Through the turmoil of the past eight months, including a flopped share sale and a massive erosion of stock-market wealth, two of the beleaguered tycoon Gautam Adani’s crucial relationships have held up surprisingly well.

One, his proximity to India’s government appears intact, even though opposition politicians have relentlessly attacked the businessman from Prime Minister Narendra Modi’s home state of Gujarat for currying favors, allegations that Adani has always denied — and Modi has just ignored.

Two, the former centibillionaire’s clout with bankers seems to have escaped unscathed. The acquisitive Indian conglomerate, which expanded its assets nearly threefold in four years, continues to have sizable relationships with 20 global banks. It’s broadly the same number that did business with the group until last year. The likes of Sumitomo Mitsui Financial Group Inc., DBS Group Holdings Ltd., Mitsubishi UFJ Financial Group. and Standard Chartered Plc, appear to be comfortable with their exposure. Now that Adani has demonstrated that he can deal with extreme liquidity stress, and his crucial equity partners — like the French oil giant TotalEnergies SE — are returning with more money, bankers may have an easier time selling the story to their credit committees.

Overseas institutions are also a better bet for Adani. Tapping Indian banks, especially state-run lenders, would be a tad cheaper, but might invite greater political scrutiny ahead of next year’s general elections. Besides, capital markets are still nervous. Ever since the New York-based Hindenburg Research accused the infrastructure giant of stock-price manipulation and accounting fraud in January, equity investors have hauled it over the coals. Although the group denied the allegations, it had to cancel a share issue by Adani Enterprises Ltd., the flagship. Soon after, France’s Total hit the pause button on a green-hydrogen partnership. Even after a recovery, the combined market value of Adani’s 10 publicly traded firms remains more than $100 billion lower than before the short-seller’s attack.The bond market hasn’t been immune, either. After Deloitte Haskins & Sells LLP, the auditor of Adani’s ports unit, abruptly resigned last month, the yield on the group’s investment-grade-rated notes widened to about 9%, above most junk-rated India debt, Bloomberg Intelligence noted. The dollar securities fell again, after the Financial Times reported, based on documents made available by the Organized Crime and Corruption Reporting Project, that as of January 2017, two foreigners linked to Gautam’s older brother Vinod Adani secretly controlled at least 13% of the free float in three of the four group companies listed back then. The conglomerate called them “recycled allegations” that it had already rejected. There is a simple explanation for the contrast between capital markets’ heightened risk perception and the sangfroid of bankers: hard assets.

Adani firms have been under the spotlight for everything from alleged breaches of minimum public-shareholding norms, related-party dealings and potential conflicts, and the meteoric rise in their share prices before this year. These issues are largely capital market-centric. To banks, however, the group represents a bouquet of disparate but valuable infrastructure: ports, airports, mines and mining contracts, power stations and transmission lines, solar farms, city-gas networks, roads, cement factories and data centers.

