downside? Well, traders who like running multiple strategies at once or want to offset risk by holding opposing positions won’t get the flexibility they crave.

Hedging: The Strategy-Lover’s Playground

Now let’s look on the opposite side. Say you buy and sell the same asset at the same time. In a hedging account, those trades don’t cancel each other out, they coexist. You could be long and short on EUR/USD simultaneously.

Why would anyone do that?

Good question.

Hedging is all about risk management and strategic manoeuvring. Traders might hedge to:

- Lock in profits.

- Limit losses without closing a position.

- Execute complex, multi-layered strategies.

It’s the key for traders who like having options (literally and figuratively).

Drawbacks?

It can get messy. Multiple trades mean higher margin requirements and more active monitoring.

So… Which Is Better?

In simple terms. Neither. And both.

Netting and hedging aren’t about “right” or “wrong”, they’re about fit. It all depends on your clients’ trading styles, goals, and experience levels.

Here’s a quick comparison:

Why Offering Both Sets Your Brokerage Apart

Imagine you’re a trader comparing two brokers. One offers only netting. The other? Netting and hedging. Which one sounds more tailored to your growth as a trader?

The majority if not all will be drawn to the one with options.

And that’s exactly what Leverate brings to the table. By offering both netting and hedging account models built into their flagship platform SiRiX, Leverate doesn’t just meet trader’s needs where they are, it empowers them to evolve, experiment, and succeed.

This dual-model flexibility means:

- New traders can start simple with netting.

- Experienced traders can thrive using hedging strategies.

- Brokers can widen their client base by appealing to all levels.

In short? Leverate helps you be the broker traders stick with as they grow.

Give Your Traders the Power of Choice with Leverate

The trading world isn’t one-size-fits-all. Traders have preferences, strategies, and risk tolerances that change over time. By offering both netting and hedging models, your brokerage isn’t forcing them into a mould, you’re giving them room to shape their journey.

And when traders feel understood? They stay.

So if you’re building a brokerage that aims to lead, not follow, make sure you’re offering flexibility where it matters most. Because in this game, choice isn’t just a perk. It’s a power move.

About Leverate

Leverate is a leading force in fintech innovation, dedicated to empowering brokers and prop firms with cutting-edge technology that drives growth, efficiency, and success. Rather than just offering trading tools, Leverate provides a complete ecosystem that helps firms launch, operate, and scale with confidence in today’s fast-moving markets.