The Securities and Exchange Board of India (Sebi), the market regulator, has mandated that all mutual funds display a riskometer in their scheme documents. This riskometer is a standardized scale that helps investors understand the risk associated with a particular mutual fund scheme. By displaying the riskometer upfront and clearly, investors can make informed decisions about investing in a scheme.

The riskometer for mutual fund schemes is determined on a monthly basis. It takes into account the securities in which the scheme invests and the assets under management (AUM) at the end of the month. Regulatory guidelines assign a value to parameters such as volatility and other factors for the scheme’s underlying securities, which are used to determine the risk level.Investors can find the riskometer on the front page of a new fund application form, scheme information document (SID), key information memorandum (KIM), and in scheme advertisements. This ensures that the risk level is easily accessible to potential investors.

How does the riskometer classify risk?

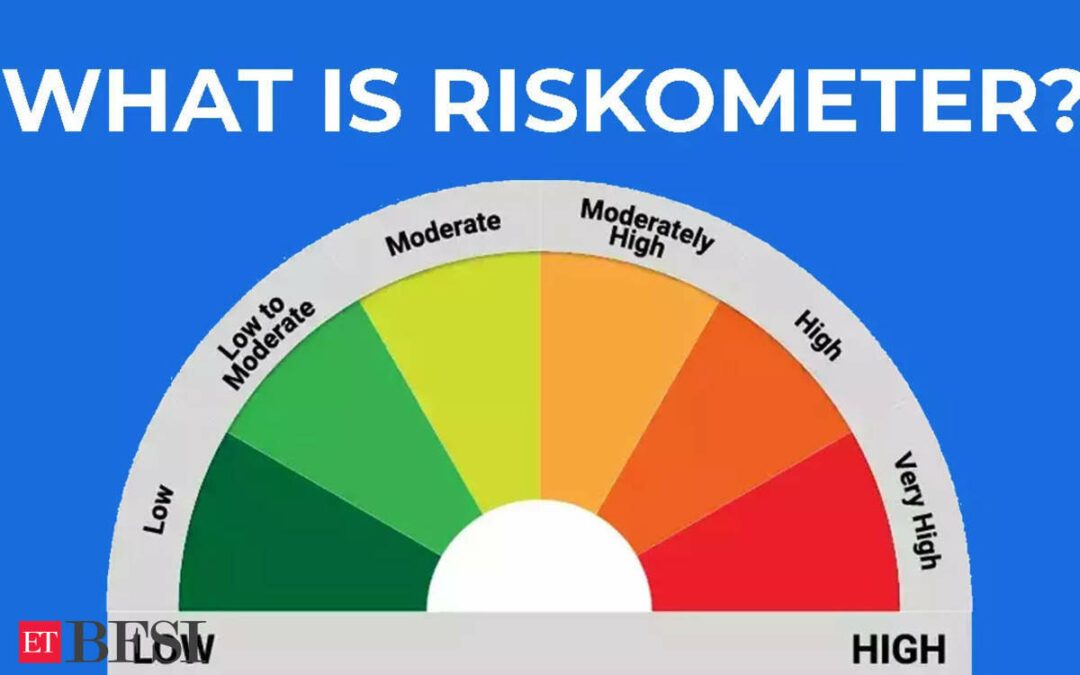

The riskometer classifies risk into six categories:

The first category is low risk, which is suitable for investors willing to take minimal risk. These funds have low returns and include overnight mutual fund schemes and arbitrage schemes.

The second category is low to moderate risk, which is for investors with a medium-to-long-term view and a willingness to take a small risk. Ultra-short duration funds and money market funds fall under this category.

The third category is moderate risk, which is ideal for investors willing to take moderate risk for slightly higher returns. Medium-term funds, corporate bond funds, and banking & PSU debt funds are examples of this category.

The fourth category is moderately high risk, which is for investors who are comfortable with uncertainty and volatility in exchange for higher returns. Equity savings and credit risk funds fall under this category.

The fifth category is high risk, meant for aggressive investors who are willing to take high risks to maximize profits, even if there is a chance of loss. Gold and silver funds fall under this category.

The sixth and final category is very high risk, which is extremely risky and meant for investors seeking high returns through investments in domestic or international stocks. Equity funds, sectoral funds, and international funds fall under this category.

Whenever there is a change in the riskometer, the fund house is required to inform investors through various channels. This includes publishing the information on the fund house’s website, in newspapers, and sending emails or SMS to investors. This ensures that investors are aware of any changes in the risk level of a mutual fund scheme.