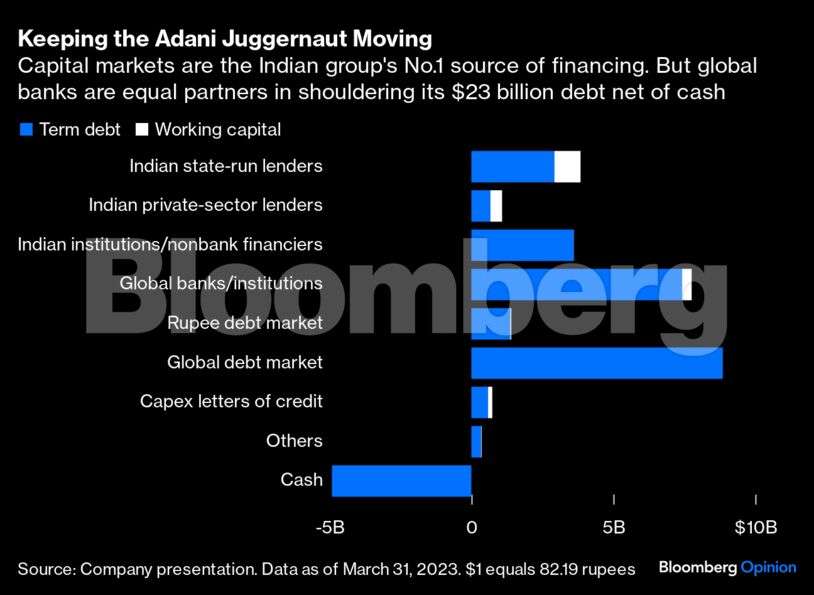

If anything, so-called core infrastructure, which accounts for 89% of the 4.2 trillion rupee ($51 billion) in total assets, may be safer to finance now than when Adani hit the accelerator hard four years ago. About 56% of his empire is now backed by equity, compared with just 40% in 2019. Granted, the 44% that’s propped up with leverage translates to a hefty $23 billion in net debt. But considering that the group is garnering Ebitda of around $8 billion on an annualized basis, earning as much in a quarter as it did in all of 2019, the leverage doesn’t appear to be problematic.

At the shareholder level, the family pruned debt by prepaying — before its March 31 timeline — $2.15 billion of share-backed financing. This was the part that was vulnerable to swooning stock prices. At the same time, by selling some of its holdings to Florida-based GQG Partners and the Qatar Investment Authority, the founders have shored up their own liquidity position to the tune of nearly $4 billion. They have also addressed the biggest source of bankers’ post-Hindenburg unease: cement. Last year’s debt-fueled $6.6 billion buyout of two construction-materials companies from Swiss multinational Holcim AG has been steadied with $2.8 billion in equity. Adani is now in the market to refinance $3.5 billion in loans it took to acquire the cement businesses. This will be a crucial test of bankers’ trust.

Odds are, there won’t be a shortage of them wanting to get in on the deal. After all, starting with nothing at all, Adani has already become a formidable player in cement. With a few more bolt-on acquisitions, such as last month’s purchase of a small local competitor, the group is aiming for 140 million tons of annual capacity by 2028, slightly ahead of market leader UltraTech Cement Ltd.’s current capacity.

Elsewhere in the empire, a copper factory in Mundra, the fulcrum of the group’s sprawling port operations off India’s western coast, will start production in March, spewing out yet more cash, and affording greater cushion to lenders. Similarly, unless sudden political change or an ongoing legal challenge stops it in the tracks, a controversial makeover of Mumbai’s largest shantytown as a modern city hub, will get added to Adani’s capital-expenditure slate — and find backers. The average maturity of the operating firms’ long-term debt ranges between two and 10 years. Credit ratings are steady. And the refinancing risk is low, except at the renewable-energy unit. And even here, Total’s announcement Wednesday of a $300 million investment in a new joint venture with Adani Green Energy Ltd. might act as a confidence booster.

Equity investors have a different horizon. Unless they’re entering the stock only to flip it, they have to be patient. Adani’s assets need to age, the debt taken to acquire them must go away, and the average Indian infrastructure user has to get wealthier. That’s when the currently low returns on capital employed will get a permanent boost. Any such long-term bet comes with considerable regulatory and contractual uncertainty — public infrastructure is a deeply political issue anywhere. The last thing investors need is news that will scare away the next buyer.

While the international bond market is its single biggest source of financing, Indian and overseas banks, taken together, are relatively more important for keeping Adani moving and growing. For now at least, global bankers don’t have a reason to worry about the juggernaut spiraling out of control.

From a lender’s perspective, any slip-ups in governance — the conglomerate has said there have been none — are minor chips around the edges of the vase: the corporate edifice. These blemishes are barely visible behind the screen of rose-tinted nationalism the Modi administration has put around everything. An increasingly pro-government local media is wont to dismiss every new allegation against Adani as an anti-India conspiracy hatched by the billionaire investor George Soros and his liberal cabal.

India’s institutions, particularly the stock-market regulator, haven’t shown much zeal in trying to enforce its own rules on the group for nearly a decade. Bankers can be reasonably confident that it won’t go into overdrive and prize open large cracks through which liquidity will seep out, and the bouquet of hard assets will wilt.