- Investors assign nearly 50% chance for a March BoJ hike

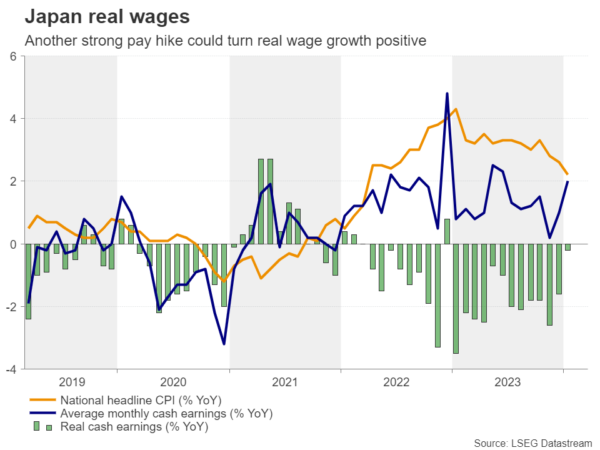

- Wage negotiations set to conclude with strong pay hikes

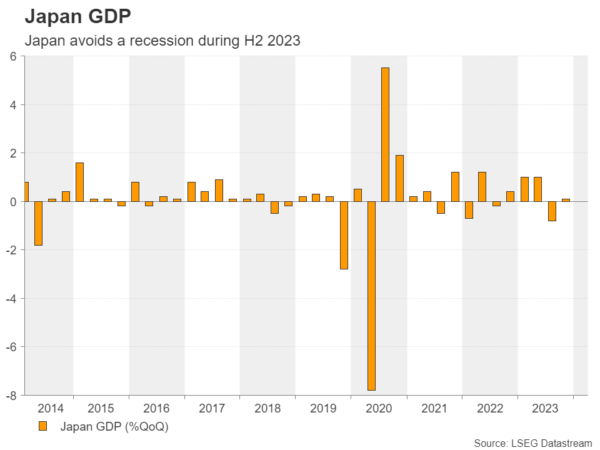

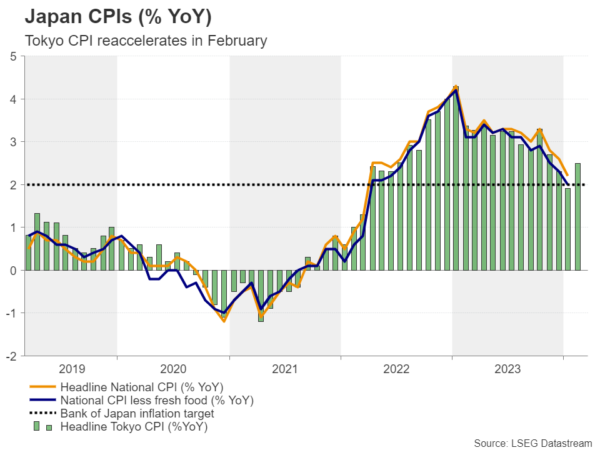

- Recession is avoided, inflation reaccelerates

- The BoJ meets on Tuesday at 02:30 GMT

March hike speculation intensifies

The yen staged a strong recovery last week following several reports suggesting that the Bank of Japan (BoJ) may abolish its ultra-loose monetary policy as early as its upcoming policy meeting, which is scheduled for next week.

After a couple of policymakers noted that the economy is making progress towards achieving the Bank’s 2% inflation objective, another report hit the wires this week, citing sources familiar with the Bank’s thinking, saying that there is a growing number of members warming to the idea of ending negative interest rates this month. This appears to be a realistic take as Japan’s largest industrial labor group said that 25 of its member unions have already seen their wage demands being met in full, which means that the central bank may not necessarily have to wait for April to act.

All this, combined with revised government data suggesting that the economy avoided a technical recession during the second half of 2023, prompted market participants to assign around a 50% probability for the Bank to take interest rates out of negative territory at next week’s gathering.

That said, on Tuesday, BoJ Governor Ueda said that although the Japanese economy is recovering, it is still showing signs of weakness, while Finance Minister Suzuki noted that they cannot declare that deflation is beaten yet, despite some positive developments like the strong pay hikes. Nonetheless, although the yen reacted negatively to those remarks, the probability of a March hike slid only to 45%.

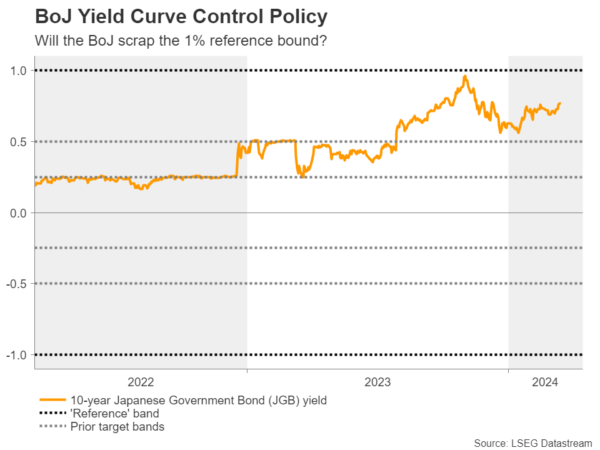

Rate hike or yield curve control adjustment?

So, the big question on everyone’s mind is of course: Will the BoJ exit its negative-rate policy next week? The upward revision of the GDP data for the last quarter of 2023 pointed to a 0.1% q/q expansion instead of the initially suggested 0.1% contraction, while the latest set of Tokyo CPI numbers revealed strong acceleration in inflation, corroborating the market’s view for a decent probability of a March rate hike. Even if they don’t push the hike button at this gathering, policymakers could well telegraph an April move and even tweak their yield curve control.

There is already a Bloomberg report saying that the BoJ is considering scrapping its yield curve control and instead start reporting the amount of government bonds it plans to purchase each time. In other words, they could stop aiming at keeping 10-year yields around 0% and start targeting the volume of purchases.

How may the yen respond?

Having said all that though, even if the Bank announces such a change to its yield curve control framework, but doesn’t press the hike button at this gathering, the yen may pull back as that nearly 50% of participants expecting an immediate liftoff might get disappointed. Nonetheless, with other major central banks seen cutting interest rates at some point during the summer months, a long-lasting fall may be unlikely if the Bank clearly hints at an April liftoff.

On the other hand, a hike now could add fuel to the yen’s engines, especially if it is accompanied by a decision to abandon yield curve control at its current form. Whether this will develop into a sustainable yen uptrend, though, will depend on the pace of subsequent rate increases. Several officials have already noted that after the first hike, the tightening process will be slow and gradual, and if it proves slower than the market’s own projections, then the yen may struggle to stay on the front foot.

Dollar/yen entered a recovery mode this week, after it hit support at around 146.45. However, the pair covered less than half of the previous week’s losses, keeping the short-term outlook blurry. For the picture to brighten, the bulls may need to climb all the way above the 150.80 zone, which acted as a ceiling during February. On the downside, a dip below 146.00, marked by the low of February 1, will confirm a lower low on the daily chart and perhaps invite more bears into the action.