- Inflation in Canada has been stuck above 3.0% since the summer

- The Bank of Canada is keeping rate hike option on the table

- Yet, the loonie has been on the backfoot versus the dollar this year

- Will Tuesday’s CPI data (13:30 GMT) put BoC’s inflation fight back on track?

The long fight to get inflation to target

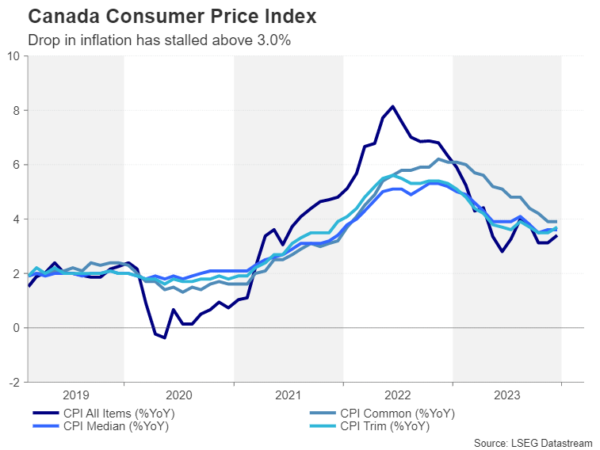

The Bank of Canada has made great strides in its bid to get inflation back to its 1-3% target band, but as is the case in the United States and other major economies, the progress has stalled lately. The downward trend in both the headline and underlying price metrics in Canada appear to be bottoming out in the 3-4% range.

Nevertheless, the Bank of Canada sees inflationary pressures receding further over the coming months and decided to drop its tightening bias at its January meeting. Although policymakers did not completely rule out the possibility of more hikes either, the shift to a more neutral stance has opened the door to a rate cut later in the year.

Will inflation ease back in January?

The key question now for both the BoC and the markets is the timing. Investors have almost fully priced in a 25-basis-point reduction in July, which represents somewhat of a dialling back from earlier bets that the first cut would come in June. For the timing to be brought forward again, there would have to be a significant change in the inflation outlook. However, it’s unlikely that the January CPI report would alter the picture much.

The annual rate of CPI is expected to have moderated to 3.2% y/y in January after ticking up to 3.4% y/y in December. This probably would not be enough to prompt policymakers to make another dovish turn imminently. Still, if CPI resumes its descent and some or all the core measures also decline, this could encourage investors to up their bets of a rate cut sooner rather than later.

The problem with a strong labour market

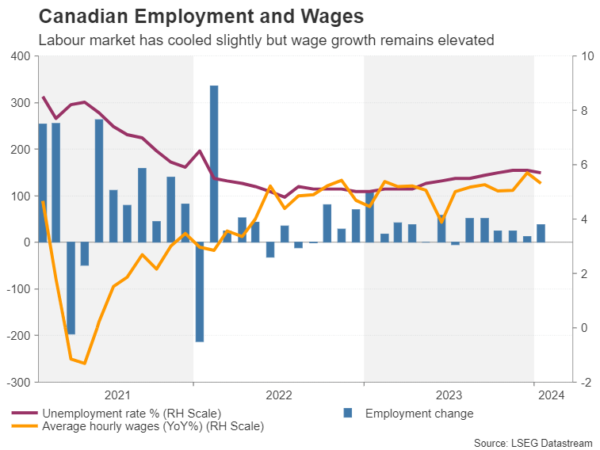

In reality, however, the Bank of Canada is in much the same predicament as other central banks like the Federal Reserve and Bank of England where a strong labour market is preventing them from taking a less cautious stance.

Although there’s been a notable cooldown in Canada’s hot jobs market – the unemployment rate has edged up from 4.8% in July 2022 to 5.7% currently – wage growth remains elevated. Average hourly wages were up 5.3% y/y in January, down from 5.7% in December but well above the pre-pandemic average.

Housing market turnaround might not be welcome

However, with economic growth coming to a standstill in the second half of 2023, the risks to the price outlook are tilted to the downside. The one worry is that the housing market emerges out of the doldrums, boosting shelter costs, amid some signs that a turnaround is underway.

Shelter costs are the biggest contributor to keeping inflation above target according to the BoC so policymakers are watching the property sector closely.

Can the loonie stage a rebound?

For the Canadian dollar, which has been battling a resurgence in its US counterpart, weaker-than-expected CPI readings on Tuesday could deliver a further blow.

Dollar/loonie hit a two-month peak of 1.3586 earlier this week, as rate cut expectations for the Fed were further pushed back. Fresh gains for the greenback combined with a selloff in the loonie could push the pair to the November 2023 peak of 1.3899.

However, if Canadian inflation surprises to the upside, dollar/loonie could initially seek support at the 50-day moving average just above the 1.3400 level before heading for the December low of 1.3174.

Beyond all the speculation about rate cuts, the loonie has been unable to reap the benefits of the recent recovery in oil prices, suggesting that US dollar dynamics remain in the driving seat. It also implies that in the event the data points to a more aggressive rate cut path for the BoC, oil prices are likely to offer limited support to the loonie.