- Hopes that PCE inflation will point to some further moderation

- But would that be enough for the Fed to ease its hawkish stance?

- US dollar drifts lower ahead of the crucial data due Friday, 12:30 GMT

The stakes are high as Fed meeting approaches

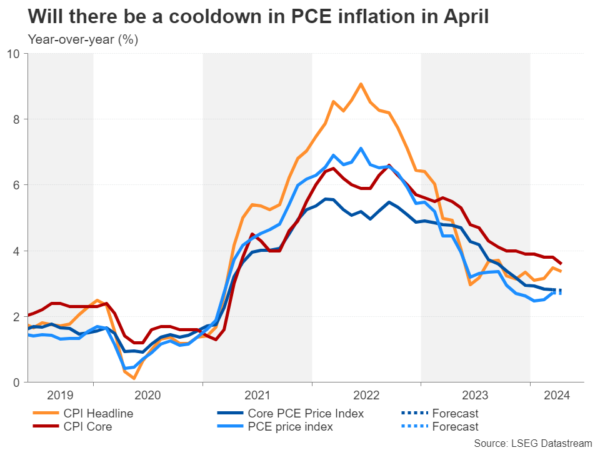

After months of hotter-than-expected inflation prints, there was finally some good news in the latest CPI report. Both the headline and core measures of the consumer price index (CPI) edged lower in April, raising hopes that the Fed will be able to stay on course to cutting rates later in the year.

But with the Fed traditionally putting more weight on the alternate inflation metric of the personal consumption expenditures (PCE) for assessing price pressures, Friday’s numbers could set the tone for Fed policymakers as well as for the markets before the blackout period begins at the weekend in the runup to the June 12 policy decision.

Hoping for a cooldown

The core PCE price metric that the Fed aims to keep near 2.0% stood unchanged at 2.8% in March. The forecasts indicate core PCE will hold at 2.8% for the third straight month in April, while the headline figure is also projected to stay steady at 2.7%. Month-on-month, both the core and headline rates are expected at 0.3%.

However, some forecasters are putting the month-on-month pace for core PCE at 0.2% while the S&P Global business surveys for the month also suggest the risks are tilted to the downside. A softer-than-expected reading in one or more of the PCE price indices would likely add to bets that the Fed will cut rates sooner rather than later.

Aside from PCE inflation, personal income and spending figures will also be watched in the same report. Personal income is forecast to have risen by 0.3% m/m in April, down from 0.5% in the prior month. More importantly, consumer spending is expected to have slowed, growing by just 0.3% m/m versus 0.8% in March.

What will it take for the Fed to change its tune?

Expectations of two rate reductions rose on the back of the CPI numbers before being pared back again after Fed officials maintained their hawkish posture despite the encouraging data. There is a risk of the same thing happening again if there is some cooling off in PCE prices – any initial euphoria could fade if the Fed does not adopt a less hawkish stance at its June policy meeting.

But the core PCE price index is not the only indicator on investors’ radar ahead of the FOMC decision. The May payrolls data is out on June 7, while there will be another CPI report on Fed Day. In between the PCE data and the NFP report, the ISM PMIs will additionally be released. Hence, unless there is a big surprise, investors will likely opt not to overact to a slight improvement in the inflation picture and instead wait for the other upcoming events.

Dollar defies hawkish Fed

Yet, for the US dollar, growing doubts about two rate cuts have barely provided a boost as Fed Chair Powell seemingly ruling out a rate hike has put a lid on gains. The dollar’s surprise underperformance comes even as other central banks such as the ECB are poised to cut rates in June.

The euro recently broke above its descending trendline, gaining support from a strengthening economic recovery in the Eurozone. The single currency may well test the $1.09 handle in the coming days if Friday’s data does not change much about the US outlook.

Investors in wait-and-see mode

In case of stronger-than-expected numbers, the euro could take a dive towards the $1.0790 region, which lies near the 50% Fibonacci retracement of the October-December 2023 uptrend as well as the 200-day moving average.

However, there’s likely to be more dollar weakness if the inflation numbers miss the expectations, with the euro potentially aiming for the March peak of $1.0980.

Summing up, with an elevated risk of Fed rate cut bets for 2024 being trimmed to just one or even none, markets will be sensitive to any sharp deviations in the PCE readings from the forecasts. Otherwise, traders will prefer to form a more complete picture with the help of the June FOMC meeting and the other releases due until then before deciding on the next direction.