Spot bitcoin ETF approvals are a done deal, the only question is how the market will react.

The co-founder of crypto manager Valkyrie Steven McClurg today said the SEC will approve the ETF sometime after the market closes on Wednesday with trading beginning on Thursday. They have a pending approval for a spot bitcoin ETF with the ticker BRRR.

Short-lived White House spokesman and crypto investor Anthony Scaramucci is also out saying the same thing.

If sources aren’t your thing, then consider what Bloomberg ETF reporter Eric Balchunas is arguing:

The idea that [SEC Chairman Gary Gensler] would make his Staff work countless hours with 11(!) dif issuers on two dozen massive documents each well over 100 pages long full of technical jargon through the holidays just to give him cover to deny is tin foil hat stuff in my opinion.

All this wrangling over filings is a dead giveaway that it was a done deal a long time ago. I’ve been saying the same thing for months.

Still, I was shocked to run a poll that shows this:

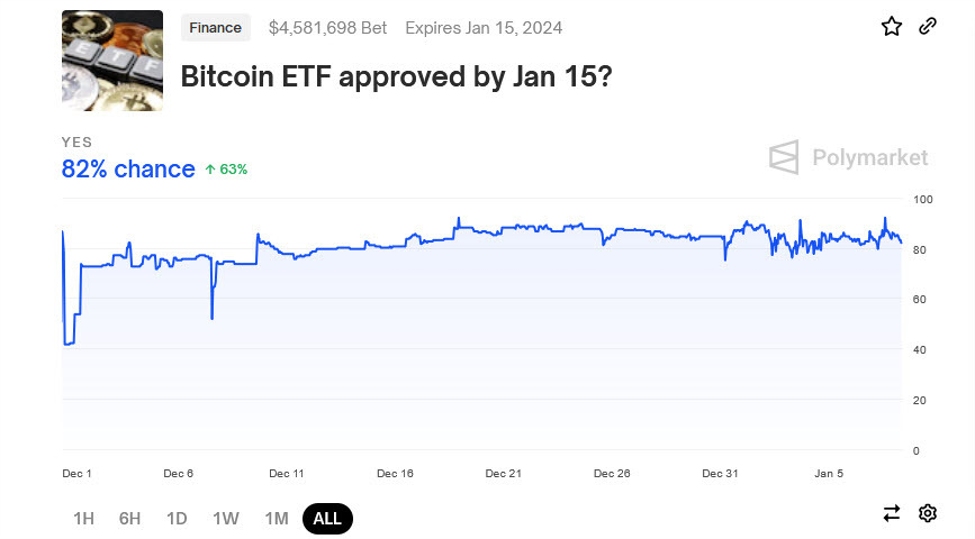

What that makes me wonder is if that’s how the bitcoin market sees it? Or if there’s some kind of biased sample here. But along those same lines, Polymarket has a line on approval by Monday at 81%.

Now that’s a very thin, small market but presumably it’s at least somewhat informed.

So let’s assume that real people are still pricing in a 15-20% chance it’s not approved, which still seems insane to me but ok. Given that bitcoin has rallied to $47K from $30K on an 80% chance of ETF approval, that would make each percentage point worth $212 and if you fill in the blank, that would put it at $51,000 on approval.

Now that’s a terrible way to think about anything but it’s some kind of basis, you can certainly adjust for your own percentages. I’d put it at 98% already so the upside might be $500 with a ‘sell the fact’ coming afterwards.

For awhile now I’ve been pondering if the trade was to ‘sell the fact’ on the announcement, the first trade or the end of the first day/week. Given the timelines, I’m gravitating towards the back of that equation. Part of that is because it looks like ETF issuers will be playing games on Day 1 to boost volumes and that could create some fake hype.

But after approval, what’s the catalyst to go significantly higher? There’s some people talking about the halving but that’s been known as long as bitcoin has existed.

If you look at the volumes on the futures ETF, the AUM in GBTC and Canadian ETFs, I just don’t see enough buying interest to sustain what’s already been a 57% rally.

As for the future, time will tell and bitcoin is an enigma so anything is possible and risk management is paramount. Good luck.